06Jan1:35 pmEST

The Best of Tech Times, The Worst of Tech Times

With the major indices rallying again today it seems hard to believe that the Magnificent 7 ETF, first below on the daily timeframe, is flashing red. Furthermore, MAGS has been dropping steadily since the Friday after Christmas. But with Apple, GOOGL, and now Tesla unwinding, it seems to be weighing on the ETF.

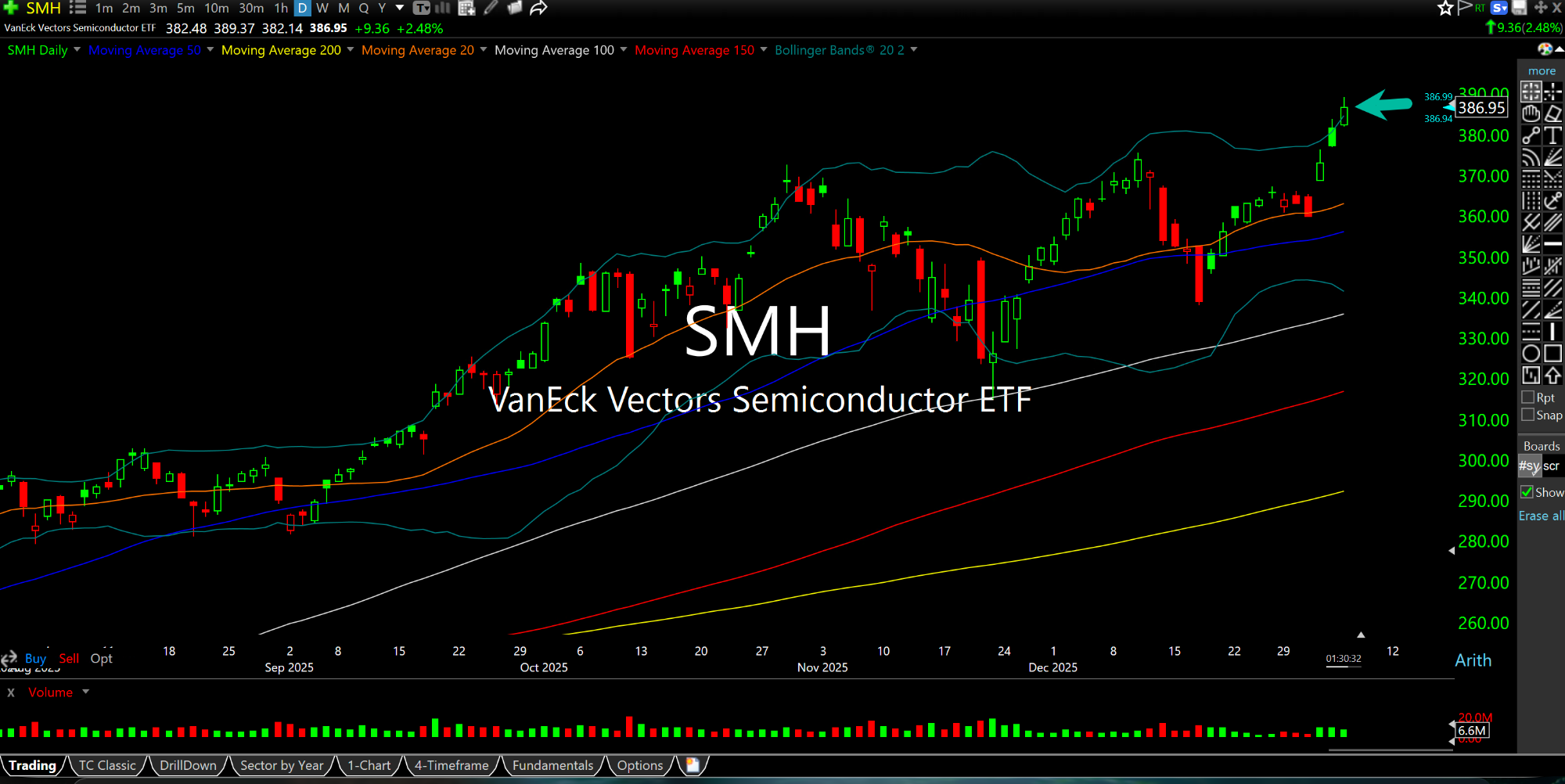

On the opposite side of tech spectrum we have the semiconductors staging another surge to new highs (SMH ETF daily chart, second below), this time thanks to Sandisk, MicroChip, and Micron, among others, even as NVDA itself it mildly red and still well below its October 29th, 2025 highs (the same day the Nasdaq topped, too).

We also have the software stocks int he IGV ETF pinned below their 200-day moving average, completely at odds with the latest rally in chips.

Overall, the action in tech continues to feature hot money quickly shuffling around seeking whatever action is present. But it is a far cry from a broad-based rally. You will note the SMH poking its upper Bollinger Band on the second chart, indicative of rather overbought conditions. If there were ever an early-year setup for a top in semis, this would seem to be it.

Elsewhere, the precious metals and miners continue to chug higher unabated, even as oil and oil stocks slow down after the Maduro news. The persistent strength in metals and miners smacks of a loud warning alarm (not being heeded, yet) that monetary and fiscal policies remain severely misguided.