12May1:26 pmEST

There Still Ain't No Free Lunch

Equities may very well be reading into the U.S./China temporary tariff cuts as avoiding stagflation, at least for the time being. However, this reaction has all the makings of a knee-jerk emotional one which will see sobering effects in due time, likely within a week or two.

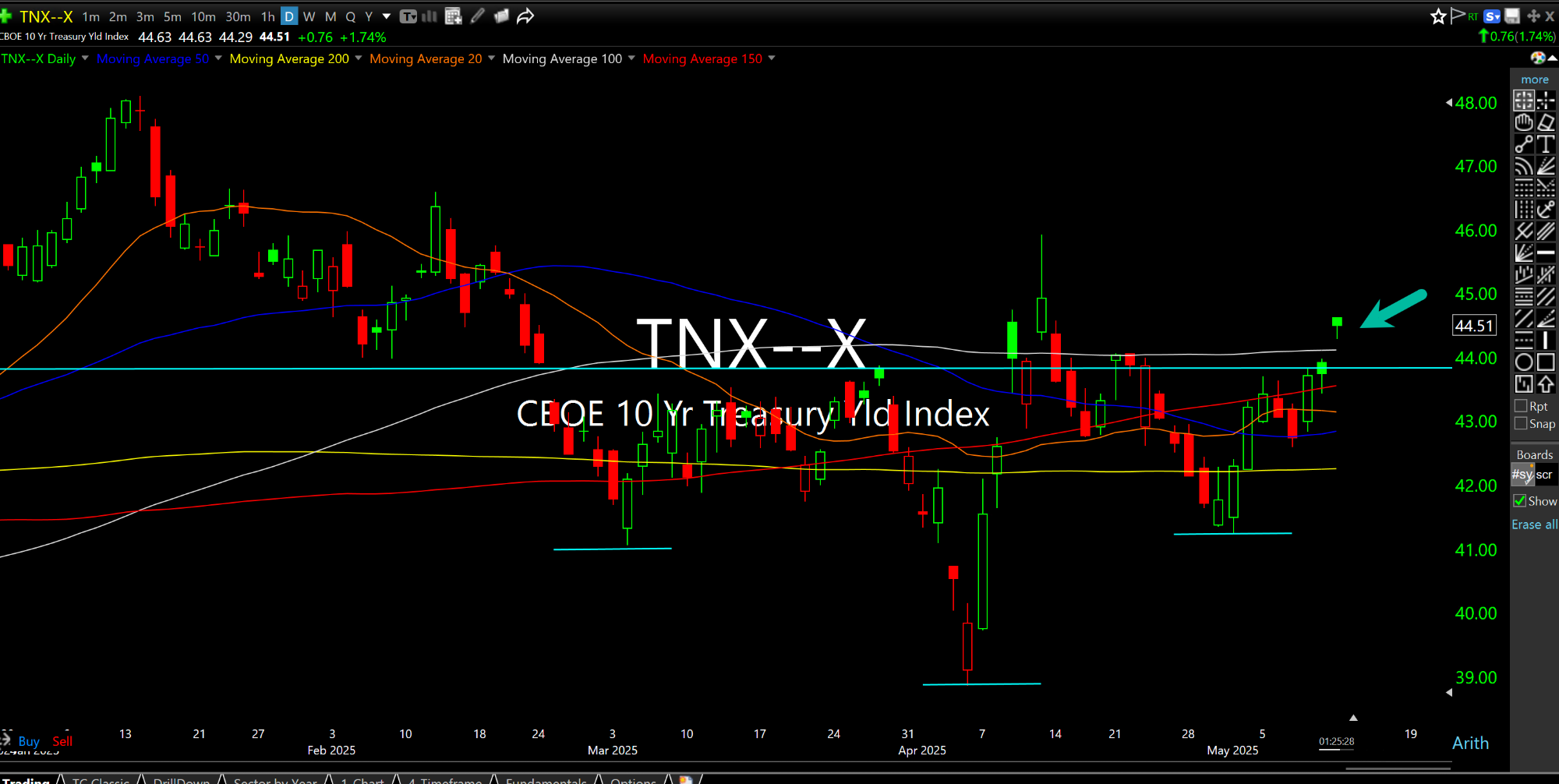

Specifically, you may notice that rates are pushing higher again, this time with rates on the 10-Year Note (Index below on daily chart) clearing some important resistance at the 4.4% (44 on this chart) area. As we have discussed here and with Members, clearing this area opens the door to a move to 5% based on the bullish inverse head and shoulders setup.

Considering where we were a little over a month ago, it is clear that the Trump White House chose to err on the side of inflation rather than allowing deflationary forces to take hold. While that is the conventional political play--always has been and probably always will be due to political expediency and the general strategy of trying to win the next election--the reality is that a dangerous situation is in the early stages of developing, once again.

Should rates on the 10-Year push towards 5% into this summer, as I expect, you will see The Fed float the idea of raising rates and, in effect, a repeat of 2022 where the market was shocked that inflation was hot and getting hotter. Tomorrow morning's CPI print is merely one part of the equation, since the bond market is more than capable of simply pushing rates higher on its own, regardless of the data. Case in point: Last September 2024 when The Fed began cutting rates, yet the long end of the curve saw rate rally sharply higher.

Near-term relief and taking the easy way out got us into this mess. And with Trump following the path of previous administrations now, we should expect the long end of the curve to start reminding people about how scary the bond market can be when it asserts itself.