13Oct2:31 pmEST

Long Live the SS Gairsoppa!

Despite (or, perhaps, because of) how many were adamant that gold had topped out last week we have the precious metals and miners extending higher yet again today alongside the reflex rally in equities.

This sort of price action make it excruciatingly difficult to establish new long positions in the precious metals and miners, as the likes of gold and silver all jump from what were already short-term overbought conditions. Granted, other precious metals like platinum and palladium, as well as the precious miner ETFs (GDX, GDXJ, SIL, SILJ) are less extended than gold and silver.

But the larger point is that this price action in an undervalued, under-owned, under-appreciated sector is likely wildly bullish for the intermediate and long-term, even if a short-term shakeout occurs at any moment. Again, this stands in sharp contrast to the Nasdaq and the hot growth stocks, which are wholly loved, rich, crowded, and chock full of hot money on all timeframes.

With this in mind, we must put in the extra effort to identify actionable, non-extended ideas in the precious metals and mining space.

The SS Gairsoppa was a British cargo steamship that sunk in the Battle of the Atlantic in 1941. Only one person survived. When she was sunk, her cargo included an estimated 7 million ounces of silver bullion.

A-Mark Precious Metals (Ticker AMRK, founded in 1965 as A Mark Coin Company, and seen on the first daily chart, below) is a precious metals trading company. It was the first company allowed to make and sell coins from the metals recovered in the shipwreck of SS Gairsoppa.

As you can see, the chart is one of the tighter bases you will find in the entire market right now. Beware the lighter volume. But this is still an enticing long idea given the sector strength.

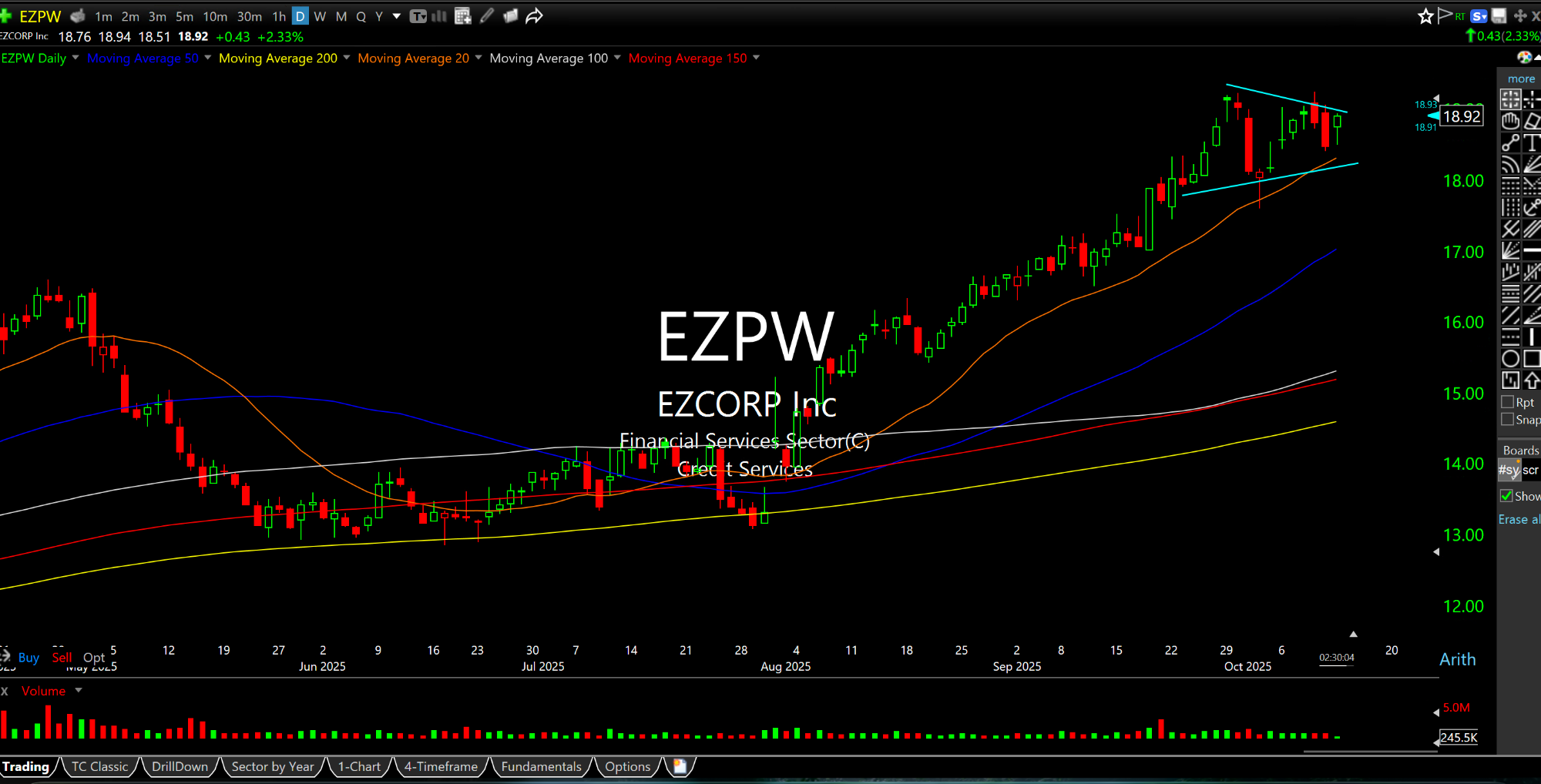

And the second chart is an old idea, the pawn shop chain EZPW which tends to track bullishly when the price of gold rises, for obvious reasons as desperate customers trade in whatever they have to liquify into fiat currency.

Afternoon Update 10/10/25 {V... People of Walmart Becomes Ro...