15Jan2:11 pmEST

It's Pretty; It's So Pretty

The market is clearly focusing more on CPI coming in cooler than expectations this morning, conveniently ignoring the year over year increase in inflation over the last four months.

Or is it?

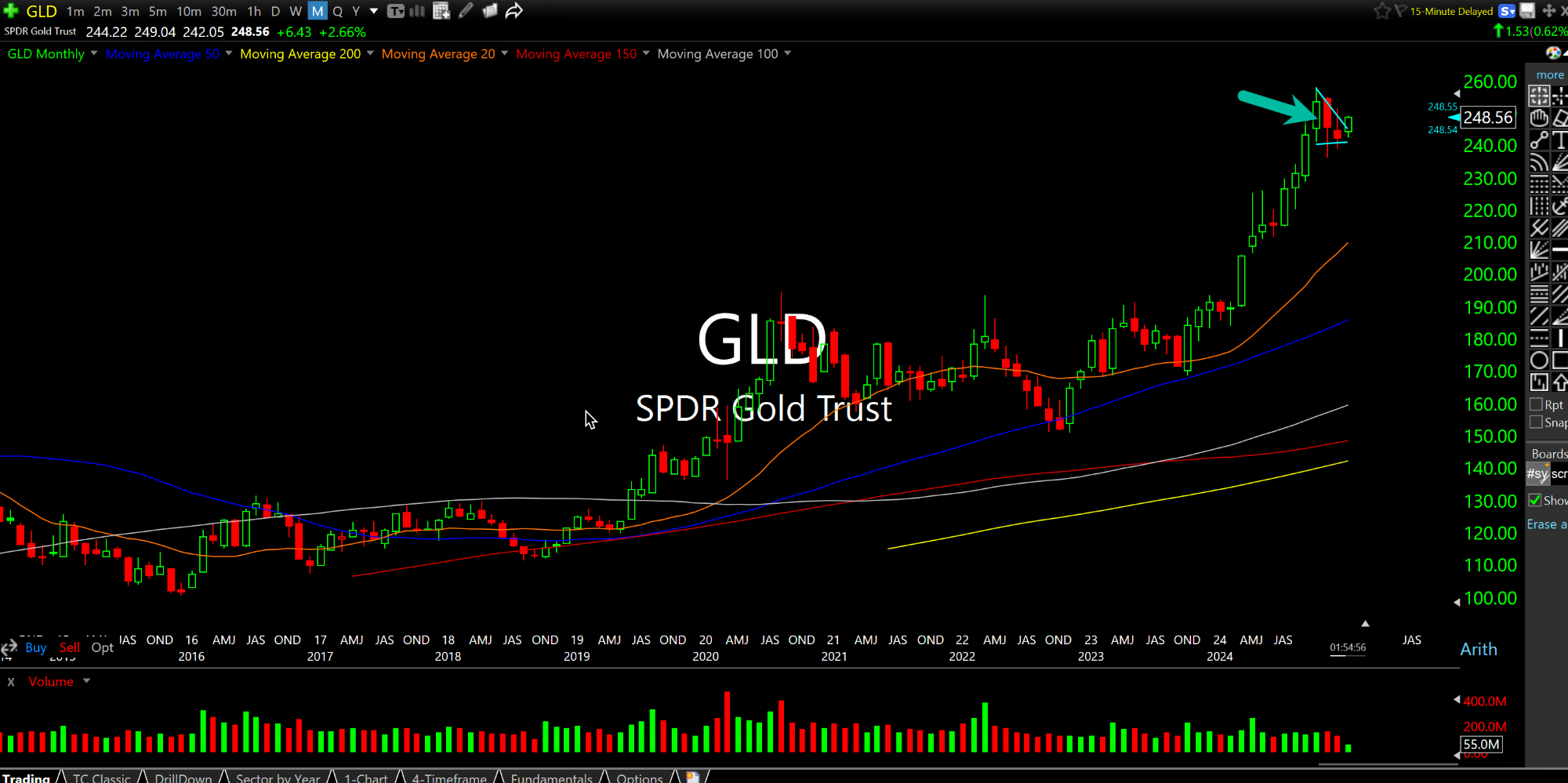

While equities are surging, and the bond market is enjoying some relief as rates come down, gold, for example, is sporting an explosive-looking monthly chart bull flag.

On the GLD ETF monthly chart, below, we can see that extremely high, extremely tight bull flag consolidation which implies price is becoming uniquely comfortable to these new highs. Indeed, gold could easily be raring to go for another move higher in the near future as it sniffs out inflation accelerating while The Fed and federal government are way behind the curve in recognizing and properly adjusting to it, not unlike what we saw in the 1970s.

Either way, there is no denying how impressive the action continues to be in gold, even as crypto garners far more hype as an alternative asset to fiat. Needless to say, crypto dates back fifteen years or so, while gold dates back to least 600 BC as recognized currency. So you will pardon me all over if I do not eschew gold simply because crypto bros assert that gold is dead.

As for the rally in equities, the S&P 500 is closing in on its 50-day moving average from the underside as we speak. I am keying off that area to gauge if this bounce amounts to merely another lower high since last month.