14Oct2:05 pmEST

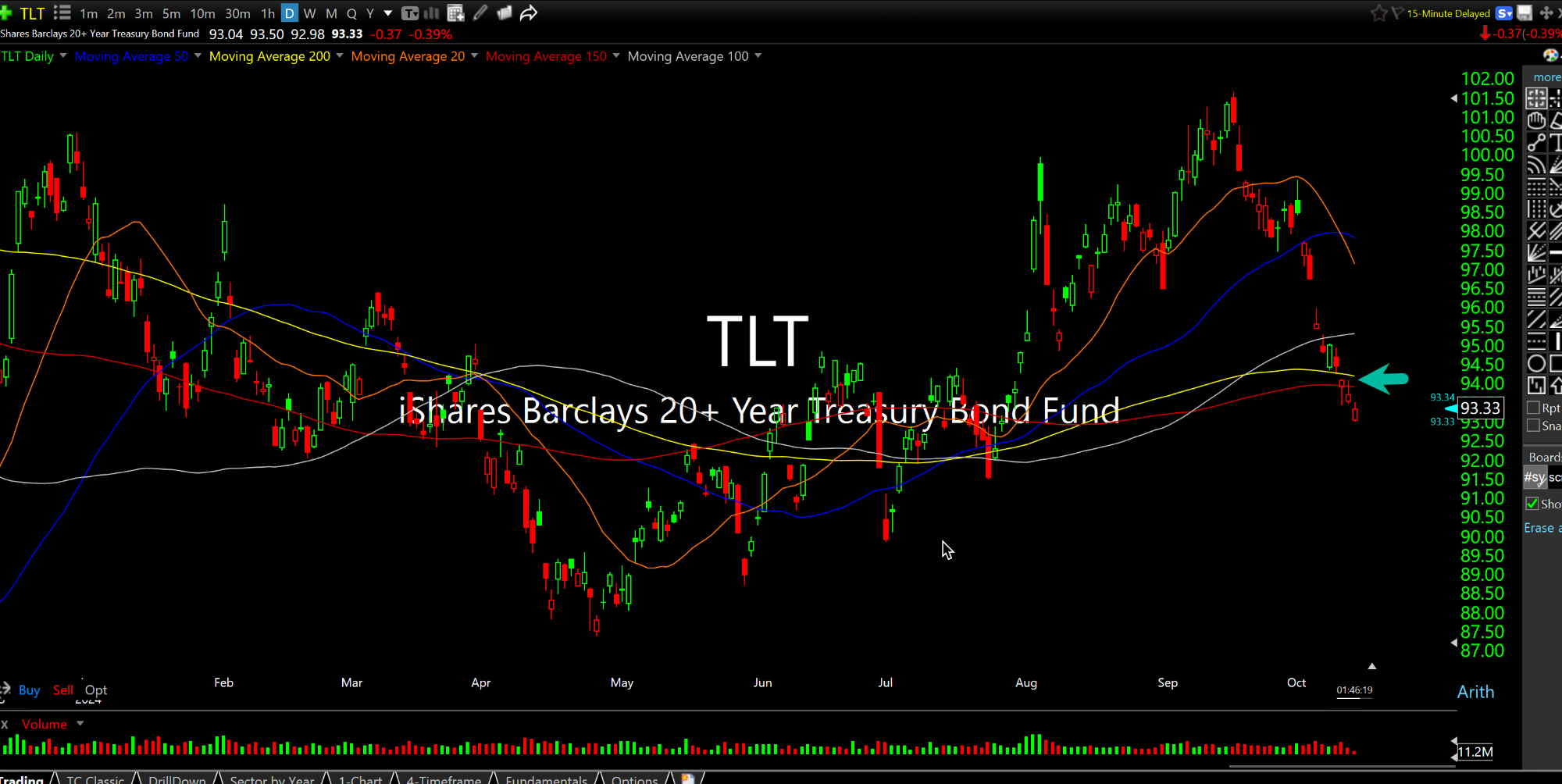

A Tell on the Bond Market Pain Trade

Today is Columbus Day, which is federal holiday in the U.S.. And that means government offices and banks are closed. The bond market is also closed for the holiday, but the New York Stock Exchange and Nasdaq are both open and functioning normally today. Well, at least mechanically they appear to be.

As far as sentiment, it is more of the same as the put/call ratio plunges to levels where we have previously seen market corrections due to complacency. Longs are chasing up NVDA without a worry in the world today, but overall breadth is unimpressive.

However, as far as the bond market is concerned, with its holiday closure today I have seen many instances over the years where TLT (ETF for Treasury prices, inverse to rates) would help itself to a seemingly "free" rally on Columbus Day.

That is not the case today, however, with TLT red as I write this despite its multi-week selloff on the news of the Fed cutting rates back on September 18th. Indeed, this has been one of the most glaring sell-the-news unwinds in recent memory, as bond bulls thought they had easy money on TLT as The Fed embarked on a new rate-cutting regime.

It is not almost a full month since the 50 bps cut, and rates on the 10-Year note are hovering around 4.12%, sharply higher than pre-FOMC and completely at odds with what The Fed is trying to do.

This action continues to smack of the early stages of stagflation, and the holiday action today reinforces to me that the pain trade in bonds may be lower yet, which means rates go higher into the November FOMC and put The Fed is a tough spot.

Overall, equities are ignoring the incongruent action in the bond market for now. Earnings season takes a turn for the more serious starting this Thursday evening with the very steep long-term NFLX chart reporting (trading at a red-hot thirty times forward earnings, to boot).

Afternoon Update 10/11/24 {V... Get Your ASML Out of the Roa...