07Jan1:19 pmEST

Beating You to the Punch

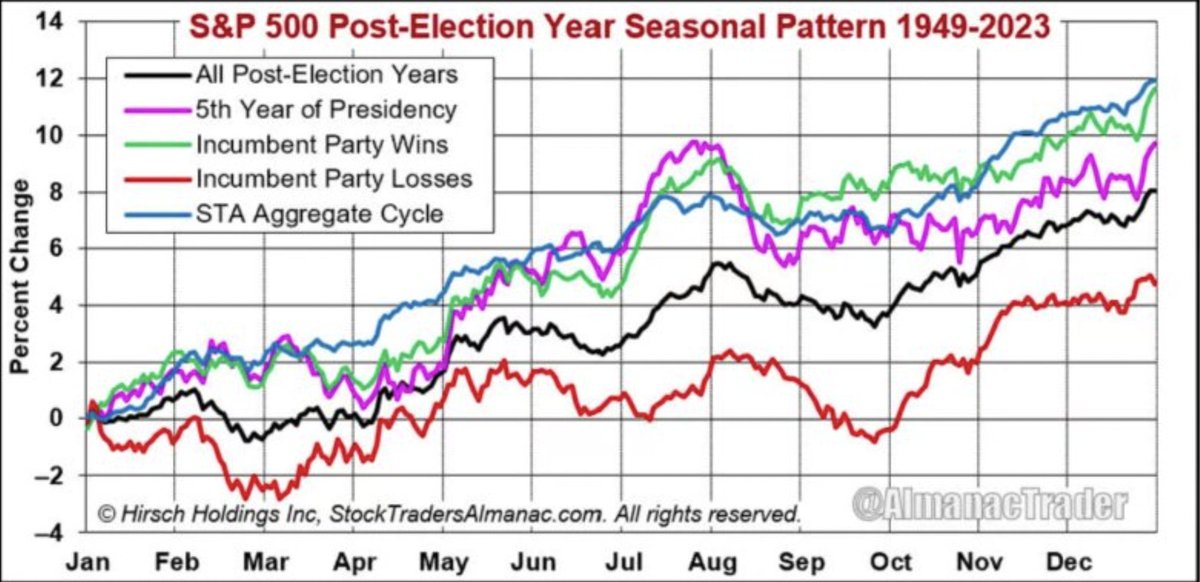

With 2025 underway it is a good idea to look at post-election year seasonality.

Courtesy of @AlmanacTrader on X, below, we can see the 1949-2023 data set for all post-election year patterns in the S&P 500 Index.

Clearly, the black and red lines are most relevant, with the incumbent party losing.

As you can see February is a uniquely weak month in a post-election year even more than usual, especially when the incumbent party loses, as is the case this year. June and August/September are also notable weak spots.

The pertinent issue, however, is whether this market will continue its propensity to front-run various seasonal and other aspects. We have clearly seen this tape have a penchant for beating everything and everyone else to the punch, usually in terms of pricing in bullish themes, but sometimes bearish spots as well like last summer's brief super-spike in volatility in front of September.

Hence, mid-late January weakness would be the scenario to front-run February's uniquely weak seasonality in a post-election year where the incumbent party has lost.

Just today, we have Trump pushing The Fed to lower interest rates, as he did throughout this first term.

This time around, however, Trump is dealing with sticky high inflation, and a bond market pushing rates higher yet. I strongly suspect the bond market will not play nice this time around with political demands for lower rates by The Fed.