02Jan1:13 pmEST

Pick a Side, Any Side

If the first trading session of 2025, so far, is any indication of what is to come this year we are in for a doozy of a tape. As of this early-afternoon, we have seen a plethora of whipsaws, squeezes, fades, before the market finally sold off aggressively during the New York lunch hour.

Granted, we are still technically within the "Santa Rally" period which ends, officially, tomorrow at the closing bell. And many traders are still on vacation.

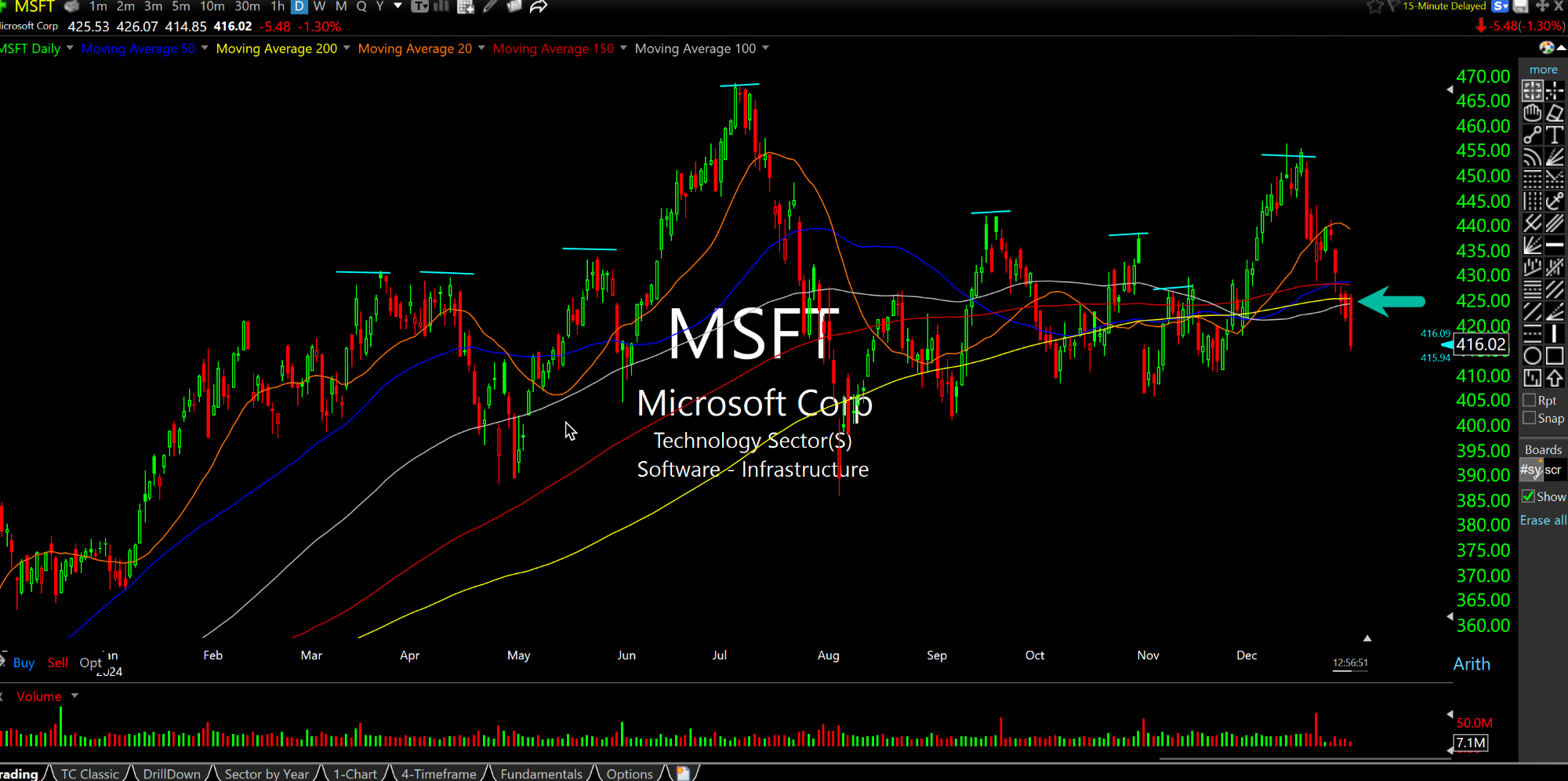

However, when we look at some of the leaders like Microsoft, updated below on the daily timeframe, it is hard not to at least entertain the scenario where the last few quarters have amounted to a major topping pattern.

With over $3 trillion in market cap and a forward PE of 27 (far from cheap), "Mister Softee" just erased its entire post-Thanksgiving rally in one fell swoop, taking the stock back below its 200-day moving average (arrow). I have also highlighted the various peaks since March 2024, indicative of the consistent selling into strength each time it looked (to bulls) like the monster tech leader would embark on a new, sustained leg higher.

Overall, the Santa Rally this season is under heavy pressure relative to most other prior years. A weak Santa Rally period is said to portend poorly for the new year, although each year and each market has its own identity.

But what seems more significant is the inability of bludgeoned sectors like housing, REITS, healthcare, small caps, even Treasuries as an asset class to stage much of a bounce, if at all, during this period. And now the monster leaders are showing some cracks, which part and parcel of an unhealthy, bifurcated market showing its age.

Stock Market Recap 03/23/20 ... Stock Market Recap 03/24/20 ...