27Aug2:45 pmEST

Twenty-Five Years Ago to the Month

With NVIDIA earnings this evening it is worth revisiting a parallel we have previously drawn both here and with Members: The magnificent bubble and collapse of Cisco during the dot-com mania. CSCO still has not recaptured its prior highs from mid-2000, as seen on the quarterly chart, below.

If you traded back then, you know that CSCO, with hotshot CEO John Chambers, was widely considered the NVDA of its time--A can't miss winner at the epicenter of the bubble that everyone simply had to own at any price and at any valuation. However, here we are twenty-five years later with the stock, despite an impressive rally of late, still sitting below those highs leaving trapped longs frustrated for two and a half decades.

But what is even more instructive and potentially actionable with CSCO is the precise earnings report they delivered in late-summer 2000.

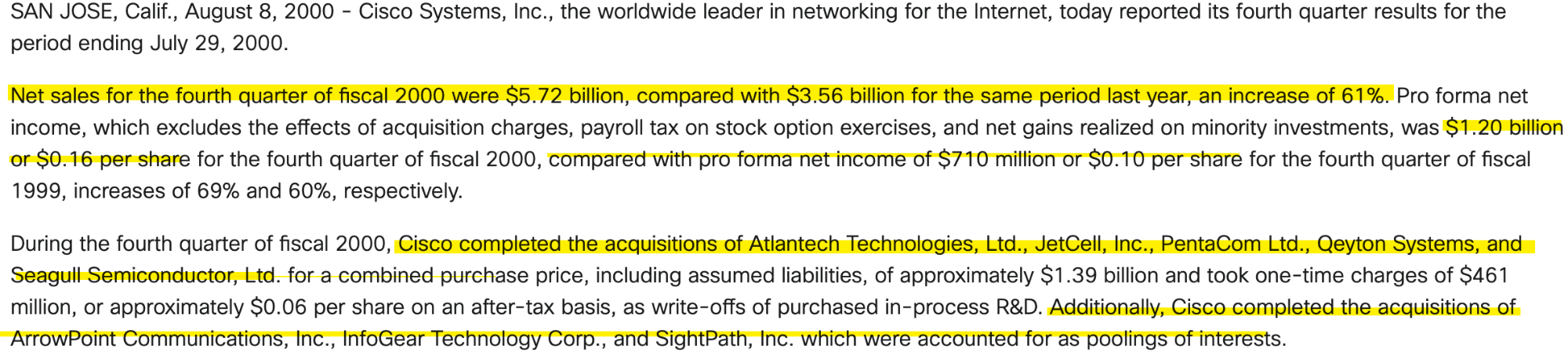

As you can see on the press release (from Cisco's website), just below, CSCO's August 8th, 2000 earnings did a good job of beating estimates up and down. Much like NVDA they had various M&A to announce and finalize as well to keep the gravy train running hot.

And, yet, the stock was already topping out. In fact, the stock sold off on the good news and never looked back.

This analogy seems appropriate in this exact moment given the mantra bulls have been repeating that the Magnificent 7 names have the big-time earnings to justify virtually any stock price and any valuation.

At a certain point, Wall Street history teaches us that the market decides the stock price has baked in all the good news going forward, with CSCO being an excellent case study.

Still the Prey, Not the Hunt... What's LUV Got to Do with Th...