29Aug2:42 pmEST

Surviving the Game

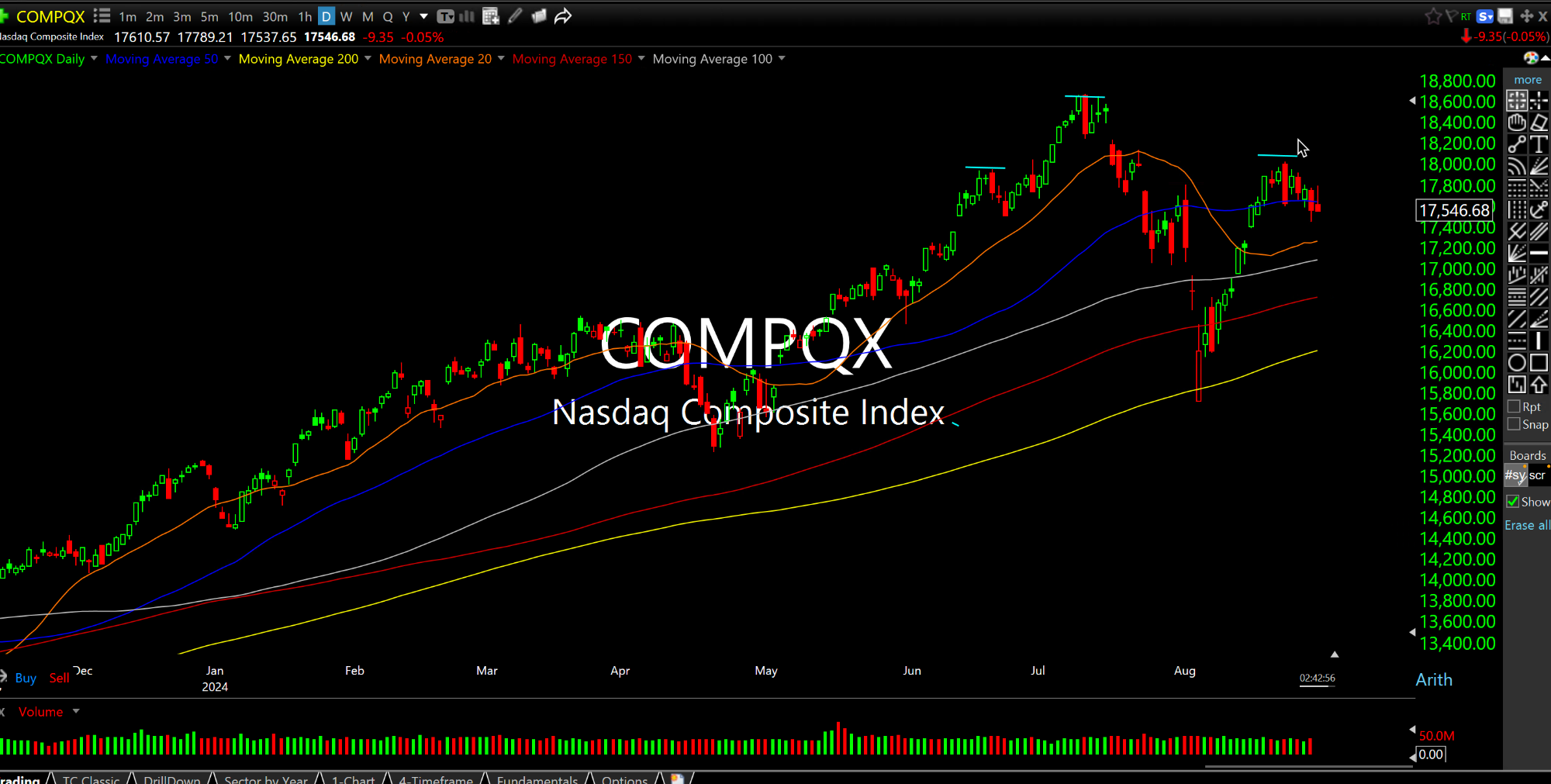

An afternoon fade is seeing the Nasdaq turn red as I write this, with the 17,780 level we noted here and with Members on the Nasdaq Composite Index asserting itself as firm resistance today.

NVDA is currently down 6%, GOOGL is a dud again, yet bulls were as cocky as I can recall earlier today on the prospect of an unstoppable freight train of a market bound for a sustained new uptrend.

As you might imagine, I continue to be on the other side of that view.

On the updated Nasdaq daily chart, below, we still could easily be working through a "right shoulder rally" of a head and shoulders top spanning virtually all of summer trading.

Despite a strong GDP print this morning, which is highly likely to be a lagging indicator, most Americans are certainly not acting like the economy is booming beyond the wealthiest consumers, with Dollar General being the poster child today for that argument.

Also note the CRM fade off earnings, as Salesforce was one of the big winners to offset NVDA overnight, only to see if gains dissipate so far today--It just went red as I write this.

Overall, bears still need that elusive follow-through lower which sticks, clearly a lingering issue. However, the bull optimism seems to be at fever pitch and far more hat than cattle at this juncture, particularly headed into one of the worst season months of the year for them.