23Oct2:48 pmEST

The Rally That Wasn't There

It truly does not seem like much of a controversial statement to suggest that the last thing most market players and pundits (including jaded oil bulls) expect is a powerful, sustained rally in crude and the entire oil complex, going forward.

After all, as you can see on the first monthly chart, below, of the USO ETF for crude oil, we have seen nearly three and a half years of sideways, churning price action. Furthermore, most oil stocks have lagged miserably while many other commodities and commodity stocks have been thriving.

In the 1970s, when we last had entrenched inflation, gold and oil were the two best performing assets of that decade. Thus far this time around it has been all gold with oil not pulling its weight.

But oil has suddenly decided to at least flirt with a rally, as the USO enjoyed some of its strongest buy volume in recent sessions to little fanfare. This would be the perfect moment for a high buy volume breakout which no one believes can sustain.

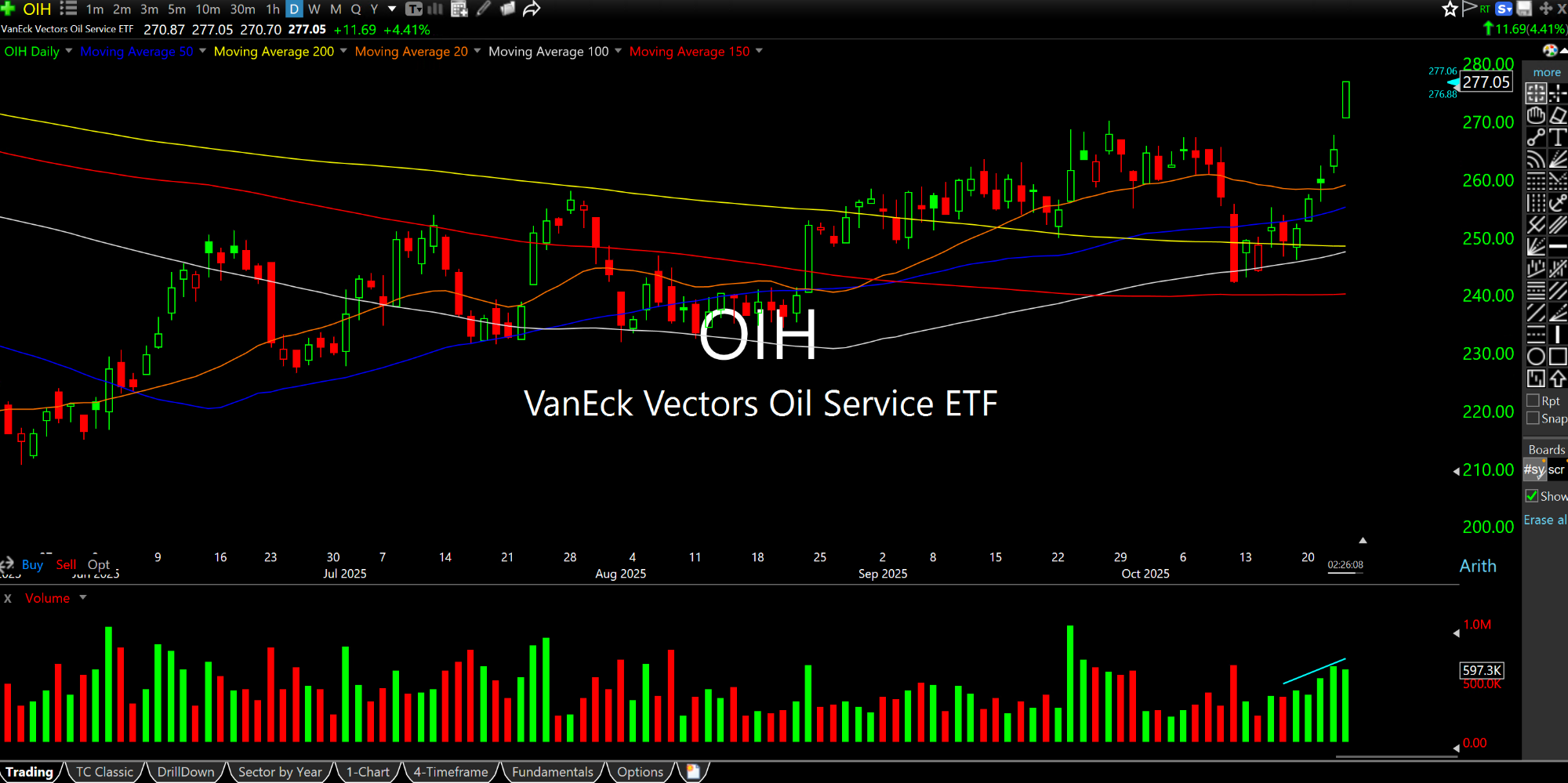

Also note the oil services, on the OIH ETF daily chart, second below, surging to multi-quarter highs today.

Similar comments apply to gasoline prices, also sideways for years. Again, the last thing most people fear right now is a surge in prices at the pump. Given the K-shaped economy perhaps that ought to be a legitimate fear, as it would surely wreak havoc on an already tapped out consumer.

Drugs: Got Anything Good in ... Stock Market Recap 06/12/15 ...