26Aug2:16 pmEST

The Hangover Effect

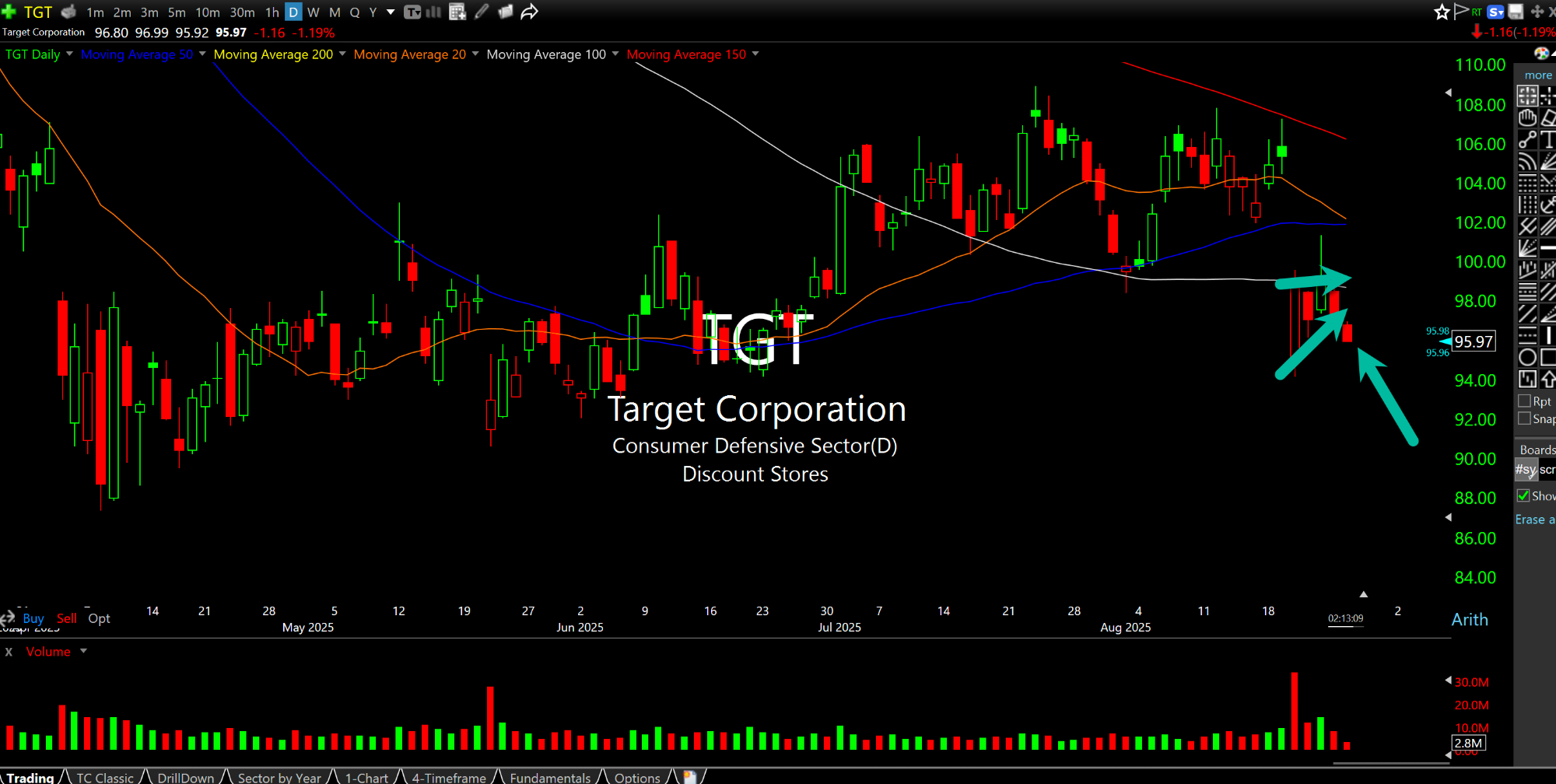

It has been a wild late-August for Target after a summer-long rally abruptly ended on news of its CEO stepping down alongside a recent earning selloff. Overall, shares of TGT topped out back in late-2021 and remain well below those $268.98 highs, with the stock now trading in double digits as I write this.

For our purposes, however, the instructive and actionable lesson is to not shut off the lights, so to speak, after a stock has a big move alongside some major events. After all, it is only human nature to have a bit of a hangover from Target and move on to the next news items, particularly in this nonstop cycle with Trump, The Fed, social media, and everything else for that matter.

But in doing so we would overlook an actionable setup, as seen on the updated TGT daily chart, below. Note the bear flag consolidation, at risk of breaching today for another move down. I see no bottom in place or even trying to form for Target.

Recall that much of Target's target (pardon me) demographic is getting absolutely pummeled by sticky high inflation coupled with uneven growth favoring the ultra wealthy. Hence, it follows they are slowly getting tapped out which will only see a retailer like TGT continue to struggle. Similar comments apply to CMG LULU SBUX, all weakening retail/consumer plays showing no signs of improving and still short ideas.

Stock Market Recap 06/06/16 ... Slowly Finding Themselves Tr...