30Jan1:04 pmEST

Catalysts Versus Excuses

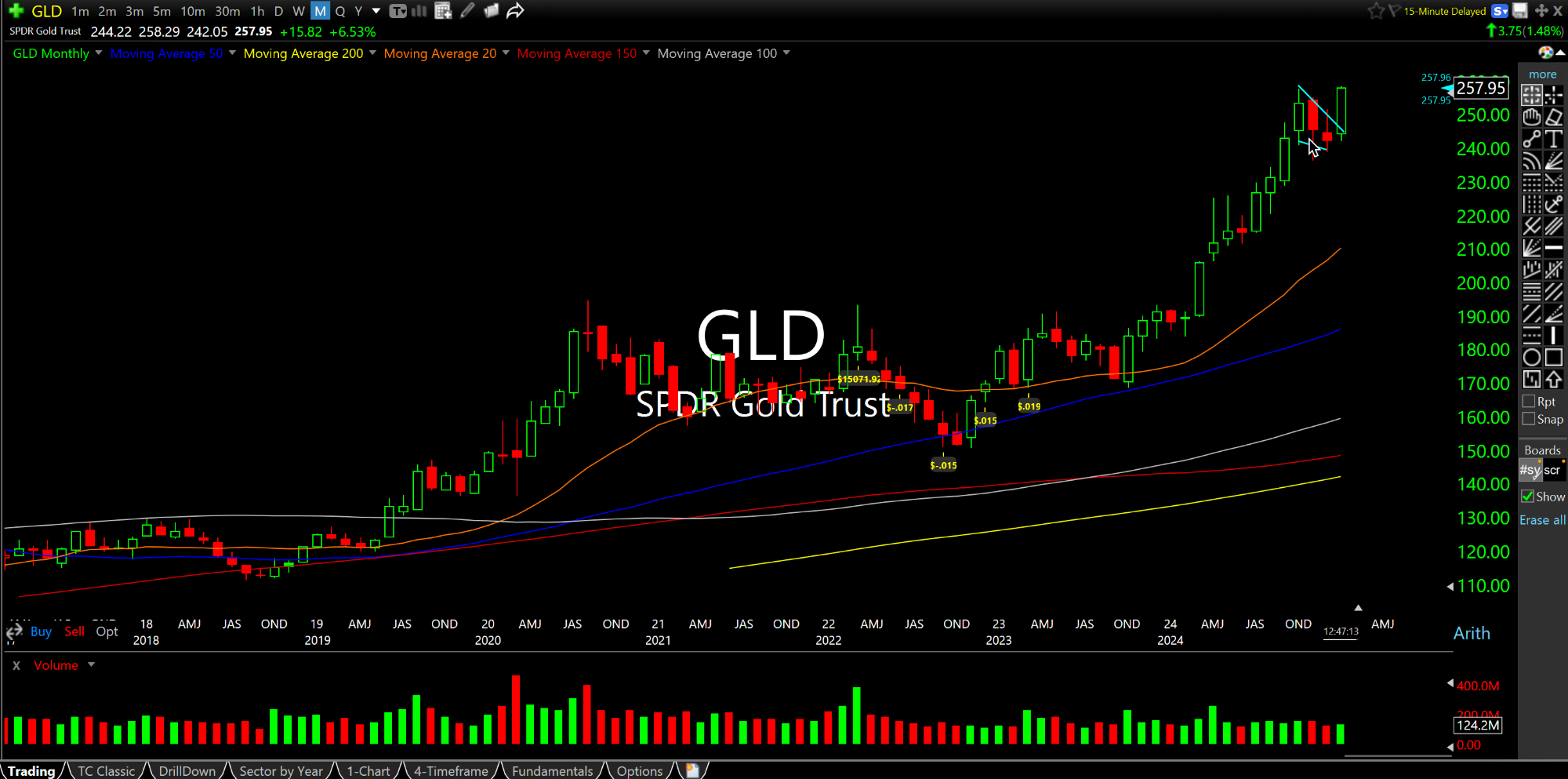

When you see a high, tight bull flag, especially on a long-term timeframe like the GLD ETF (for gold metal) monthly chart, first below, uncoil higher with aggression it is almost assuredly a sign of extreme bullishness given the urgency of buyers to pounce on any and all long-term pauses. We have been highlighting this flag for a while now, both here and with Members. And seeing it unwind higher so soon is impressive, rather than seeing the pattern either morph out for months or becoming negated with a sharp move down.

Indeed, after the FOMC yesterday it is no coincidence that gold, silver, and their miners are red-hot as Fed Chair Jay Powell jawboned his way through another presser of double-talk and covering his backside in lieu of more assertively trying to beat inflation back to the long-term 2% target (even as absurd as that is to begin with).

And just as in the 1970s, gold serves as an excellent "check" on central bankers and federal politicians failing to toughen up when necessary.

Now, the issue is whether The Fed serves as a catalyst or an excuse for gold to go higher. At this point, it may be irrelevant which is which, since there is no rush to change the monetary policy stance to something more aggressively hawkish, even though Powell stopped cutting temporarily.

Applying that same excuses-versus-catalyst framework to NVIDIA, the stock is suddenly a glaring laggard perhaps due to DeepSeek. But mostly I suspect it is due to a parabolic, epic multi-year uptrend finally rolling over.

On that note, American Airlines is having a rough session after one of its regional planes crashed last night in what looks to be the deadliest U.S. air disaster in more than twenty years.

Focusing solely on the stock, though, the second daily chart, below, shows the stock recently sold off after earnings and has been looking heavy ever since. Like most airlines in the JETS ETF, AAL enjoyed a sharp rally since last August and seems ripe at least for profit-taking if not a larger correction, beyond the awful news.

It's a Snappy Consolidation,... A Great Bull Market in Toile...