05Sep1:25 pmEST

Face/Off for the Head/Off

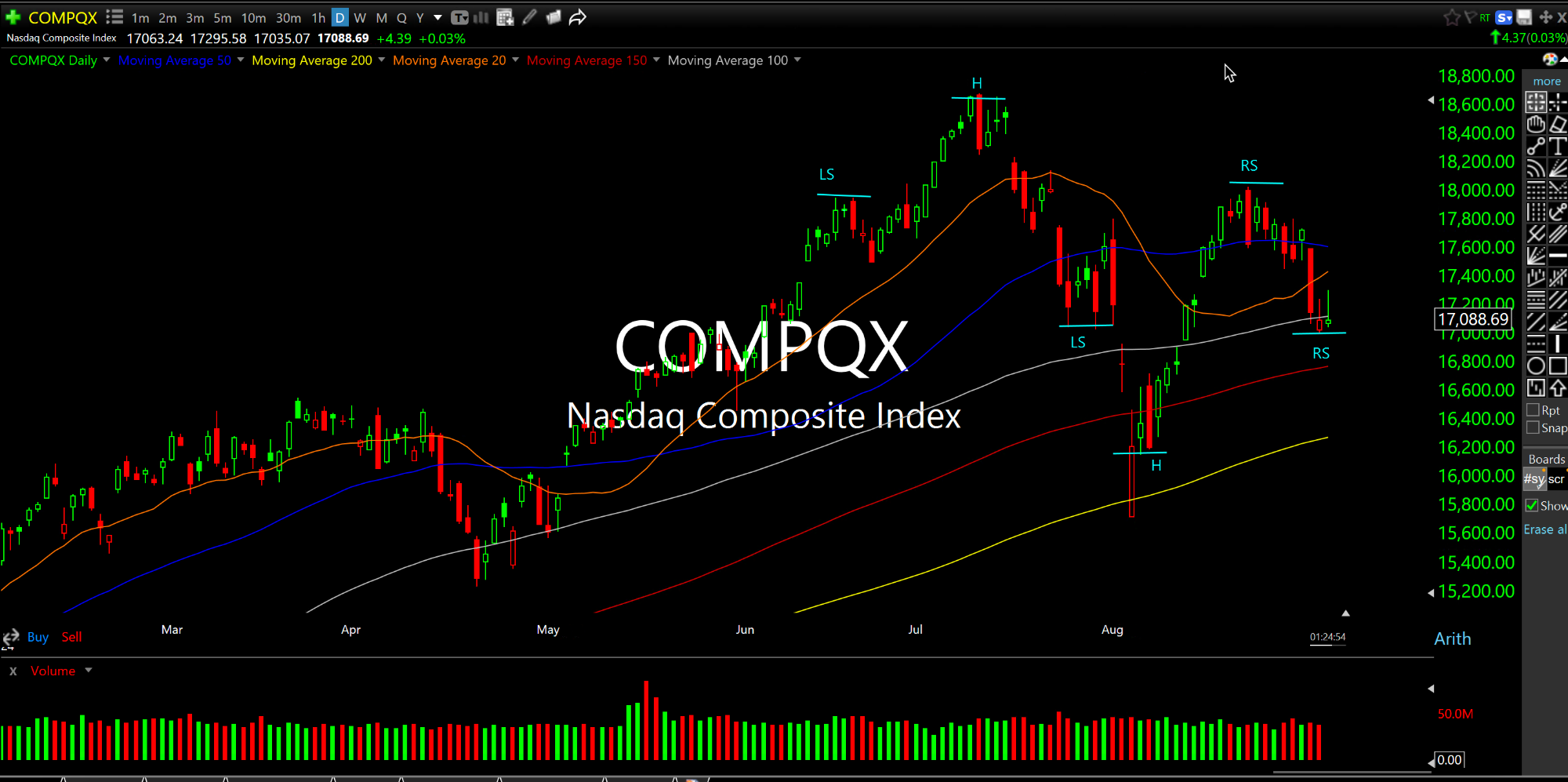

The Nasdaq Composite Index, updated below on the daily chart, now has a high quality setup to rug-pull a sizable portion of market participants.

Specifically, we have competing head and shoulders patterns, each highlighted below.

The top one is, of course, a bearish head and shoulders top setup. And with the recent rallies, selloffs, backing and filing over the last month or so, we also now have a potentially bullish inverse head and shoulders bottom setup on the bottom.

Given the prior multi-quarter advance higher, the inverse head and shoulders bottom tends to be a fake-out more often than not--Those patterns tend to work better in the context of a prior established downtrend or, perhaps, on the first consolidation off a major rally coming off a bottom. That said, it is true bulls may be correct that the melt-up will continue unabated as a "Fed put" alongside Janet Yellen's help ensures constant liquidity to patch over any warts, even though I personally disagree with it.

As for the bearish top, as we noted previously it is not surprising to see so many folks cavalierly dismiss its efficacy given how often they have been invalidated during this melt-up. But, then again, that offers fodder whenever it does confirm to the downside in the form of trapped longs and underweight bears on the short side scrambling to press.

Ultimately, seeing these two competing patterns tells me that a big market move is coming and it is likely imminent as, again, each side becomes attached to their given pattern.

Just in Time to Catch the En... Stock Market Recap 07/24/18 ...