29May2:28 pmEST

Trade War Heretic

Last evening's fast and furious spike in the futures had bears bellowing about just how impossible and pointless it was to short this market, which seemingly finds any and all reasons to reverse back higher into even the slightest of dips.

Indeed, the combination of NVDA up after earnings and then the headline that a U.S. trade court ruled President Trump's tariffs overstepped his authority sparked a vicious pop overnight which has since faded virtually the entirety of the move as I write this.

Overall, we have a remarkably flat session headed into the final ninety minutes of trading. Tomorrow morning's PCE (The Fed's favorite inflation gauge) is being overlooked for now given the various news flow but it could easily spark a big market move.

My general view remains the same: Seasonality is turning decisively bearish until about the Fourth of July. I have been expecting rally attempts to sputter out and eventually resolve lower into June. So far, so good on that front. With a lagged like AAPL also being conveniently ignored, below all daily chart moving averages and lagging again today, there are definitely signs of this market being way out over its skis.

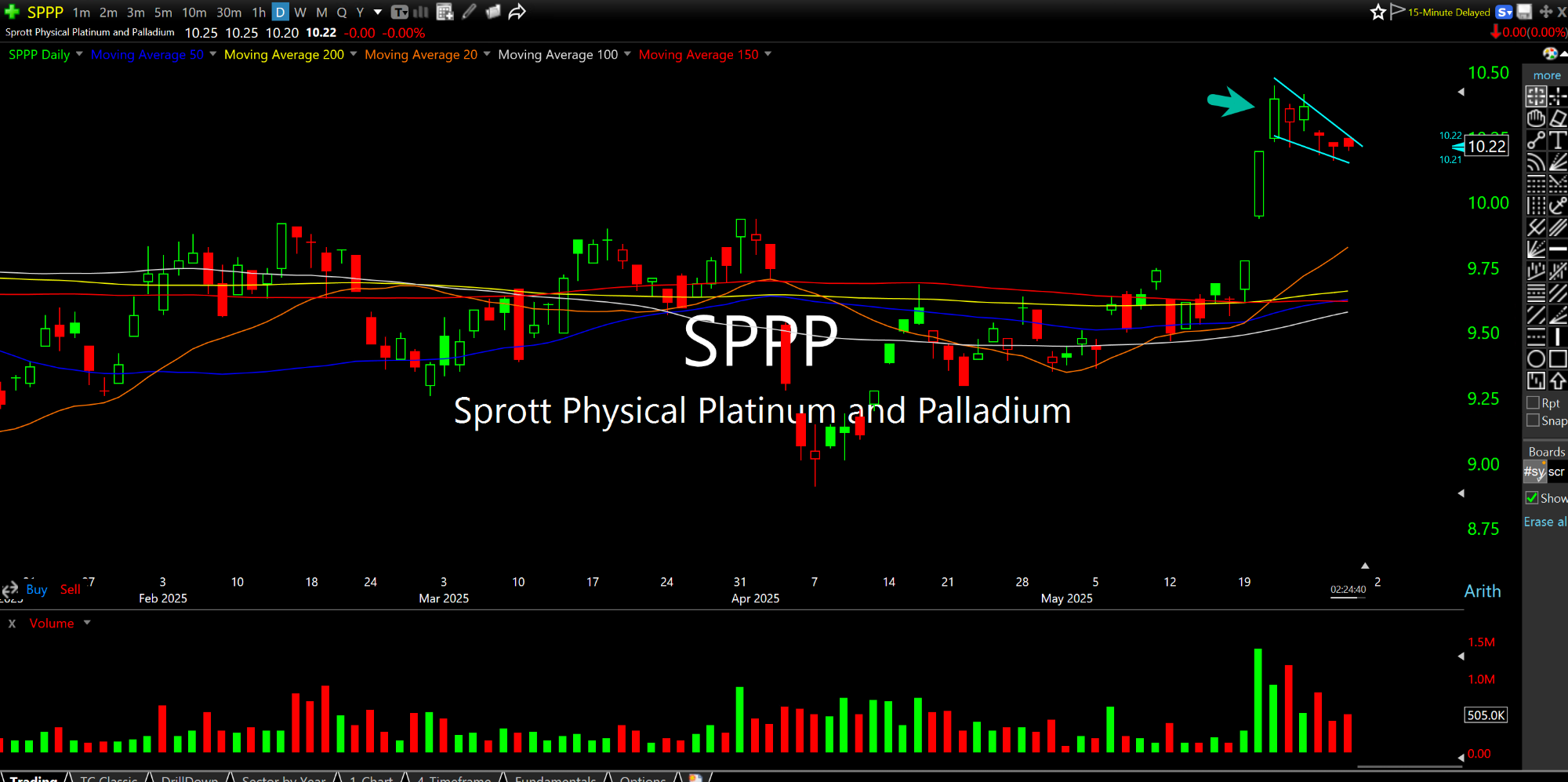

As for fresh ideas, keep an eye on the long side for SPPP, the Sprott physical Platinum and Palladium Trust, seen on the daily chart. below.

The bull flag highlighted is tight, attractive, and likely signaling a new leg higher is coming for two overlooked precious metals. Of course, gold and silver are coiling, too.