11Dec10:13 amEST

Ready to Go At a Moment's Notice

Natural gas is red-hot this morning, out in front of the commodity complex as the CPI print confirmed what we basically knew anyway: Inflation is reaccelerating into Fed rate cuts. Further, while it is certainly true that uranium and nuclear reactor plays are enticing on the long side, the more imminent, realistic play for AI energy is natural gas.

Moreover, natty has been out of favor for so long that any inkling of a change in character which sticks to the upside has the potential for seemingly endless chase.

We can gauge the UNG ETF as a proxy for natty itself. But the natural gas-related stocks still pique my interest. We have noted the likes of AR CTRA NOG before.

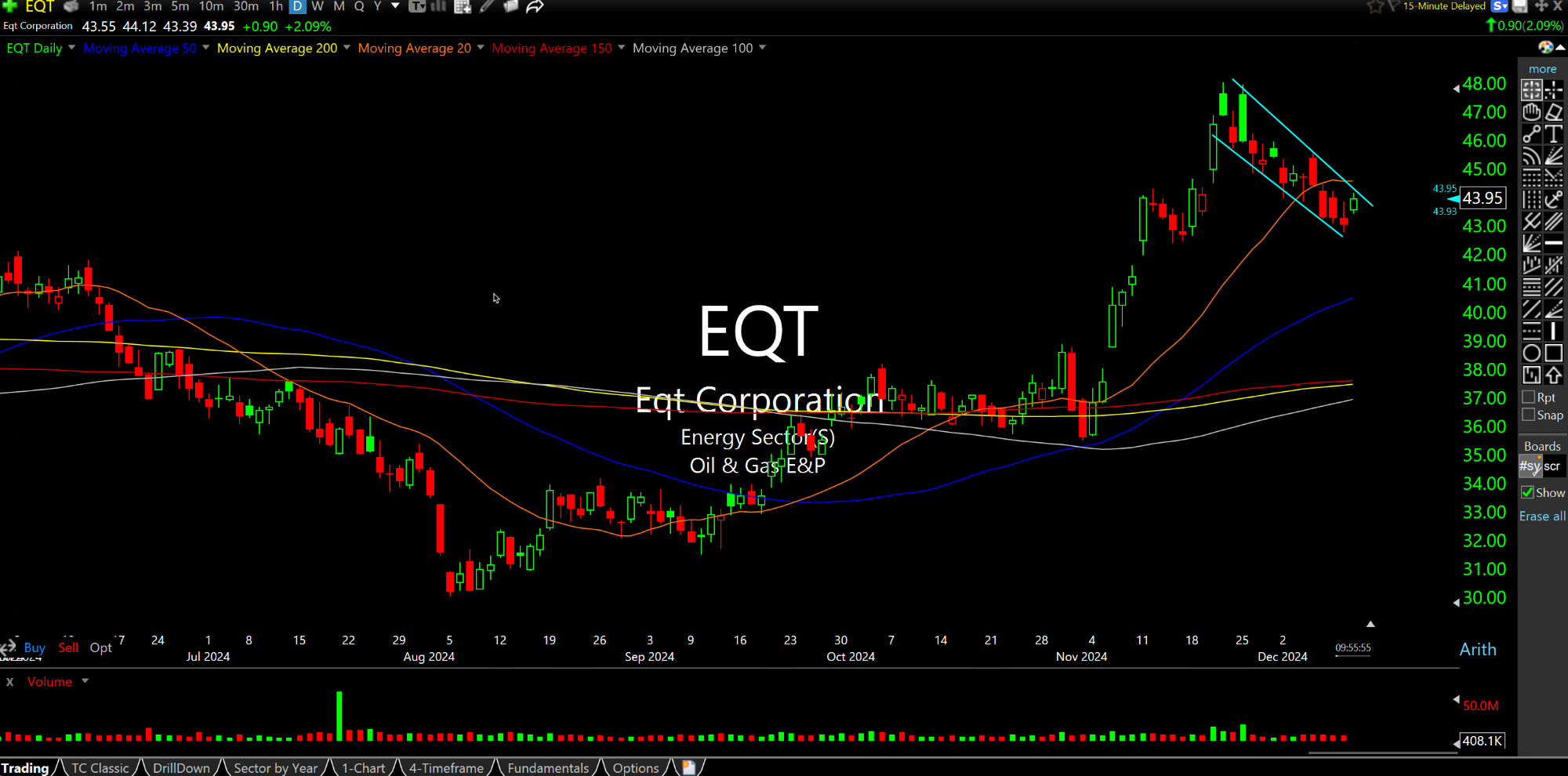

And there is also the Pittsburgh-based EQT, below on the daily chart. The stock's falling channel of late looks orderly, with this morning's pop threatening to resolve the consolidation higher.

Overall, natural gas-related stocks have exuded relative strength to pure oil plays of late. The general chart structures are better, and I am looking to see if that theme continues particularly if natural gas itself closes out 2024 well.