12Jun2:54 pmEST

Minsky Moments in Time

“(S)tagflation is the price we pay for the success we have had in avoiding a great or serious depression. The techniques that have been used since the mid-sixties to abort the debt-deflations have clearly been responsible for the stepwise acceleration in the inflation rates” -Hyman Minsky

Earlier today I saw @sidprabhu on X link back to some of his older tweets regarding stagflationary risks to the U.S. economy. The above quote he tweeted by the great economist and thinker, Hyman Minsky, seems appropriate for the current market and economy. Minsky died in 1996, of course. And he is blatantly referring to the 1960s and then-incoming 1970s period of stagflation.

But it is hard to ignore the parallels here.

Case in point: Even with the cool CPI print yesterday, as Sid notes, we have had fifty (!) consecutive months of Core PCE being above the 2% target on a year over year basis. In other words, The Fed's 2% inflation target is functioning more as a floor than a ceiling, which I expect to become even more problematic in the back half of 2025 as inflation turns higher in the face of White House pressure to cut rates again.

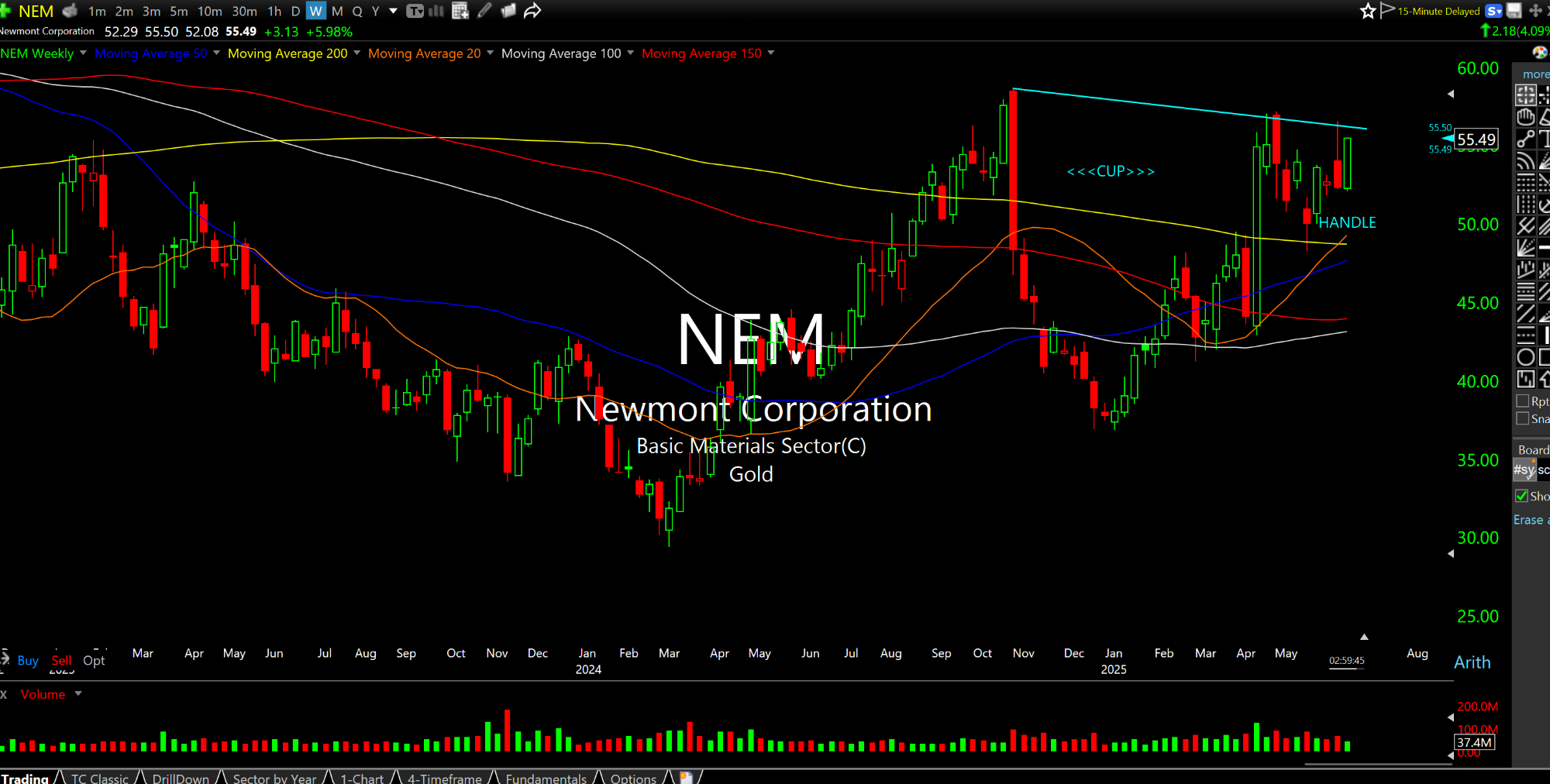

On that note, just like in the 1970s we have gold leading again. Newmont, the largest market cap name in the GDX ETF, is sporting a bullish weekly cup and handle pattern, below, surging higher today.