03Nov2:33 pmEST

Let's Not Cry Over Spilled Gamma

This earnings theme of this week will be a slew of some of the hottest momentum/meme stocks both of this year and this decade, namely PLTR HIMS HOOD, even AMC, among many others like AMD TTD UPST.

And that seems appropriate at the moment, given what is known as the "dispersion" of this tape reaching a fever pitch.

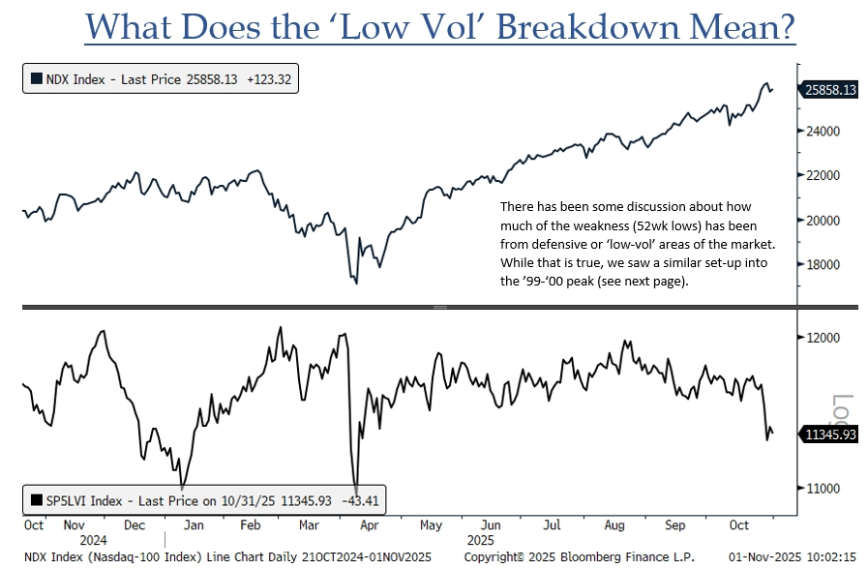

As my friend Jon Krinsky notes below in a series of charts, dispersion refers to the bifurcation of this market where the ultra hot growth/AI/tech/Mag7 names continue to move the indices higher while many other "low vol," or low volatility, "boring" stocks and sectors are actually breaking down or close to breaking down.

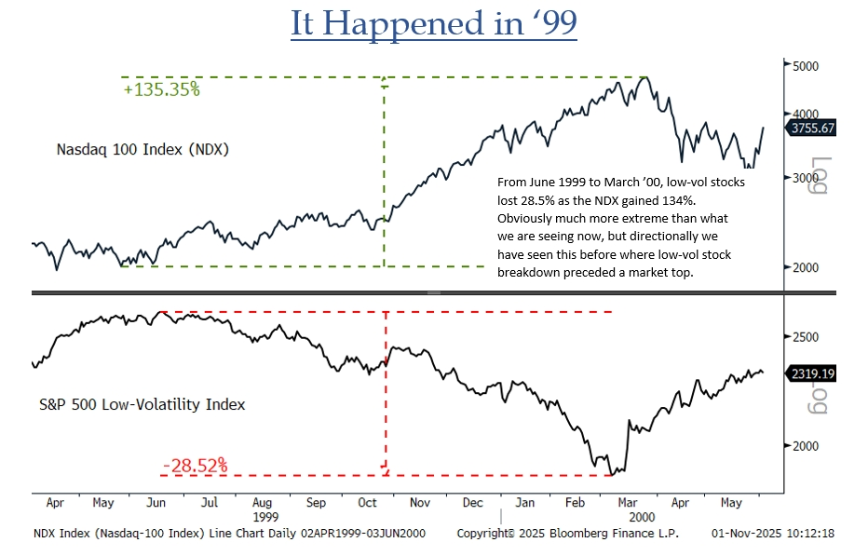

While bulls argue it is entirely healthy and even wildly bullish for the defensive or boring sectors to lag while the leaders lead, as Jon notes we saw a similar setup preceding the Dot-Com bubble bursting in 2000.

As always, the poison is in the dose (of dispersion). Here, we are not just talking about some mild weakness in the defensive sectors but rather major breakdowns, like in the XLP consumer staples, as well as names like Visa weakening on top of the private equity weakness seen in APO KKR OWL.

In 1999-2000 this extreme dispersion lasted for nearly nine months, which reinforces how challenging it is to time the big inflection point.

But even though we all struggle to nail that timing down, myself especially, it does not negate the view that this market remains far from a broad-based, robust bull. In fact, the fractures are growing.

Afternoon Update 10/31/25 {V... Tear Down the Jets, Tear Dow...