03Oct2:59 pmEST

Let Me Explain Sumin' to You

The complacency in both markets and society at-large regarding the longshoreman strike is extreme but not surprising considering we are in the midst of one of the most forgiving markets in modern history, coupled with a generation or two who has not seen a crippling nationwide strike's deleterious effects on the economy and morale.

Putting to one side the escalation in the Middle East, the longshoremen strike seems uniquely dangerous given how much leverage the dock workers have, on top of the sense of urgency they feel with AI replacements breathing down their necks.

The important, actionable point for us is this: It is almost assuredly a lose/lose situation for Americans: If the strike drags on for more than a week or two, the supply chain issues will wreak havoc on pricing and cause a spike in layoffs into a jobs market which was freezing up anyway. If the longshoremen get their massive pay rise and stave off AI, it will absolutely cause higher prices as the higher costs get passed along to the consumer, as usual.

And, let's be honest, there does not seem to be the political will in D.C. to take on the longshoremen and play hardball with them, and probably won't be for a good while.

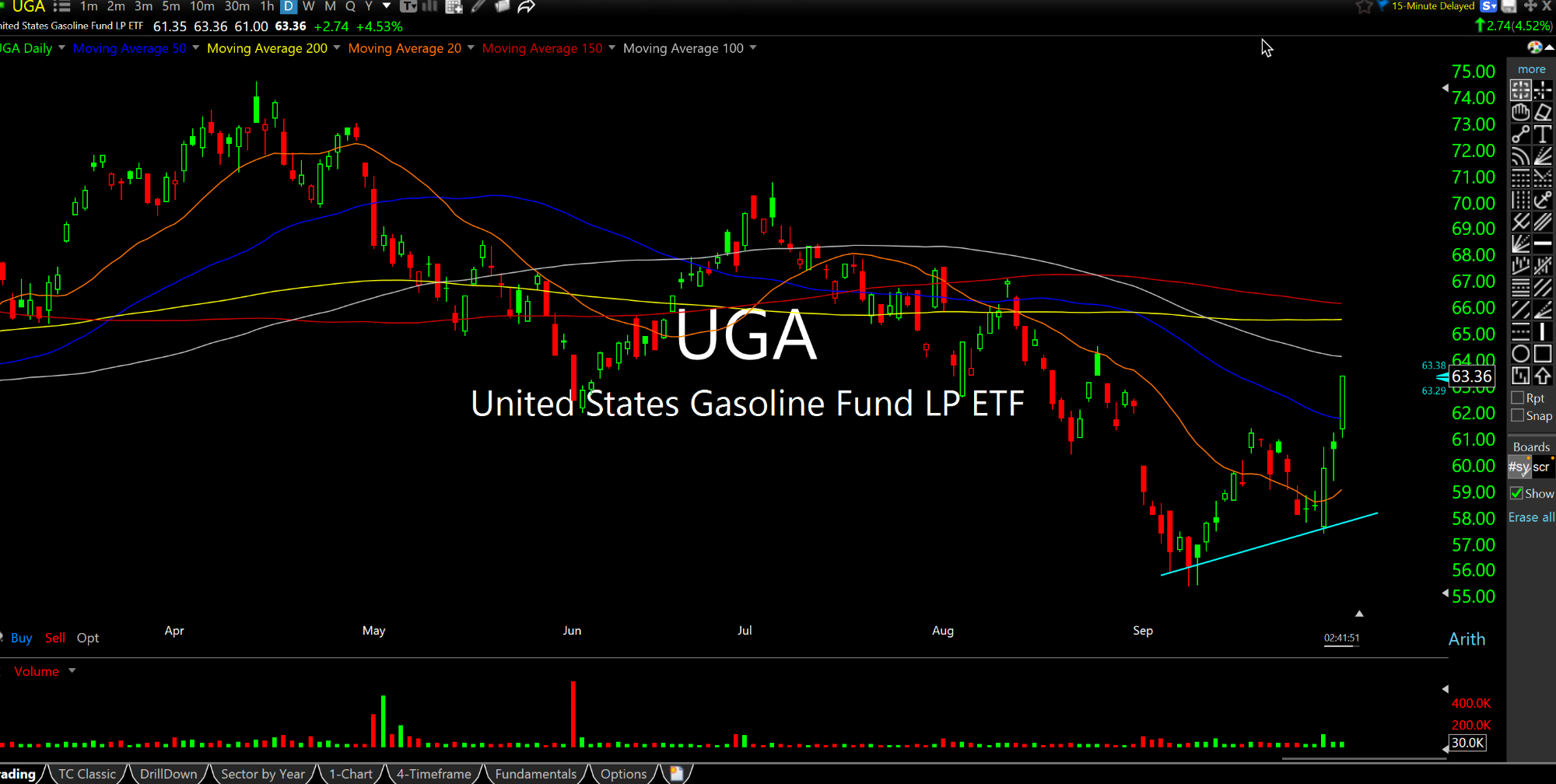

Gasoline prices, along with crude, are finally noticing, seen on the UGA ETF daily chart, below. Again, the Middle East hostilities are certainly part of this.

However, this longshoremen strike has the stuff out of which history is made: A major sea change where over forty years of supply side Reaganomics is buried and a new secular era of demand side is officially ushered in.