23Dec3:36 pmEST

Go to Australia for the Final Puzzle Piece

Melbourne, Australia-based. BHP (formerly BHP Billiton) is valued just north of $150 billion market cap currently. As far as miners go, that is pretty much as big as it gets. The firm focuses on non-precious materials, such as iron ore, copper, metallurgical (steelmaking) coal, nickel, and potash (for fertilizer). Alongside other larger global materials miners like RIO VALE, it is instructive to keep tabs on BHP to see if the commodity rally is broadening out beyond gold and silver, which of course are getting most of the hype these days.

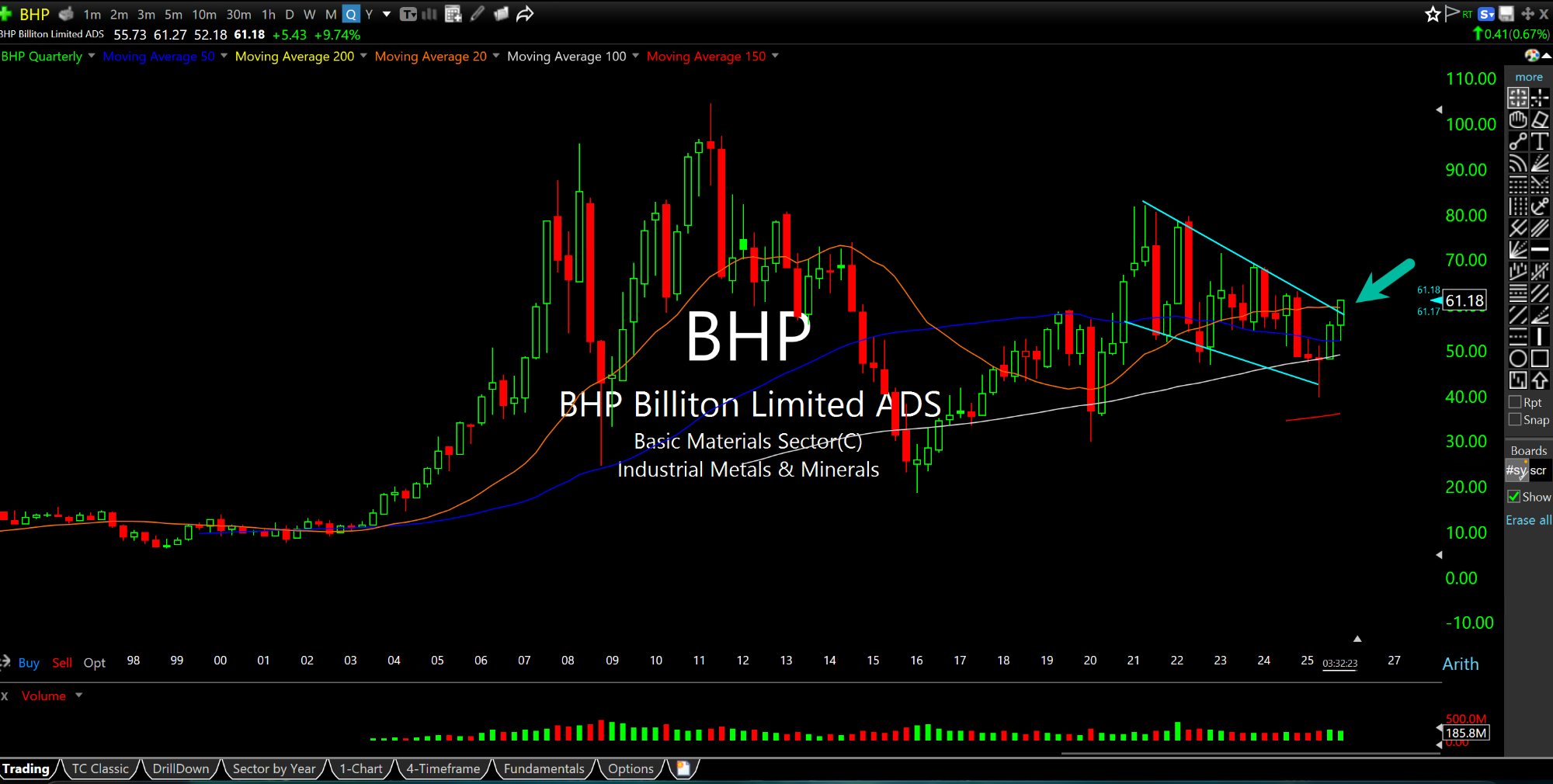

On the BHP quarterly chart, below, headed into 2026 we have the makings of a fresh breakout after years of rangebound price action, at best, if not downright lagging action. A push above $70 should confirm the long-term bull move underway.

Either way, it is tough to see a broad mining rally sustain itself into next year without the likes of BHP participating with vigor.