06Aug10:29 amEST

One Last Trip for Old Times' Sake

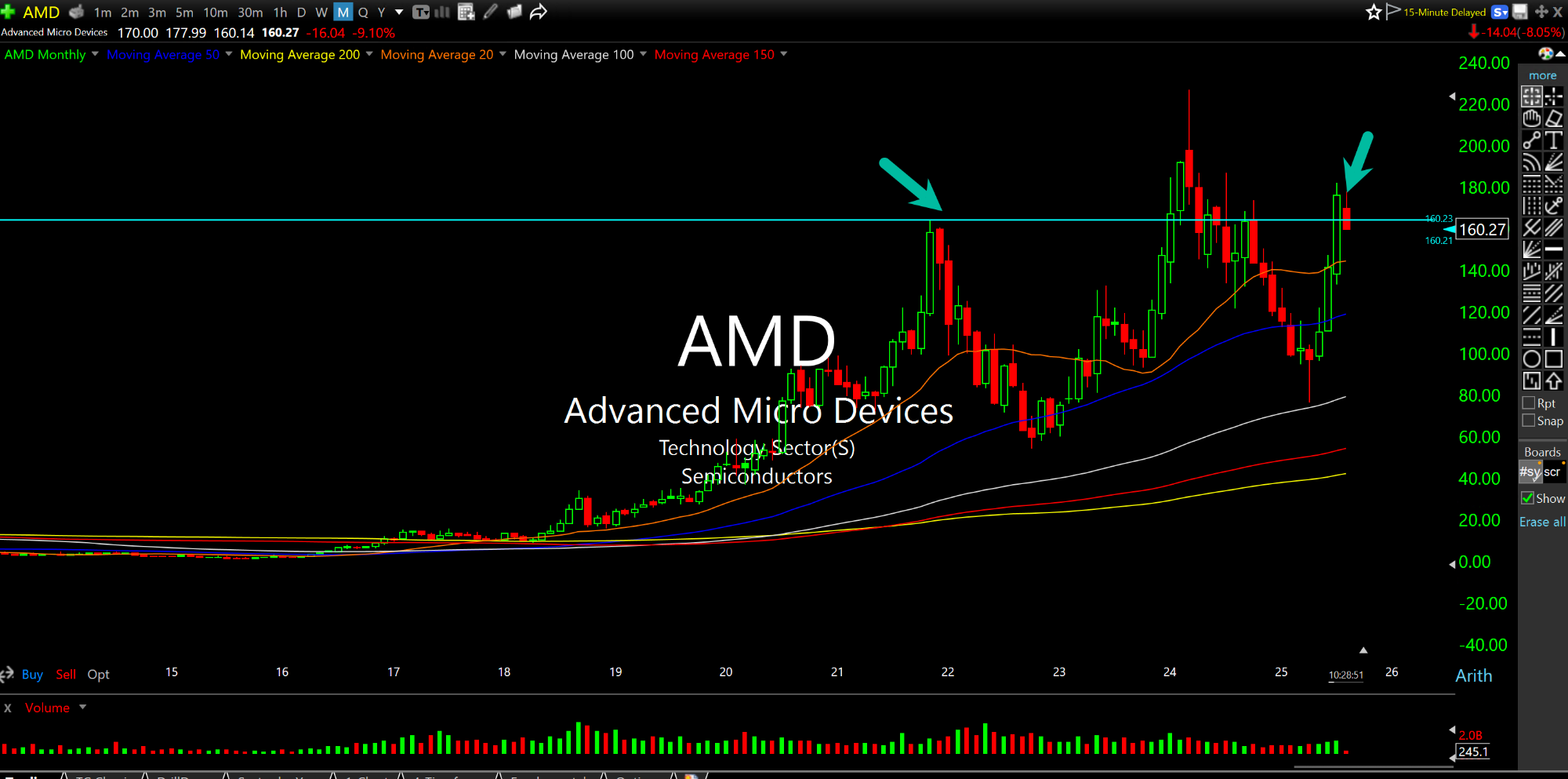

It should not come as too much of surprise to see the semiconductor AMD struggle after earnings in the area above $160. After all, gauging the monthly chart, below, we have seen Advanced Micro Devices run into major tops above that level dating back several years now.

As I write this, AMD is leading the SMH semiconductor ETF lower, the former down more than 7-8% and the latter down more than 1%, as clear laggards. But what is more of a surprise to me is that AMD made another run above $160 in recent months in the first place. Indeed, this has been one long drawn out macro cycle.

Going forward, we have NVIDIA earnings at the end of the month for chips which, without question, outweigh AMD both in terms of market cap and AI/chip significance.

Overall, the SMH clear underperformance should not be overlooked. Chips have always been the key sector in this market during the AI craze and, actually, since the 2009 bear market lows compared to other sectors. We may be gearing up for yet another "NVDA saves the day" type of report in a few weeks, but that is still a ways away.

For now, the Apple/U.S. investment news popping shares of AAPL 4% seems to be masking quite a bit of weakness in tech, as noted.

Big Week for Vegas But Well ... I Feel Sorry for Your Bubble...