15May11:38 amEST

Everyone Loves a Comeback, Except This One

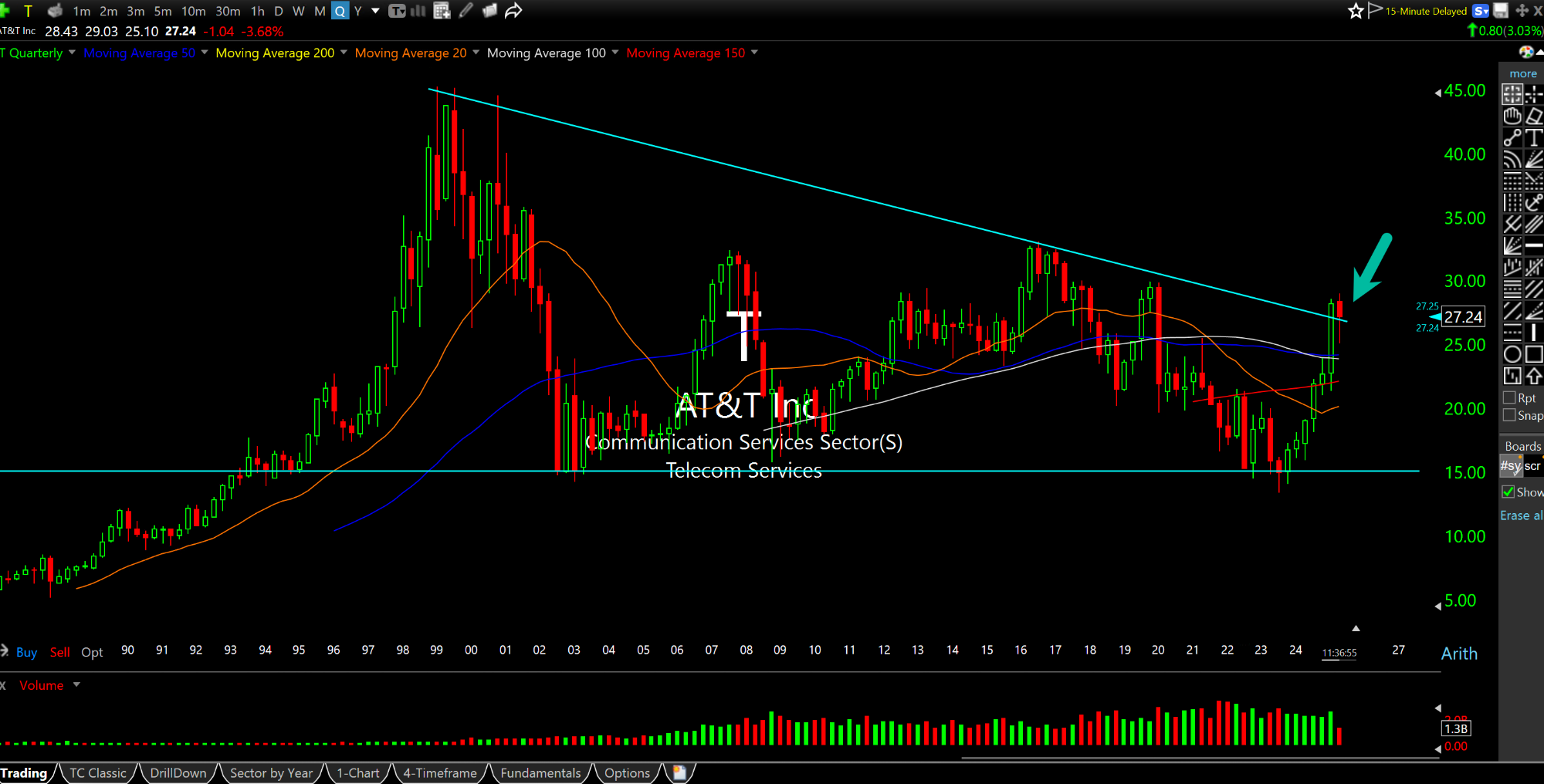

It is worth doing another update on AT&T, as the quarterly chart, below, shows the stock threatening a multi-decade breakout from the well-defined resistance trend-line I have drawn.

AT&T yields just over 4% now, not quite the monstrosity of a dividend it had when we turned bullish on the name in May 2022 inside the VIP segment (where we focus on very long-term investing) of Market Chess Subscription Services. Back then, popular television personalities were openly mocking T as a dead-money name. But the stock was (and mostly still is) dirt cheap.

AT&T also remains firmly out of favor in the cliquish investment community, a major reason why I prefer to operate in the shadows of it, in lieu of gossiping and wasting time, not to mention succumbing to group-think about "cool" and "uncool" stocks.

With T far from a trendy name, and a sustained era of stagflation likely underway I am still looking for it to handily outperform the rest of this decade as investors eventually begin to gravitate towards relatively cheap, dividend paying names with reliable brand strength.

Also note the difference between T and, say, Coke and MCD--The former trades at a forward PE of 12 while the latter trade with forward PEs in the 20s. Once again, not all defensive names are valued equally.