10Feb1:28 pmEST

More Tariffs While the Market Spins Its Wheels

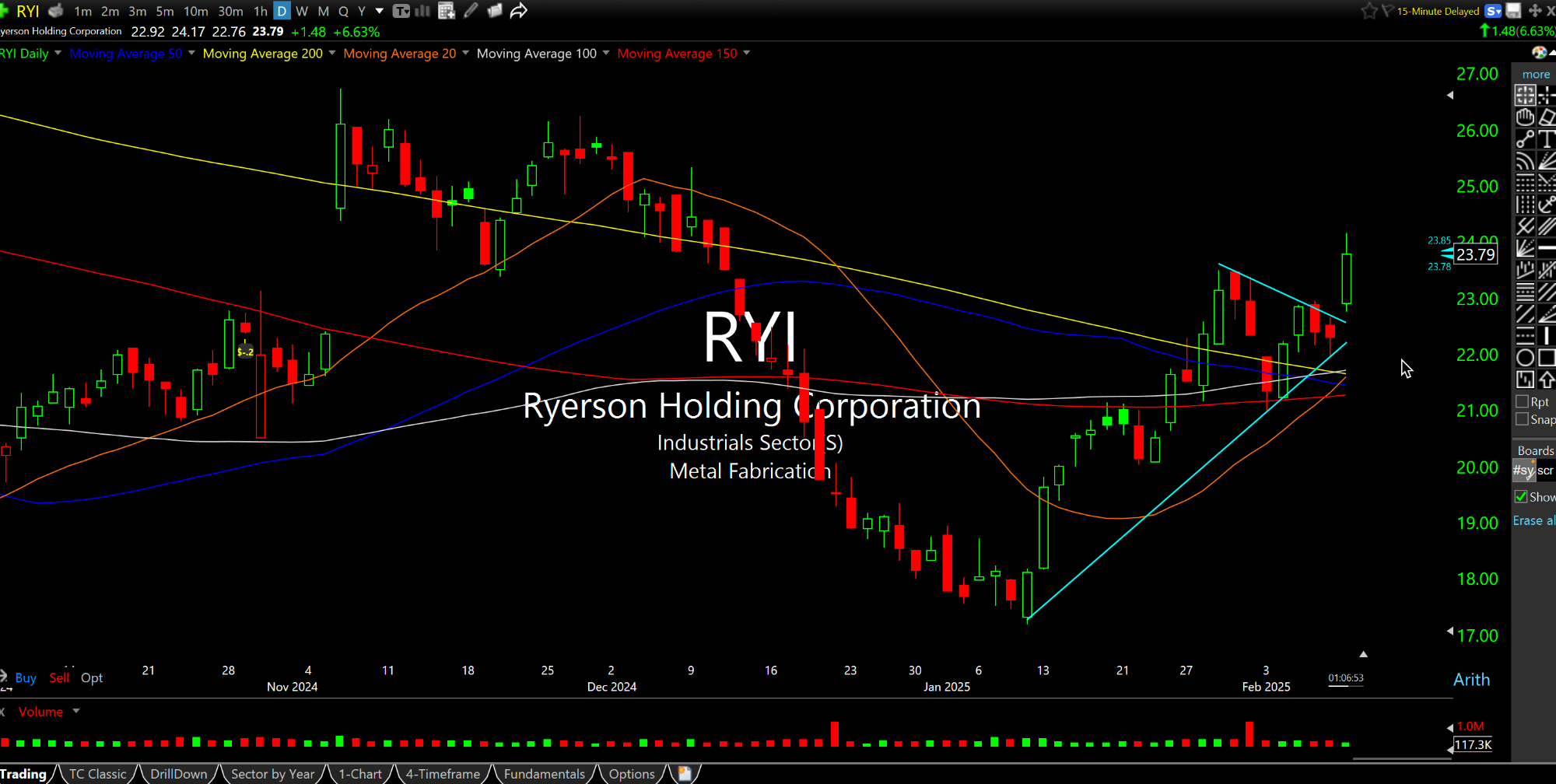

News of President Trump saying he will impose a 25% tariff on aluminum and steel imports has the domestic materials plays mostly higher today. Larger names like AA NUE X are getting attention. But smaller names like Chicago-based Ryerson, below on its daily chart, ought not be overlooked.

Compared to other smaller domestic materials plays like CMC ZEUS, Ryerson is above its 200-day moving average and acting well today on the news. Should the 200-day (yellow line) now become firm support I suspect the tariffs will become a more durable bullish catalyst.

We also have natural gas, some nuclear plays, along with gold acting well. That said, we have a busy week ahead of market moving data, including the CPI, PPI, jobless claims, more earnings, not to mention Powell giving testimony before Congress tomorrow and Wednesday. Tech and semis are bouncing back from Friday's selloff, though their overall charts of late (and semis especially for several quarters) are giving the look and feel of spinning their wheels more than anything--Other key sectors like financials, REITs, and small caps are essentially sitting this bounce out, alongside the relative weakness in some Mag7 names like AAPL.

Afternoon Update 02/07/25 {V... I'd Rather Have Low and Slow...