24Jul12:43 pmEST

Stand By Your Mine

Colorado-based Newmont Mining reports tonight, a name I have held for years in the VIP section of Market Chess Subscription Services, which is dedicated to long-term investing.

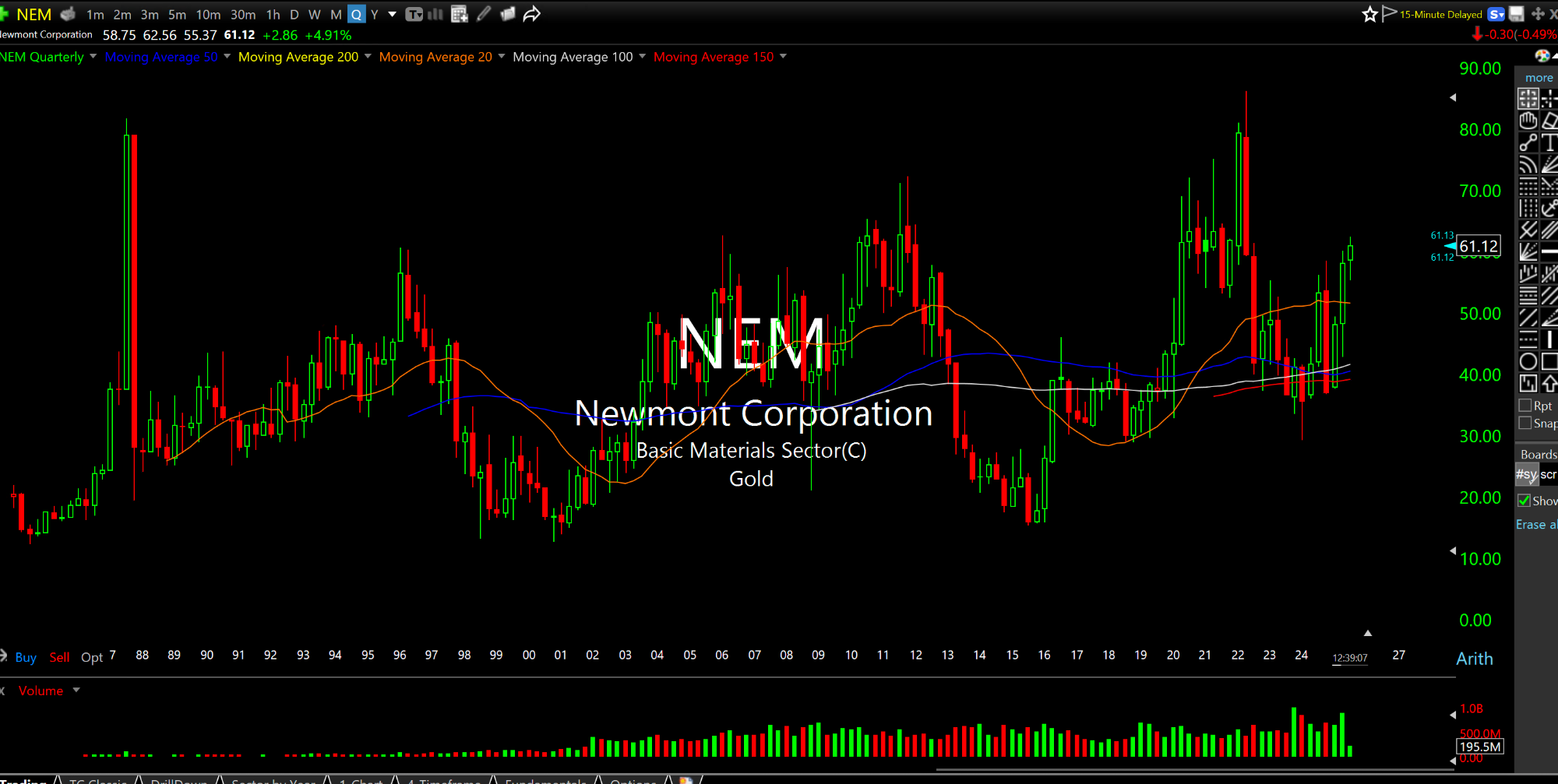

Despite Newmont coming on strongly over the last eighteen months or so, when we look at the multi-decade chart, below, you can clearly see the stock trading, overall, sideways since the late-1980s.

Newmont has almost always ranked as one of, if not the, largest precious miners by market cap in the world, which makes this analysis all the more instructive.

Thus, the pertinent issue is whether the precious miners on a long-term basis, using NEM as a proxy, are on the cusp of following the gold metal itself to new highs. Gold bullion has been the leader of the pack, not just relative to miners but other precious metals, even with recent outperformance by silver, palladium, and platinum. To be clear miners have done quite well this year. So it is not like they are suspiciously diverging in a bearish way.

But on a multi-year/decade basis the real magic may lie ahead for gold bugs.

Simply put, gold needs to stand by its mine.