18Nov2:05 pmEST

And Just Like That, SMCI is (Not) Fixed

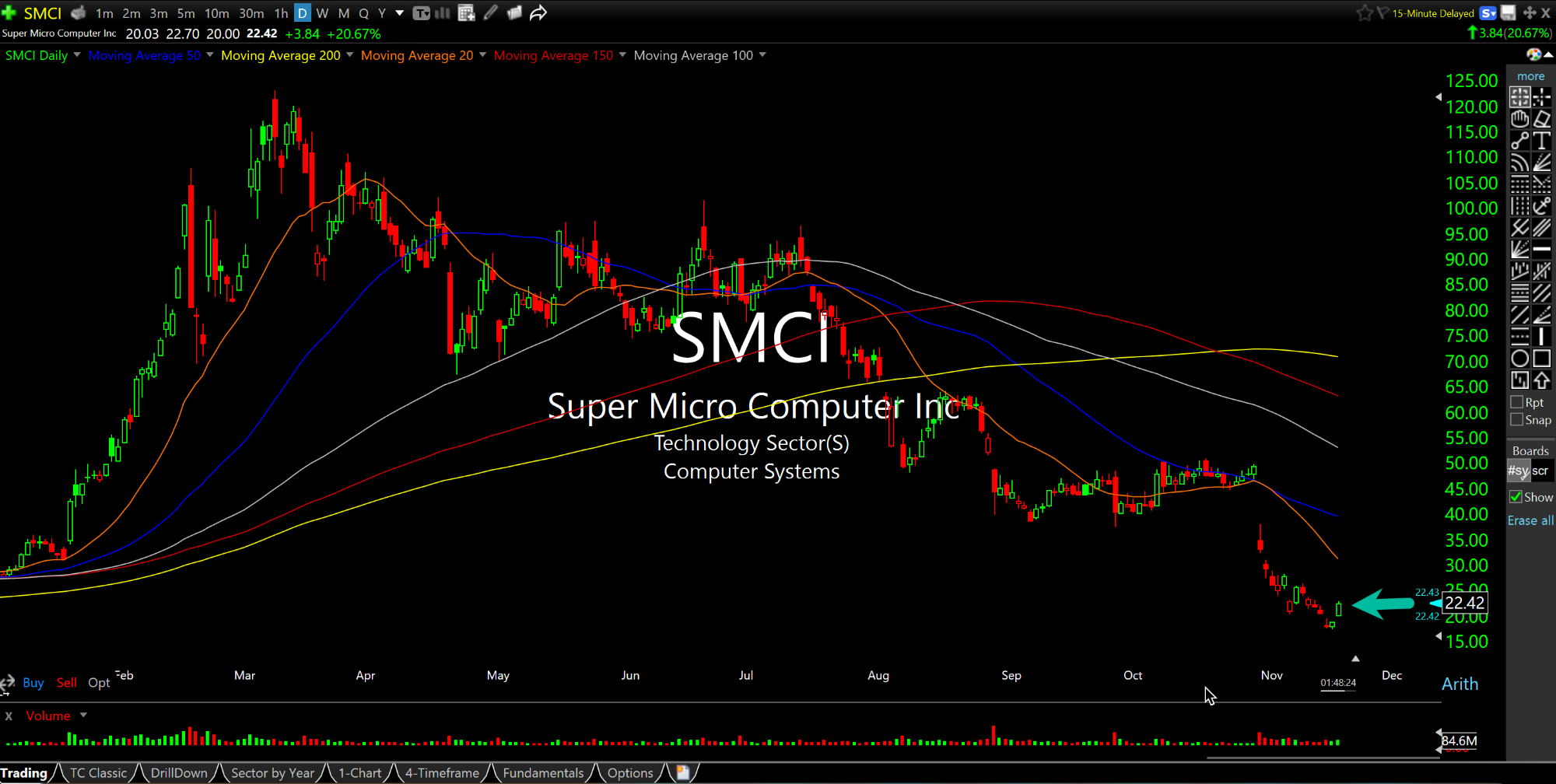

The headlines today about SMCI read, "Super Micro Stock Jumps As Data Center Firm Preps Plan To Avoid Delisting" (courtesy of Investor's Business Daily). The stock is up more than 20% as I write this.

Bulls may want to think long and hard on that one--A massive relief rally in a mere plan to avoid a delisting for a stock in the hottest sector of the market in what is supposedly a life-changing movement.

Recall that SMCI, during this very calendar year back in the winter months, was once actually the hottest single stock in the entire market, hotter than even NVDA, to the point where it was added to the S&P 500 back in March. Of course, that was also right around when the stock had topped at $122.90.

SMCI hit a recent low of $17.25 before the hopeful rally today.

And while it is not an apples-to-apples comparison, from a behavioral finance standpoint one can certainly make a viable case that the vast amount of hope for SMCI to avoid a delisting is not unlike some of the casualties of the 2008 global financial crisis, especially in its early stages (Bear Stearns comes to mind). In sports, you might call today a "moral victory" for bulls. But moral victories usually mean outright defeats.

I expect this wishful rally to fail in SMCI. If the firm were truly serious about not having accounting issues, then it would have immediately come out with a firm plan and firm statements once they were dropped by Ernst & Young nearly a full month ago. In market time, a month is an eternity, which leads me to believe the firm is in dire straits behind the scenes and that the precipitous drop in share price is not an overreaction.

On the matter of whether there is blowback to NVDA, I strongly suspect in due time there will be at least partial accounting issues with the market leader, too. There is never just one cockroach, as they say, especially in such an intertwined segment such as AI--Just as they feast together on the upside, they swim naked when the tide goes out, as well.