09Apr3:31 pmEST

Roller Coaster of Tariff Love

The afternoon broad market surge today on the back of President Trump announcing a 90-day postponement of non-China tariffs has understandably galvanized longs while stupefying bears. After all, the major indices shot up nearly 10% in a matter of moments.

In moments like these, and indeed in markets like these, overall, it is quite easy to lose one's head: One moment you may feel like you have a grip on the action, the next a massive move comes out of nowhere and it feels as though you may be trying to capture an escaping elephant with nothing more than a brown paper bag.

If nothing else, since the inception of Market Chess and Market Chess Subscription Services ten years ago we have cultivated a culture of levelheadedness: You simply will not find us adding fuel to the fire of the natural emotional swings which comes with any market, let alone a market like the current one.

For that reason, now is a good time to remind you that massive daily price swings are the rule, not the exception, in bearish markets. Of course that includes significant rallies. In fact, some of the biggest one-day rallies in market history occurred both in the Great Depression after the 1929 crash and then in 2008. In other words, these monstrous swings are a feature and not a bug.

Further, in light of today's move and the recent wide price ranges, it is not hyperbole to compare these swings to what we saw in 2008--I am not saying it is apples-to-apples, especially from the macro perspective, but it is fair to equate the swings to each other as someone who traded through it every single day.

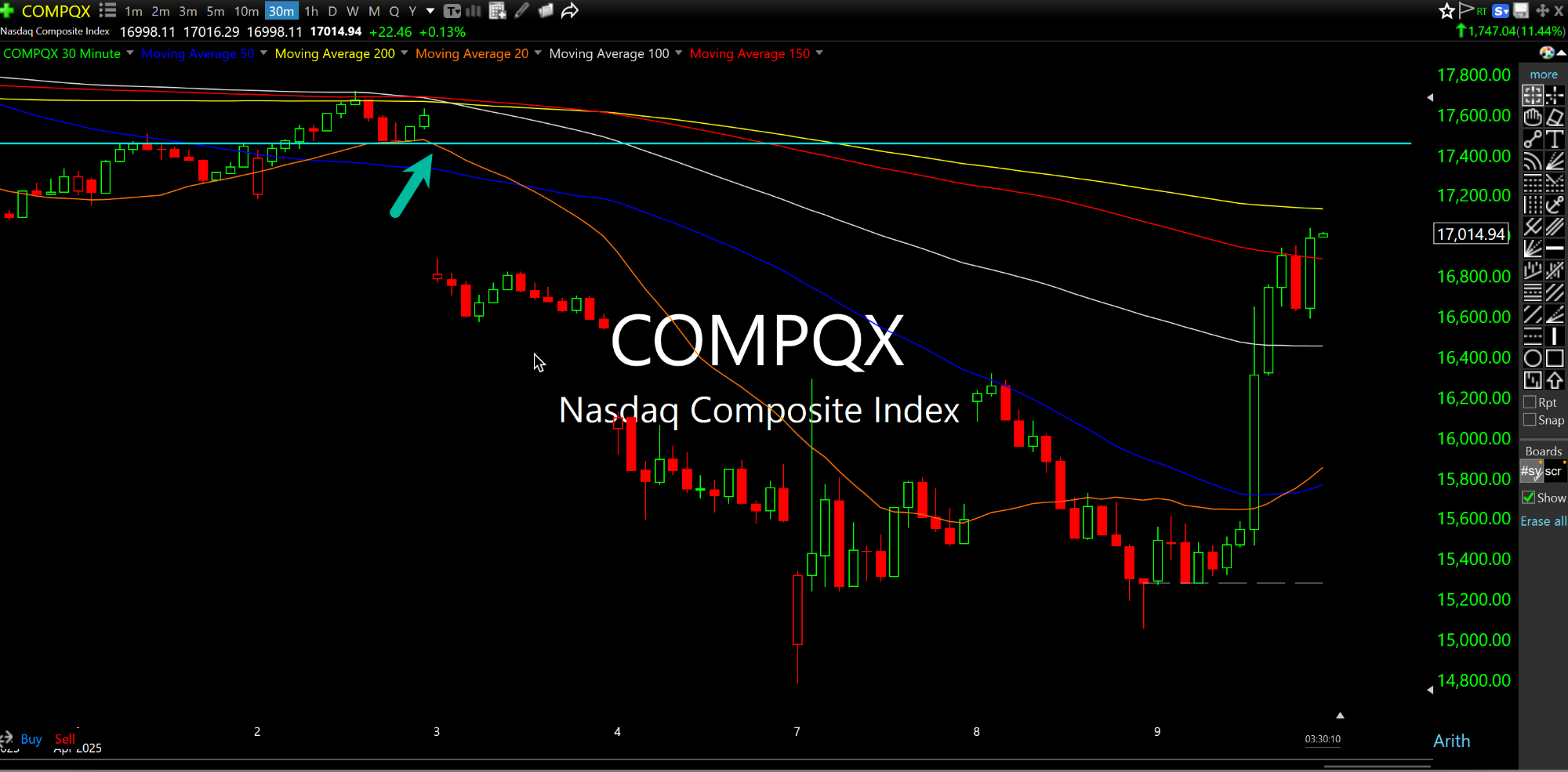

As for where we go from here, the S&P 500 overshot its 5390 gap from last Friday, while the Nasdaq (30-minute chart, below) has room above if the rally continues tomorrow. That said, I will be looking for more violent, abrupt swings and for today's dip-buyers to be put to the test in short order.