01Oct3:09 pmEST

Let the Winter Pass in October

"Sometimes it is best to lie low, to do nothing but let the winter pass." -Robert Greene

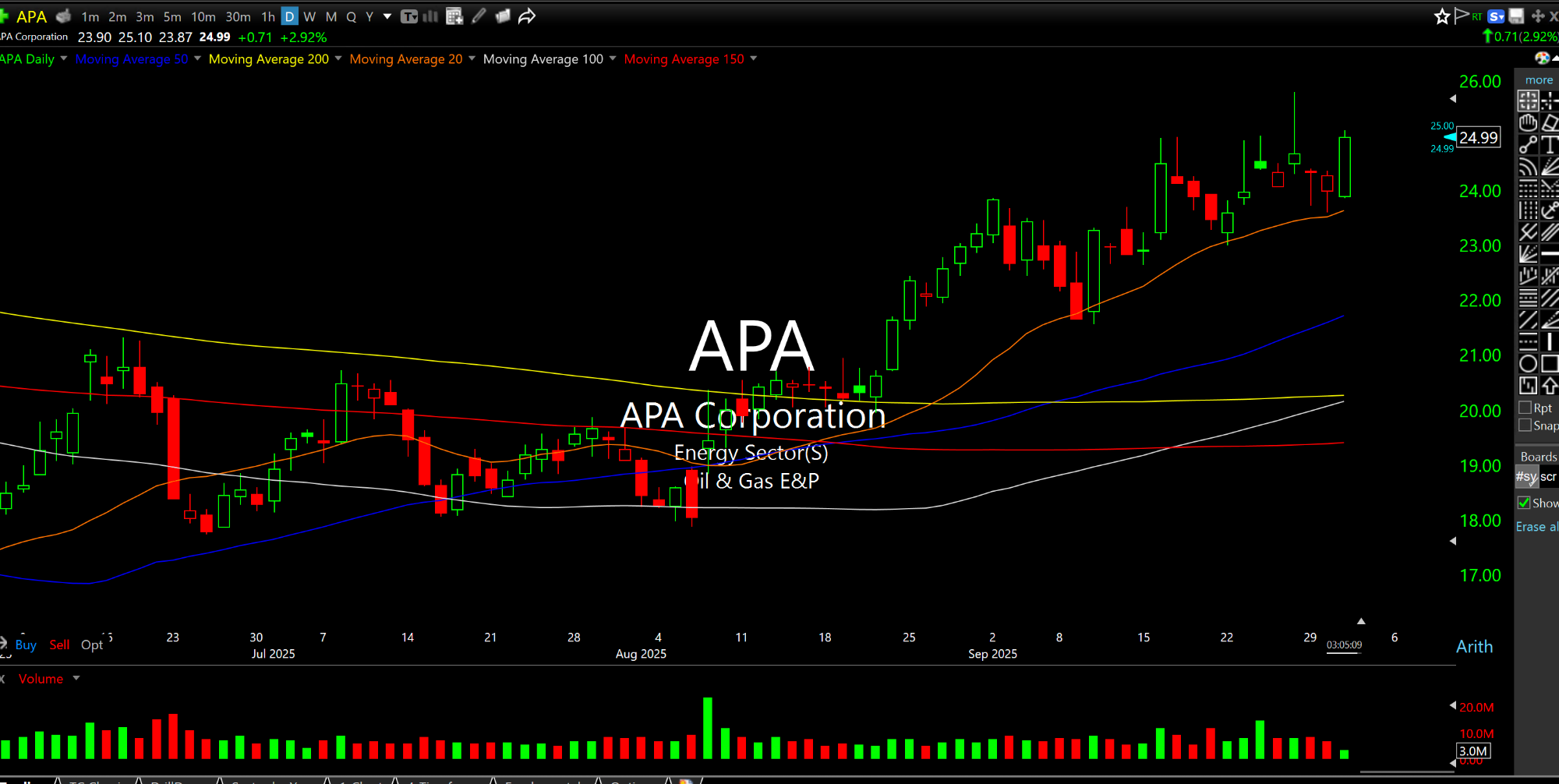

Despite how lousy crude oil itself has been, particularly when it comes to sustaining upside moves, quite a few oil stocks and related names to the oil space (e.g. tankers, discussed with Members) are acting quite well. Exhibit A would be APA (Apache) on the daily chart, below, unperturbed by the recent selloff in crude, albeit with natural gas finally showing a bit of life after its own recent swoon.

Still, you get the sense that the crude oil price action has everyone flabbergasted, including Warren Buffett himself.

In fact, despite the quote above, Buffett is taking action by making a $10 billion splash for OXY's Petrochemical Unit--After studying Buffett for decades I highly doubt he would pull the trigger on such a play unless he thought oil and oil stocks are grossly under-priced here.

But the title of this piece and the quote above refer more to the Nasdaq's daily, nonstop melt-up. I do not have a precise answer for it, other than the money supply exploding despite that being the worst possible thing for entrenched inflation. The majority of people in this country, unquestionably, suffer with daily higher prices.

Precious metal and miners are the most glaring "check" on the various blunders taking place with monetary and fiscal policies right now. However, other asset classes likely need to join in before we see enough to generate a long overdue regime change which catches many over-levered longs (and volatility shorts) off-guard.

Beyond Meat: Ingredients for... Saturday Night at Market Che...