25Nov2:53 pmEST

Beset By Bessent, And Other Political Trades

I have traded through enough presidential cycles to know that it is not just Trump, and it is not just Republicans--Every single new administration is full of guesswork on Wall Street as to the next "hot trade" based on the incoming President.

However, more often than not those trades wind up being short-lived, whether it be Obama and clean energy or Trump and oil stocks last decade.

Thus, some nuance is in order.

Specifically, private prison plays (CXW GEO are the two main ones) seem like a slam-dunk under Trump. I fully acknowledge that CXW (first below, daily timeframe) is pristine with a tight bull flag and worthy of attention for a secondary breakout higher. However, I am reticent to get behind any "Trump Trades" for buy-and-hold purposes.

On that note, Trump's pick for Treasury Secretary, Scott Bessent, is getting some initial cheer today in markets. In addition to the rally in stocks, bonds are taking their cues from some initial plans Bessent has to tackle the deficit issues.

And while that is certainly admirable, I strongly suspect once we get into 2025 and Trump's second term everything will not be so copacetic. Simply put, it takes real courage to administer the type of austerity which is now required to get the deficit spending down to acceptable levels, since a chunk of what has kept GDP positive has been government spending and government jobs in the first place.

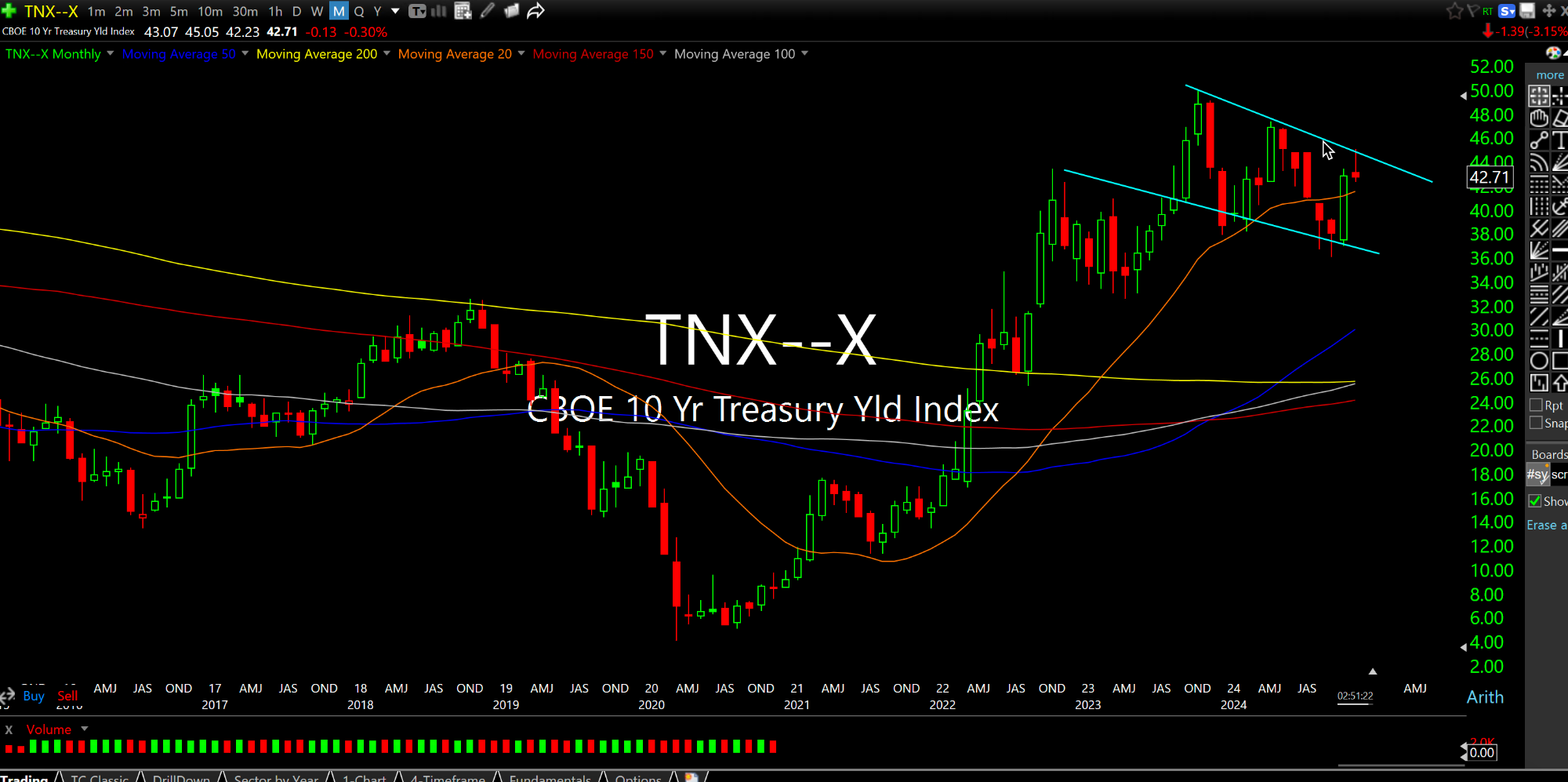

So while rates are coming in today, the second chart, below, of the monthly timeframe for TNX (rates on the 10-Year Note) shows a bull flag intact.

In due time, the market should finally accept just how entrenched inflationary pressures are.

Afternoon Update 11/22/24 {V... Saylor is Due for Rough Seas