14Jan1:50 pmEST

Just Another Toll Booth Willie, Right?

Last Friday, President Trump fired off a post on his Truth Social platform declaring that interest rates on credit cards should be limited to 10% for one year, beginning on January 20th. He did not specify how such a cap might be introduced or whether such a move would be legally enforceable.

But the market took note: Credit card and bank stocks are mostly lower since then, some sharply so, albeit against the backdrop of big banks like JPM reporting earnings this week, too.

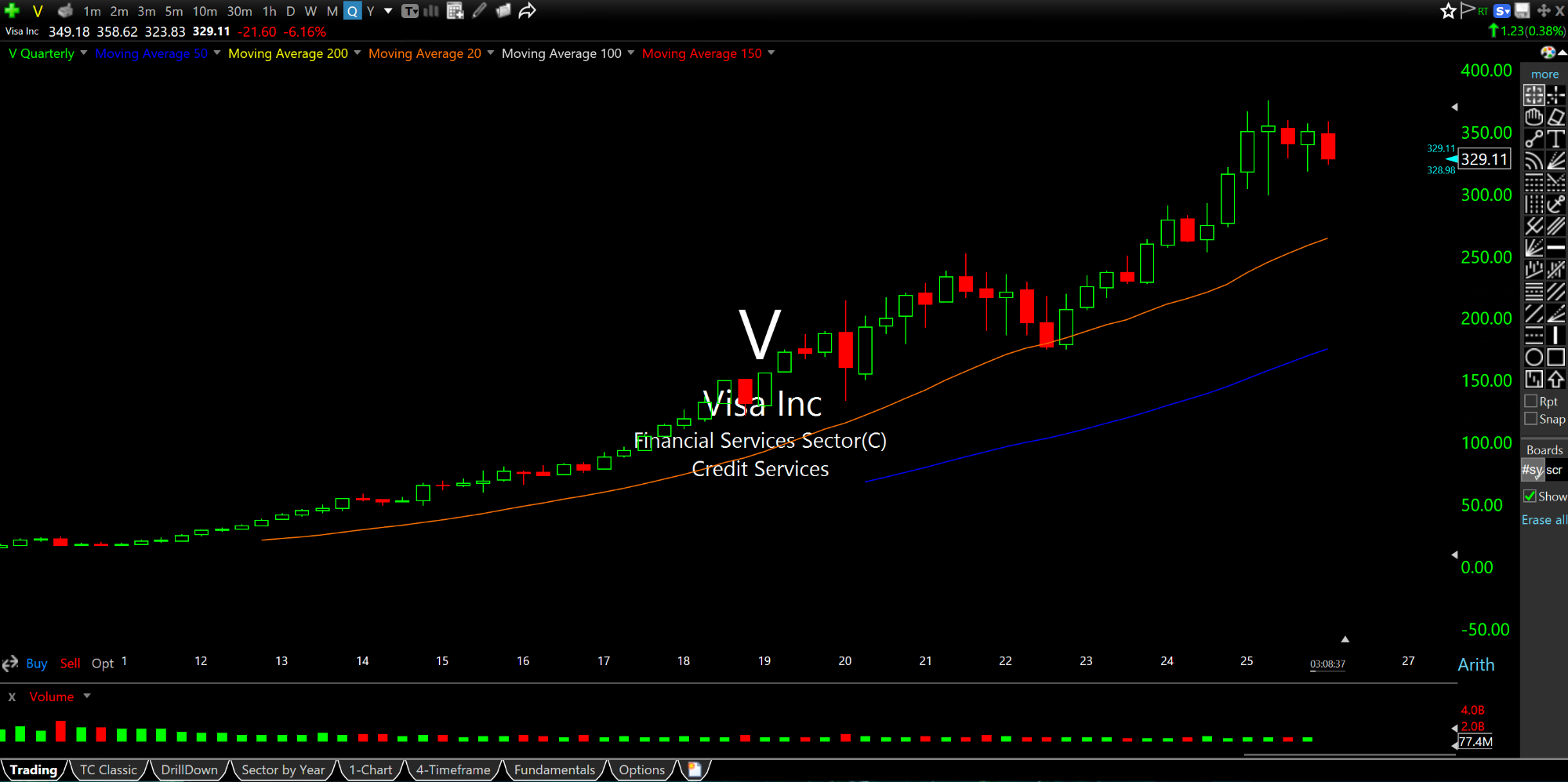

But the major credit card plays like Mastercard and Visa, respectively below on their multi-decade charts, took the news particularly hard as those stocks sold off in recent sessions. Those moves brought out many bulls exhorting investors not to sell the stocks due to the long-running "toll collector" argument, meaning those major credit card firms benefit from transaction volume more than anything else and do not assume much in the way of risk from credit card holders.

Be that as it may, there are two counterarguments against all of the "Tool Booth Willies" out there.

First, if Trump gets his way and there is a credit card rate cap, then many banks which are underwriting the risks for holders with poor credit will simply cut off those consumers from getting access to credit cards altogether. And this will diminish the sheer number of transactions, inevitably, hurting MA and V.

But even if that argument fails, the second point is that both MA and V have enjoyed seemingly nonstop, fifteen year rip-roaring rallies, as those quarterly charts illustrate, below.

At a certain point, which has clearly taken forever to materialize this cycle, the stocks have been priced for perfection, reaching out years into the future and discounting all the good news.

Thus, bulls arguing that a credit card cap is inconsequential may be missing the point that these stocks are ripe to crack anyway, regardless of the prevailing news.

Elsewhere, AI and tech are leading the market lower while oil is suddenly improving again. Silver remains on a tear to the upside, and even the lowly ag stocks are waking up. The overarching rotation seems to be out of tech and into commodities, which smacks of early year stagflation positioning more than anything else.