15Sep2:33 pmEST

Not All Overboughts Are Created Equal

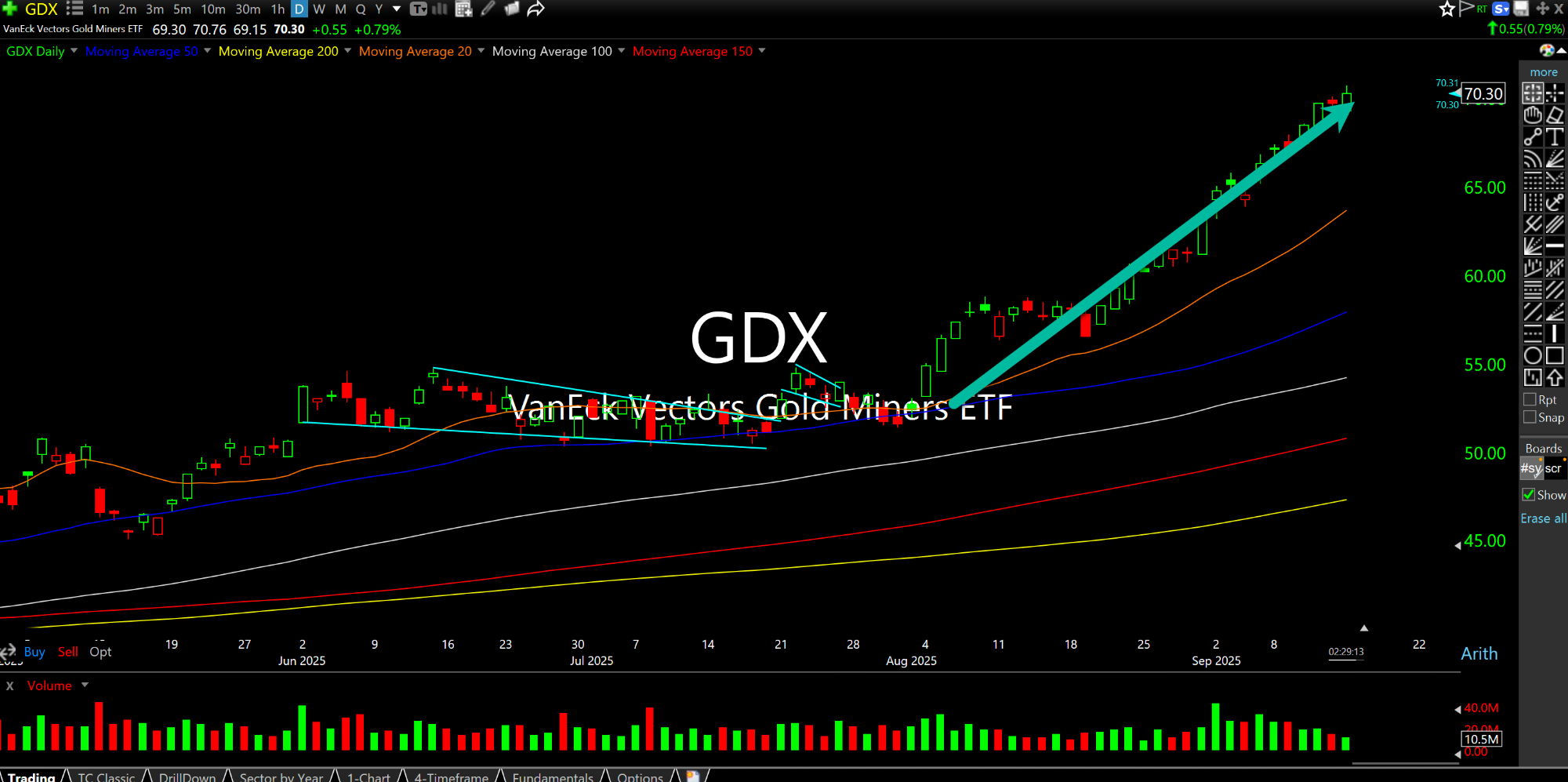

Both precious miners (See: GDX ETF daily chart, first below) and the Nasdaq are higher again, as both are pushing the boundaries of near-term overbought conditions.

However, that is where the comparisons mostly end.

Even though precious miners have been on a tear for nearly six weeks now they still remain woefully undervalued. They are also largely under-owned, still, and under-appreciated in the investing world, still, as we have noted many times both here and with Members.

Beyond that, retail sentiment and "Main Street" sentiment regarding precious metals and miners remains all but absent. The rise of crypto over the last fifteen years or so has clearly blunted what would likely otherwise be a natural ascent in enthusiasm for metals and miners given all of the deficit spending and money printing in the developed economies.

And, of course, the spotlight behind hogged by the Magnificent 7, chips as a group, NVDA PLTR, various hot tamale growth/AI/meme plays of the week like OPEN ORCL HIMS HOOD, on top of the major indices pushing new highs for 401Ks all mean that precious miners continue to sit firmly in the back of the bus despite the recent rally.

The Nasdaq, meanwhile is both driving the bus and riding shotgun as we head into Wednesday's likely rate cut at the FOMC.

In other words, my view is that the GDX overbought conditions are likely of the bullish variety, telegraphing the beginning of a much larger move higher in the coming quarters and years, whereas the Nasdaq move is likely the cherry on top of what has been a speculative bubble for the ages. The counter argument that this is not a bubble because of "real earnings" sounds great in real-time but ignores history. I can assure you that in real-time of prior bubbles many were convinced that the underlying theme of the bubble was too legitimate to be a bubble, too (just dig a bit more into PLTR and NVDA's earnings if you care to fact-check me--Tons of assumptions are being made about the future which are unlikely to prove true).

Inversely, precious miners are not likely to arrive at a long-term top until we see the sort of fervor for them amongst retail traders that they are showing now for AI and growth. And I still believe that will be years away.

Thus, non-extended miners like EXK (second daily chart, below) are on watch long to play catch-up if GDX pauses and we get some intra-sector rotation.