22Jan2:27 pmEST

Here Come the Role Players

By now, the gold and silver rallies have come to the attention of most market players and pundits, with attention finally given by the financial news media.

Mind you, we are still likely years away from widespread euphoria and positioning in the metals and miners to the point where I would even think about looking for a major top. However, the violent and persistent rallies in gold and silver have certainly garnered more attention in the precious complex than at any time in at least the last fifteen years.

For many years now, my long-term target for gold has been $5,000 per troy ounce. But not long ago I suggested that target was likely way too conservative. Thus, $10,000 seems like a more appropriate long-term target now.

That said, while gold and silver are the stars, so to speak, the "role players" of platinum and palladium in the precious metals group remain woefully under-appreciated, let alone traded/owned/etc..

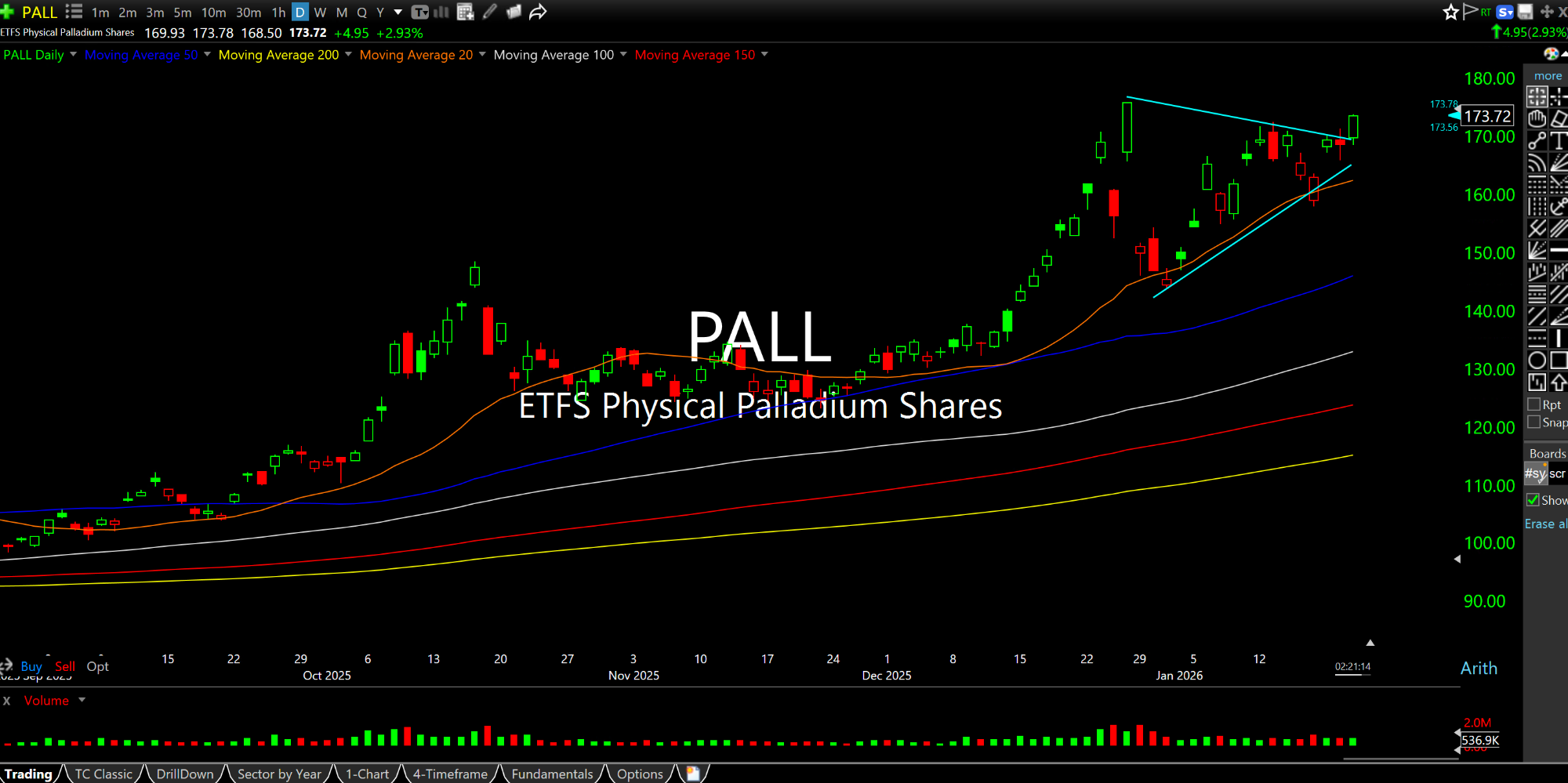

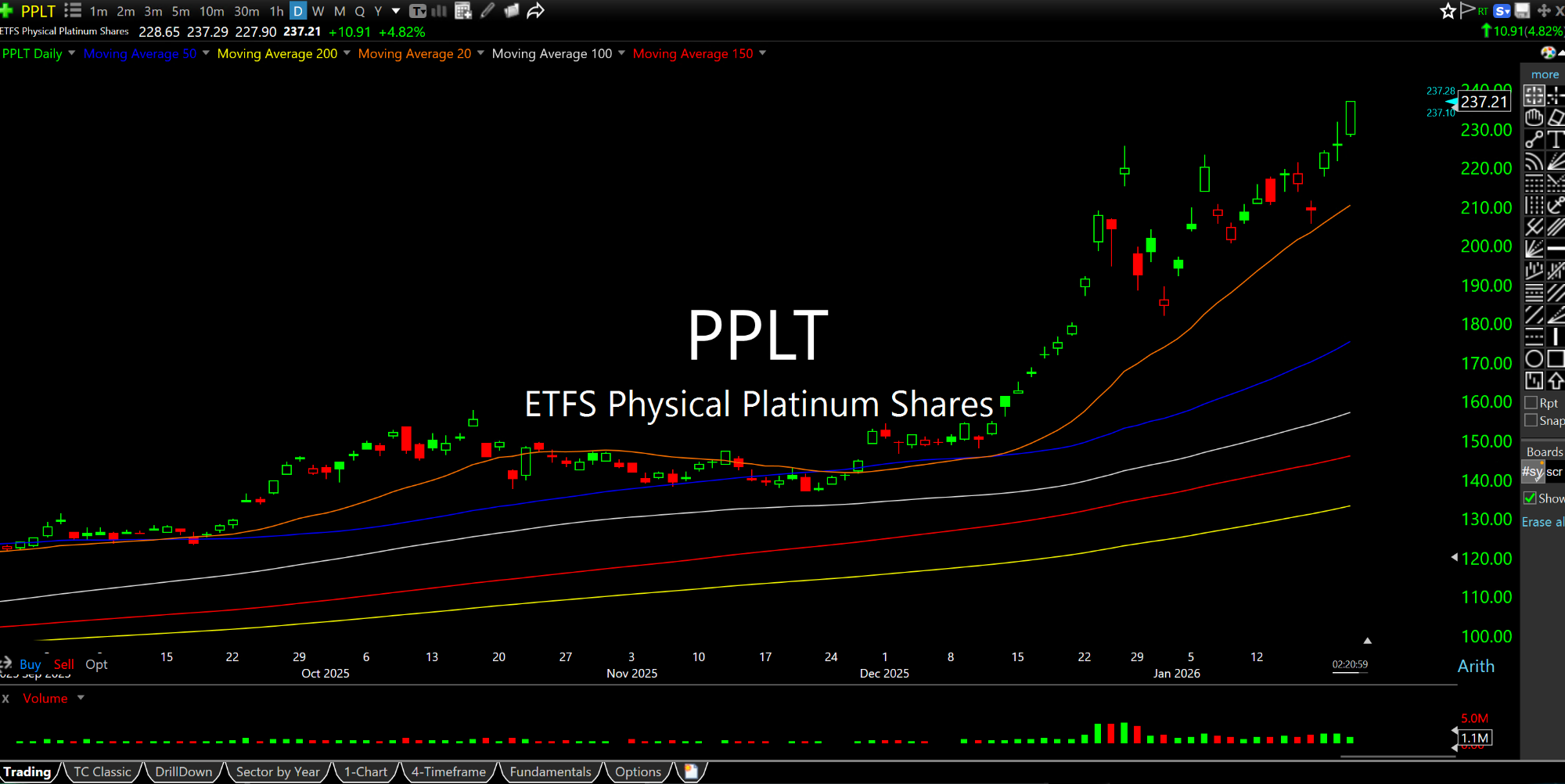

On their respective ETFs for the physical metals, below, both the daily charts of PALL and PPLT point to impressive further strength, with palladium, especially, ripe for a fresh breakout. SBSW has been a brilliant actor relating to the platinum group metals, while PLG looks set to stage a new leg higher.

Overall, the precious metals could easily be front-running the early stages of a global bond market crisis, starting in Japan in culminating with a loss of confidence in central banks in Europe and then, yes, America too. Politicians and central bankers can try to talk around it all they want, but rising gold and rising long-end yields call the shots in the end, which means austerity is the only way out, barring a U.S. gold revaluation, which should send gold above $15,000 in the blink of an eye.