10Jul2:01 pmEST

REMX for the Bull Market Remix

One of the more fascinating aspects about the stagflation of the 1970s was that even as the NIFTY FIFTY bubble finally popped and saw the major indices get cut in half, gold, oil, and most commodities in general thrived. It was not the deep depression of the 1930s where virtually everything deflated.

Now, part of that may be due to 1971, when then-President Richard Nixon ended the U.S. Dollar's convertibility to gold internationally, effectively ending the gold standard completely. We also had the Arab oil embargo in the 70s for the oil price shock and gas lines.

Still, commodities thrived even as the crowded and seemingly can't-miss NIFTY FIFTY behemoths finally cracked.

Applied to the current market we still have not yet had that "crack," as the likes of MSFT NVDA and then some names like HOOD PLTR keep finding motivated speculators who see any and all prices and valuations as buying opportunities. I still expect that to change quickly once we get the eventual rug-pull.

In the meantime, there can be no doubt that certain commodities are displaying strong signs of a new bull market. Gold remains the long-term leader, with silver and copper improving. But now we have platinum and palladium coming on well alongside the news of the day with the rare earths space.

For a long tine now we have noted with Members that the rare earths amounted to a serious political football, and the MP news aligns with that view. with the firm unveiling a multibillion-dollar deal with the U.S. government on Thursday to boost output of rare earths and help loosen a stranglehold by top producer China on the minerals vital for military applications, electric vehicles and wind turbines. MP is higher by more 48% as I write this.

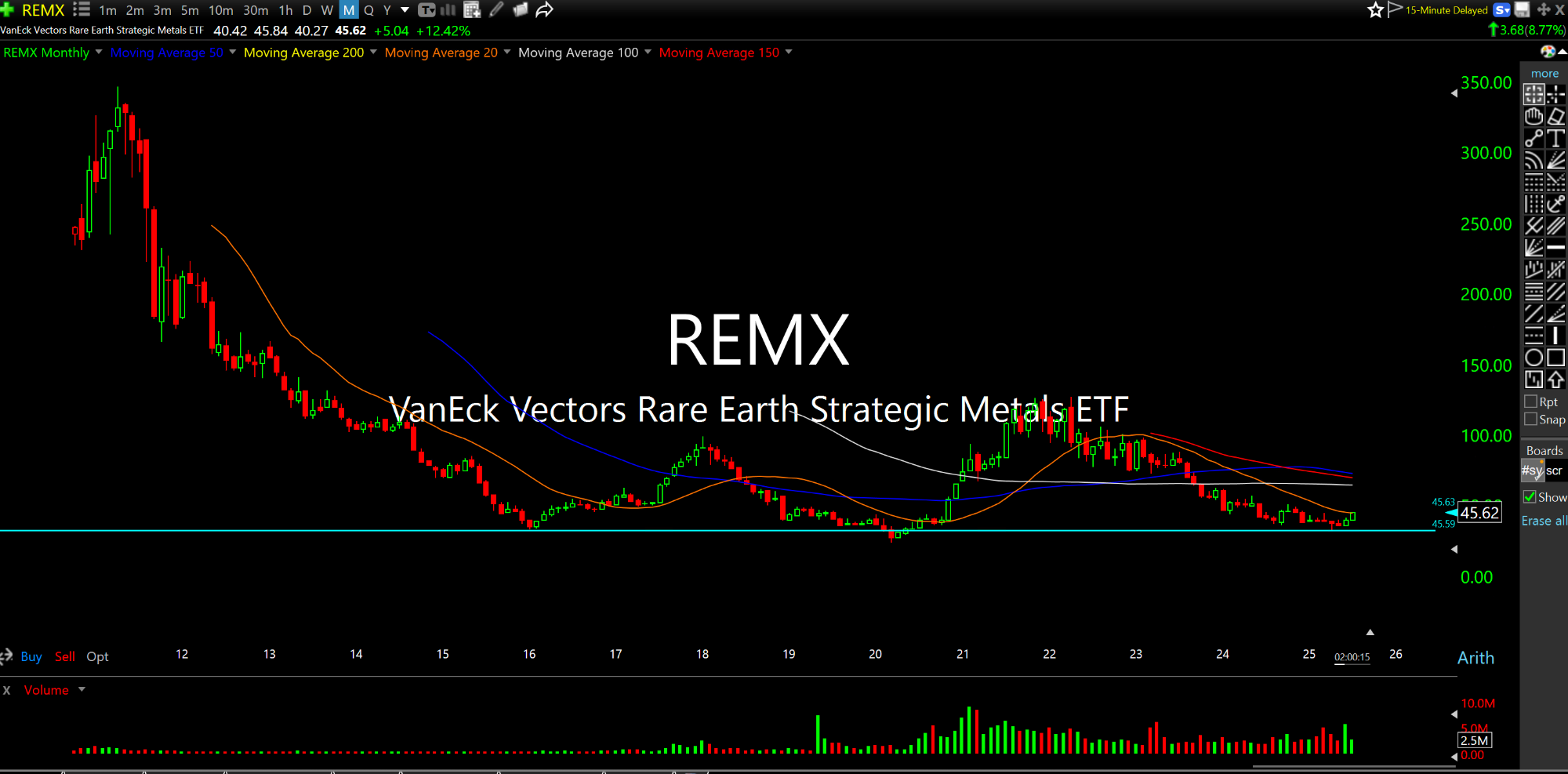

In addition, UUUU has rare earths exposure. And the REMX, below on the monthly, is the general ETF for rare earths plays.

As you can see, REMX looks to be turning back up off ten-year lows and prior major support. Under Pete Hegseth, the Department of Defense has been aggressive thus far in Trump second term. I expect that to continue with domestic rare earths, alongside other niche metals and miners, earnings more government contracts and shareholder interests.