03Feb1:35 pmEST

Don't Forget About the Real Inflation Gauge

The period immediately after the Super Bowl, which begins this Sunday evening, is assuredly the dead period of winter, where the holidays and the freshness of the winter season from late-last year are a distant memory, but the anticipation of spring is still too far away to truly get excited.

Thus, one can be forgiven for not thinking much about a new summer driving season by June. But I assure you it is a-coming. And when it does, the natural uptick in demand will be there to push gasoline prices a bit higher, as is the case every year.

However, given the current issue of entrenched inflation seen in things like the price of eggs, we simply must be mindful of gasoline prices turning back higher, since the in-your-face nature of food and gas prices has such a strong psychological impact on consumers, as opposed to even monthly bills and occasional discretionary purchases.

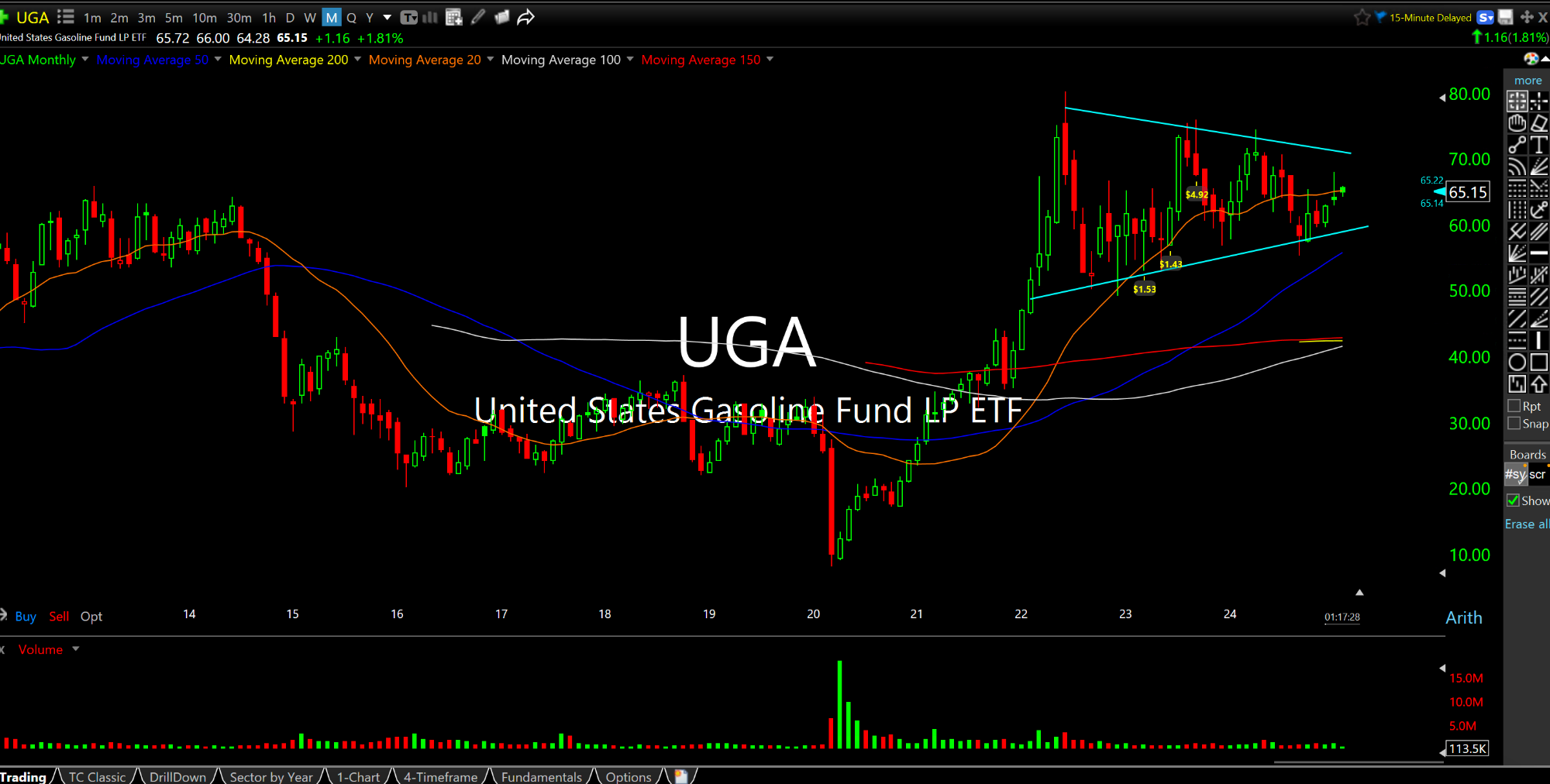

UGA, the ETF for rolling gasoline futures across the country, is seen on the daily and monthly timeframes, respectively below. The daily chart shows the recent, orderly pullback just like natural gas and crude oil since over the last several weeks. Should gas surge to new highs it would align with the second chart, showing the multi-year timeframe.

On that second chart, we have the makings a symmetrical bull flag, with multiple points of reaction (touches by price to the trend-lines) narrowing the action. This looks and feels like a bullish continuation pattern on a long-term timeframe, which means gasoline has tons of potential upside into this summer.

I recognize that plenty of folks are calling for oil prices to dive under Trump, not to mention a weak China economy. So, you might consider my view to be a contrarian one.

But given how underweight virtually the entire investment world is in oil and gas, it still seems like a pain trade scenario would involve oil and gas surging higher even in the face of Trump opening up domestic drilling, for example.