04Sep3:36 pmEST

It's Not Always the Easy Choice

Over the decades it has become Wall Street lore that investing long-term in "boring, safe, defensive stocks" with a dividend is a virtual lay-up if you have the patience and lack the desire for any kind of action in your portfolio.

However, that view has a blind spot: The liquidity bubble since the 2009 bear market bottom has found its way into just about every nook and cranny of financial assets at one point or another, including the defensive stocks housed on the XLP ETF for consumer staples, bidding them up into a virtual Towel of Babel on long-term quarterly charts (second below, for example).

As we have noted here and with Members for years now, the likes of KO PEP PG, just to name a few, are not cheap. In fact, despite their recent pullbacks I would still consider them expensive for defensives.

Of course, there have been opportunities. Inside the VIP service where we focus on long-term investing, Altria (MO) and AT&T (T) have been multi-year holds for me, benefiting from the dividend, modest valuation, and in the case of AT&T a completely overlooked name for years now finally making a comeback.

But those are much more of the exceptions than the rule.

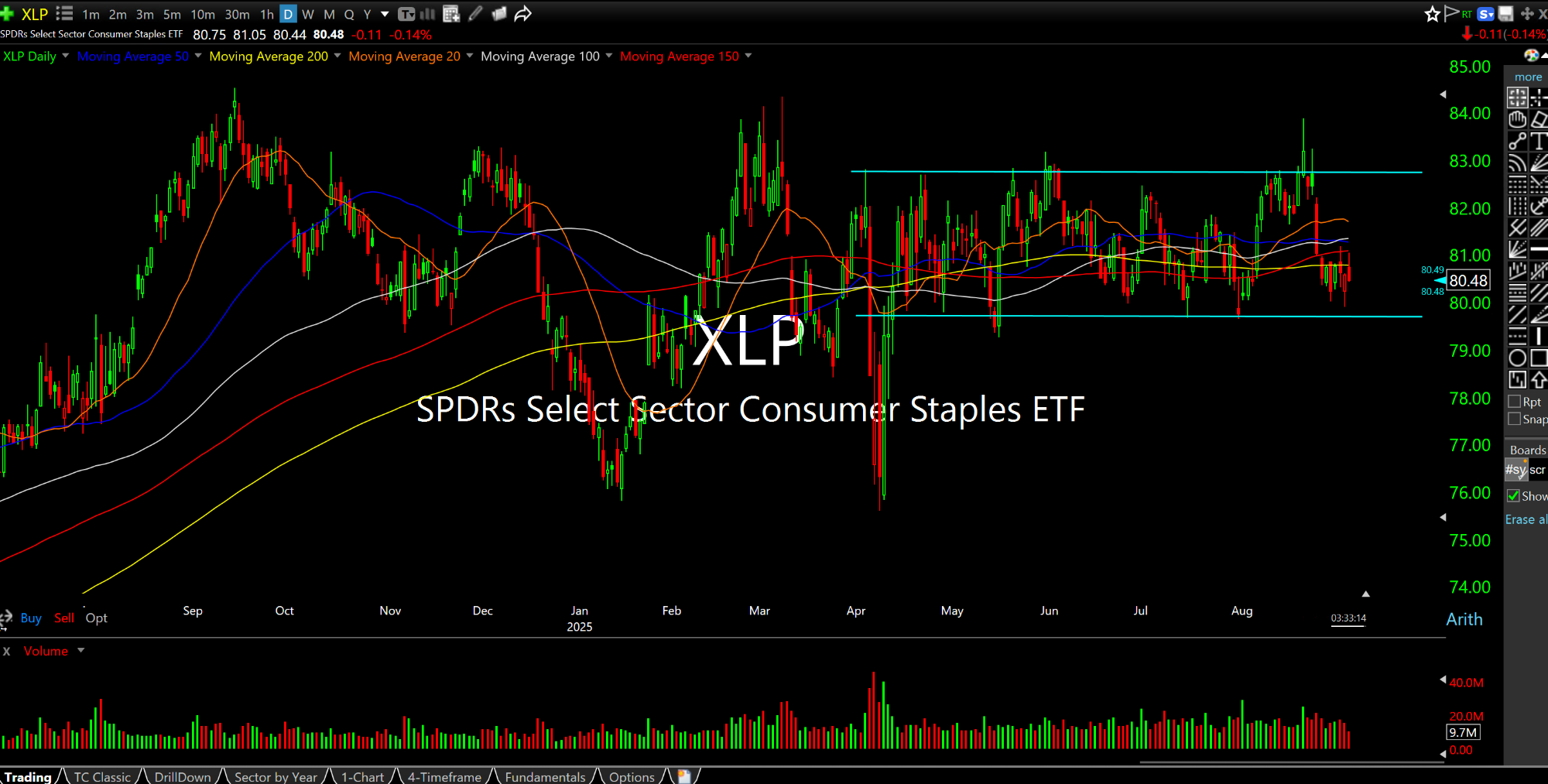

Overall, the XLP is in a tight range recently, as seen on the first daily chart, below. If we see further weakness I suspect equity bulls will cheer it on as a sign of risk appetite for growth stocks/discretionary names.

However, that is likely a mistake, since the XLP obviously more than participated in the bubble for years on end. If anything, in a world with endless liquidity the teachable lesson will ultimately be that The Fed has distorted price discovery in equities to such an extent that we may need to redefine what a defensive stock even is anymore.

Howd'ya Like That, Boys? A C... Afternoon Update 09/05/25 {V...