17Nov3:11 pmEST

Growing More Dangerous

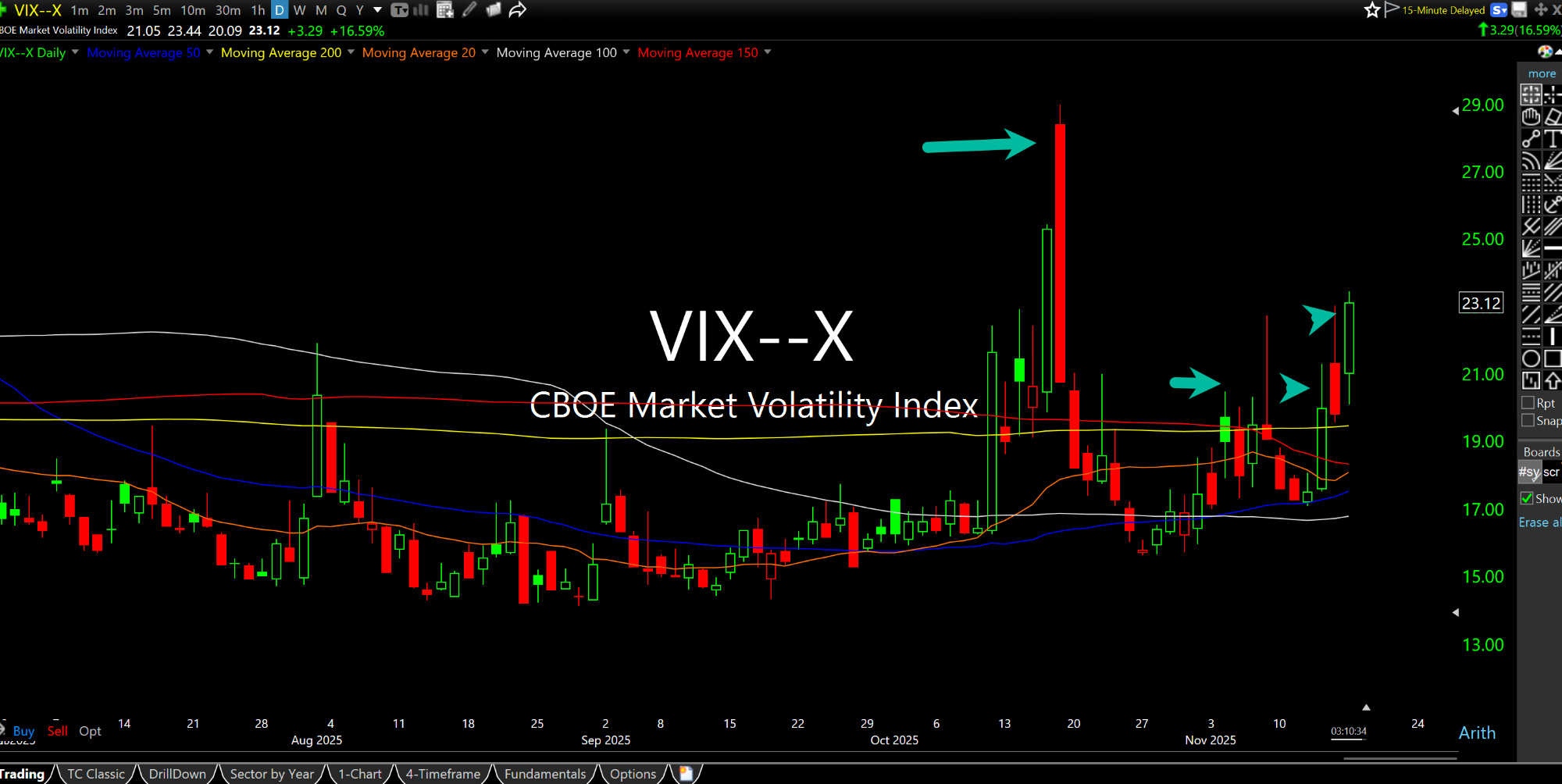

After a brief spike over 20 last month, the VIX (or Volatility Index, which typically measures expectations of fear in the options market) immediately moved back down into the mid-teens, a fairly common occurrence from this market regime we have seen over the years, particularly since the pandemic.

As we have noted often both here and with Members, the 20 level functions as a rough dividing line between regimes where markets have genuine concern of a correction in equities.

However, a key factor is whether the spikes above 20 are ephemeral (as most have been for years) as opposed to moves above 20 on the VIX which then have subsequent staying power. As you might imagine, the latter is far more ominous for equities.

With this in mind, the recent October spike above 20 and move back in the mid-teens has since seen the VIX push right back above 20 in just a few weeks. Previously, we would see the VIX fall back into a slumber of sorts after spikes and crashes, meandering in the mid-teens and even probing the low-mid teens, staying well below 20 for months at a time.

Thus, the stickiness of the VIX this time around, especially during what many have been touting as a can't-miss bullish seasonal time of year for stocks, is likely a warning sign to be taken seriously.

True, NVDA earnings this Wednesday evening could always be another exhilarating bullish catalyst for stocks. And you can be sure that the White House will spend every hour if need be talking up risk assets and the economy while downplaying any headwinds like inflation and inconvenient headlines like layoffs and plummeting freight traffic.

But coupled with glaring breakdowns in the likes of Visa (which confirms recent extreme weakness in restaurant and many consumer names), the VIX stickiness back above 20 is what bears have been pining for as far as actual evidence of the market regime changing character.

Chewing Through Nostalgic Ar... Stock Market Recap 04/26/17 ...