11Aug2:53 pmEST

Many Converts Await

With President Trump announcing he is casting his net even wider with candidates to become his nominee for next Fed Chair, it only creates an even larger incentive for said candidates to audition via a blatantly dovish view on rates. Put another way, the most dovish candidate has a better chance of winning Trump's nomination than a hawkish one, without question.

But with the Consumer Price Index release tomorrow morning for the month of July expected to come in at 2.8% year over year, one has to wonder if this entire charade is one of the greatest unforced errors in monetary history. If we do get a hot print, especially one with a 3-handle on a year over year basis, you can be sure we will begin to see converts to the hawkish camp not unlike in late-2021/early-2022.

My expectation remains that inflation is entrenched and in a secular trend, which means it will come roaring back each and every time most think it is over and done. Hence, I continue to look for a hot print.

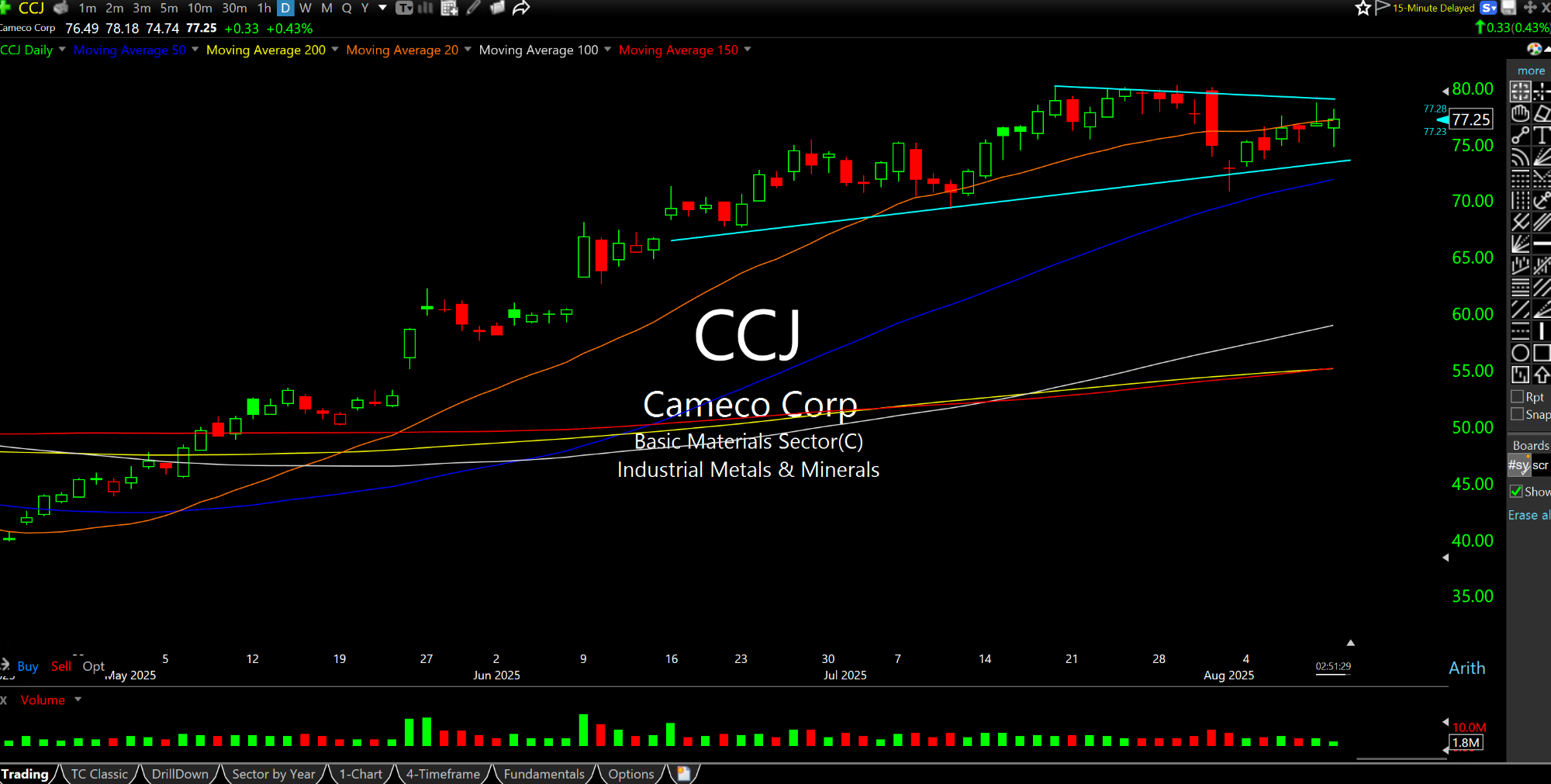

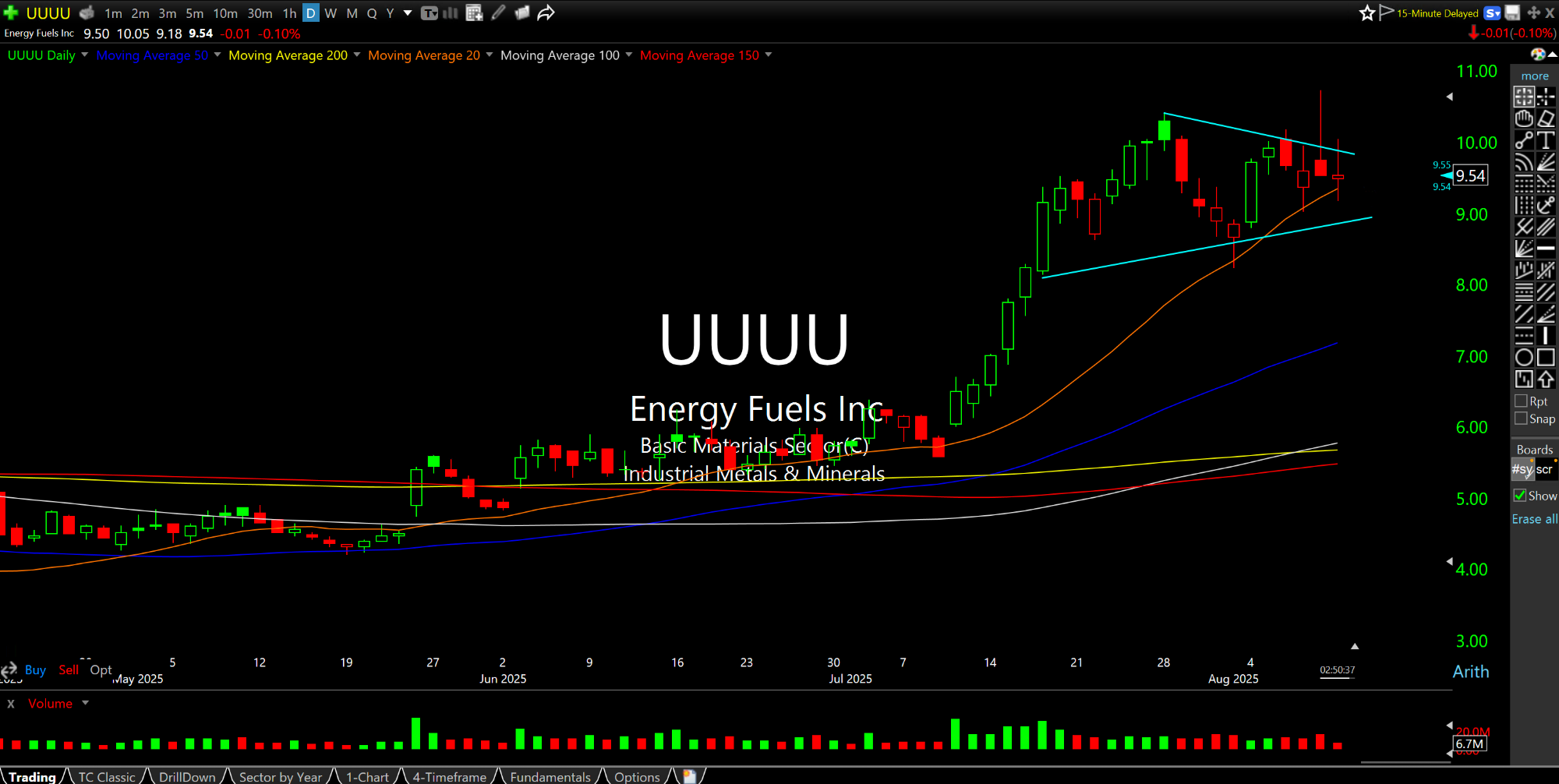

In addition, with Trump and Putin meeting in Alaska on Friday it behooves us to keep an eye on the political football plays. Specifically, rare earths and uranium. UUUU encompasses both of these, on the second daily chart, below, holding up very well. And CCJ, on the first daily, continues to be one of the best uranium miners around.