10Oct12:02 pmEST

I See the Stag and the Flation

"I was around for stagflation, and it was 10% unemployment, it was high-single-digit inflation. Right now we have 3% growth, which is pretty solid growth, I would, say by any measure, and we have inflation running under 3%,” said Powell, who is right about growth if looking at final sales to domestic purchasers, and correct about inflation if looking at the most recent year-over-year reading.

“So I don’t see the ‘stag’ or the ‘flation,’” -Jerome Powell, May 2024

After a hot CPI print coupled with more jobless claims than expected, there are reasons to believe we are headed into a stagflationary period where equities, as usual, are the last group to get the message. Ultimately, however, stagflation is one of the very worst possible outcomes for consumers and markets alike, as PE ratios compress amid profit margins getting squeezed.

First and foremost, since the September 18th jumbo rate cut we have seen rates on the 10-Year Note shoot nothing but higher. There first daily chart, below, for the Index for rates not he 10-Year Note illustrates as much, with the arrow indicating the September 18th FOMC 50 bps cut. It has been almost a month at this point, which far exceeds a few days of a sell-the-news unwind type of move. The move higher in rates stands in stark contrast to the aggressive rate cut with expectations of more cuts to come.

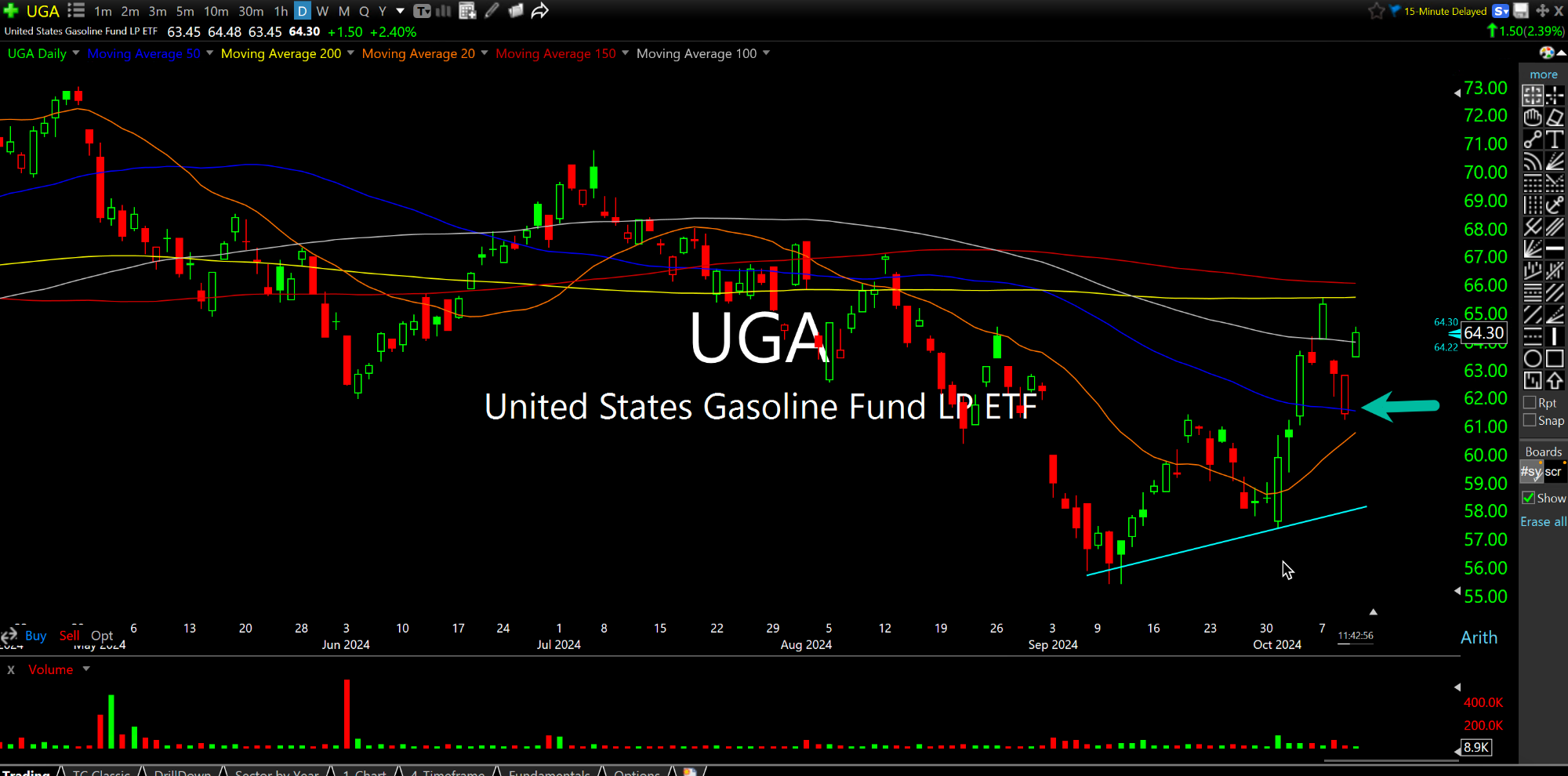

In addition, as seen on the second daily chart, below, gasoline futures nationwide (UGA ETF) are clearly higher since mid-September alongside crude oil. Soft commodities like wheat have also been on a nice run in that time as well.

None of this matters right now to NVDA and PLTR longs, let alone the Nasdaq on most days. Again, equities notoriously get the message last and then make up for lost time ruthlessly. This cycle has been unique in just how slow-moving and just how egregious the speculation has been to the upside.

But with the labor market cooling and rates back on the upswing we ay finally be headed towards the scenario I have envisioned for years--The bond vigilantes halting a rate cutting cycle abruptly and compelling more monetary and fiscal discipline Inside the Beltway.

A Wounded Wolf is Especially... Afternoon Update 10/11/24 {V...