04Dec3:31 pmEST

Trainwreck Cruise Charts

There seems to be a raging debate these days about just how strong the consumer truly is. We know the "K-Shaped" theory of the split economy has gained quite a bit of traction, with the upper crust of society flourishing while just about everyone else is getting squeezed by inflation (even if the rate of inflation has slowed since 2022 prices are, indeed, on a much higher plane and in many cases pushing higher yet) as well as a more unforgiving labor market.

But bulls counter that this is all hyperbole, with the President himself chiding those who harp on the issue of affordability.

Thus, I am sure most of us can agree that the top 1-10% of the country is doing anywhere from reasonably well to remarkably well. The critical issue is the true pulse of the upper-middle, middle, and working/lower classes.

On that note, perhaps the cruise lines offer a more clear-cut view on the consumer. After all, the three publicly-traded ones, CCL NCLH RCL, all cater to the upper-middle/middle/working classes.

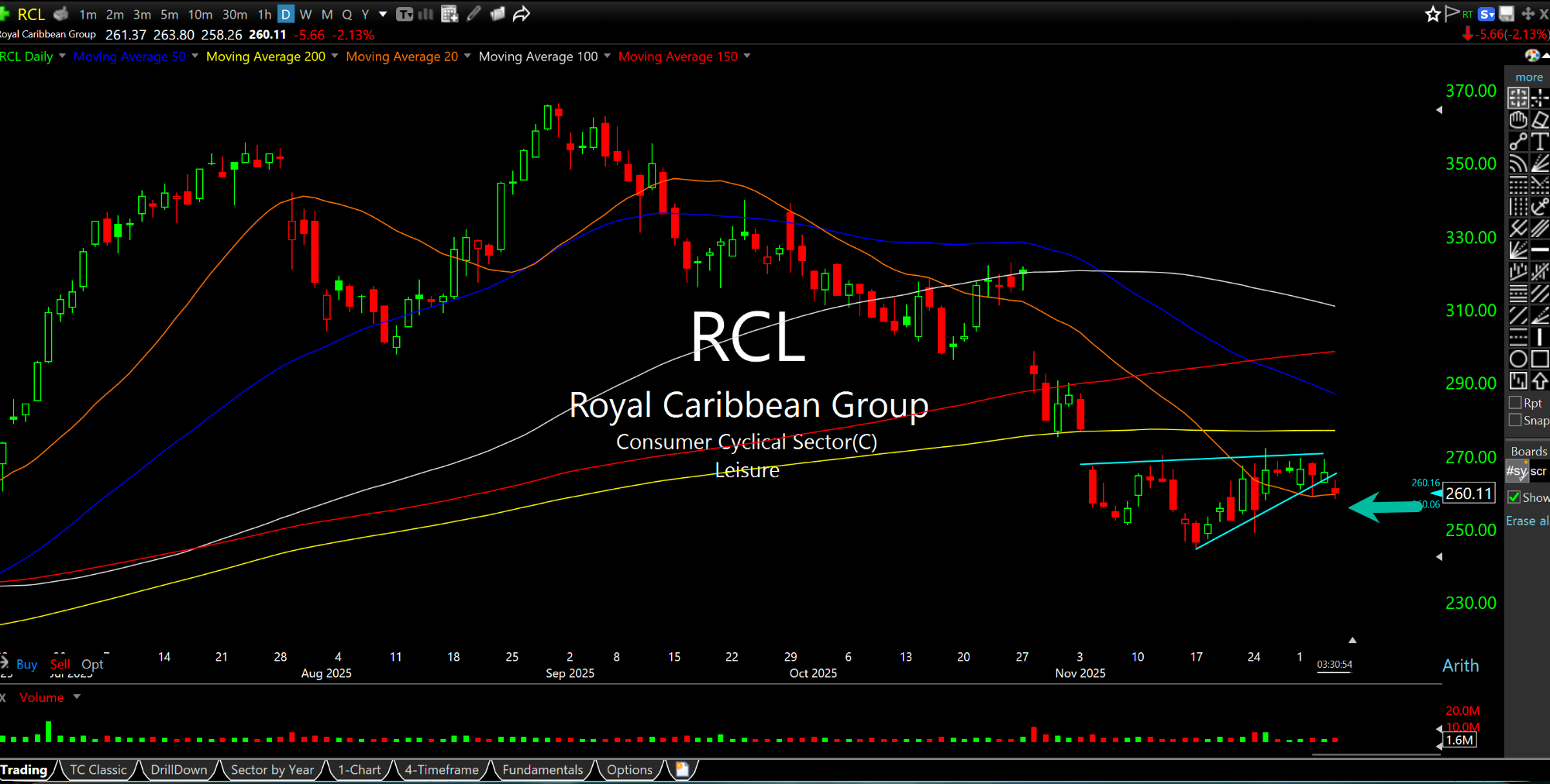

When we analyze the charts of all three, a fascinating tidbit pops out: All three stocks topped roughly around Labor Day after a glorious rally off the April lows. Recently, many Nasdaq stocks put in short-term tops around Halloween. So it is interesting that the cruise lines topped out back in late-summer.

On the Royal Caribbean daily chart, updated below, we have a bear flag below the 200-day moving average, with CCL NCLH sporting similar looks. In other words, the downturn since Labor Day figures to have more legs lower.

Indeed, the market may be telling us that the issue of affordability is not merely a political football but, instead, a serious issue growing more so by the day.

Elsewhere, rates on the 10-Year are back over 4.1% even as next FOMC's rate cut seems like a slam-dunk. Once again, the White House would be wise to reconsider their messaging in lieu of dismissing stagflationary warning signs are mere "panican" talking points.