10Feb2:36 pmEST

Until it Bends in the End

"The trend is your friend until it bends in the end." -Old Wall Street saying

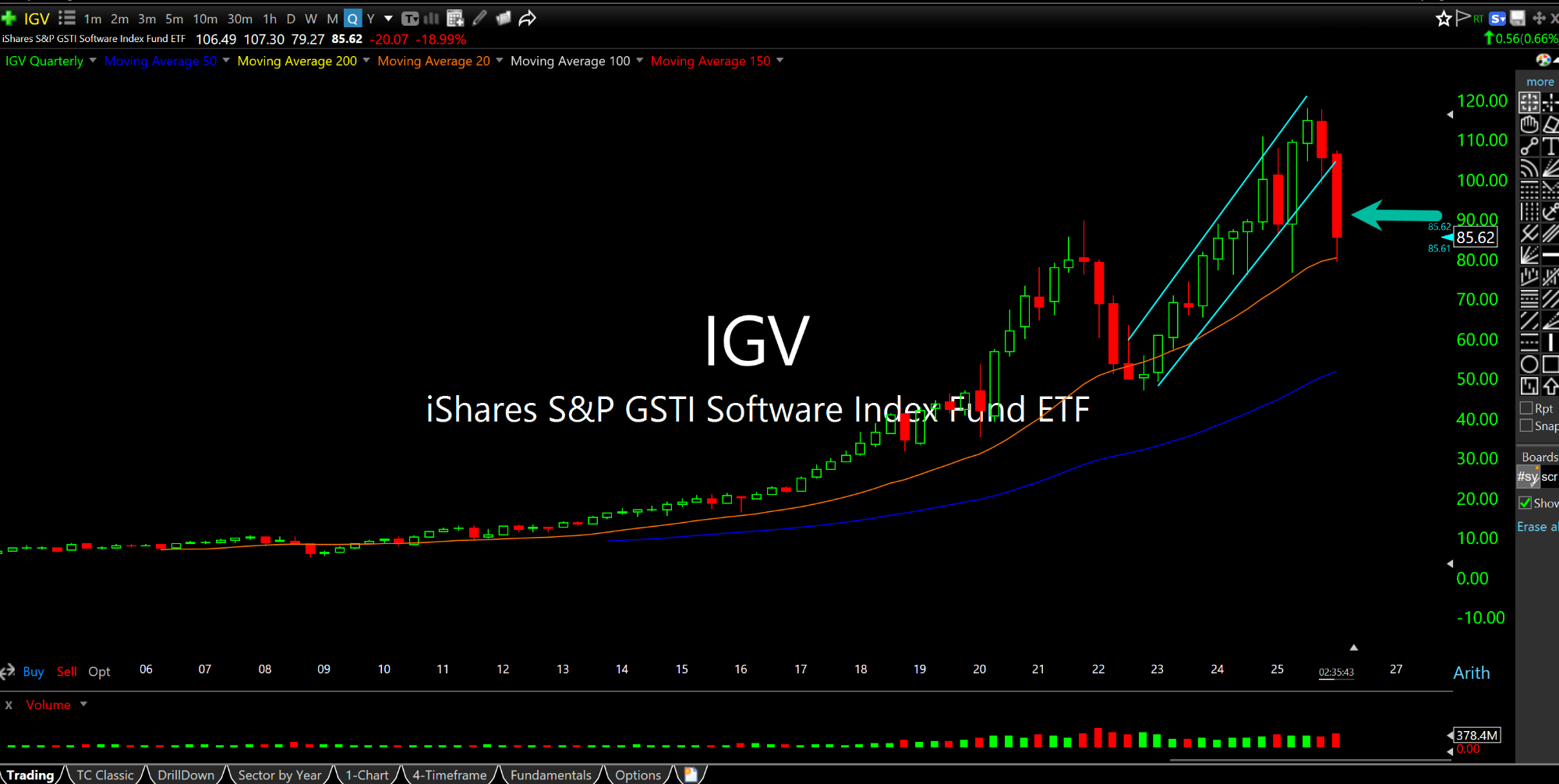

Software stocks in the IGV ETF are off to a terrible start in 2026. They were already out of favor, especially relative to other tech names like the memory segment of chips, since late-2025. But the slide became apparent to kick off the new year.

However, beginning last Friday it became trendy to call a bottom in the group. After all, the Nasdaq has been seemingly unstoppable since 2009, always snapping back from the abyss and inevitably leading, making new highs at will.

And while that still may be the case, it does feel lonely pointing out amid the President taking victory laps about the Dow making a new all-time highs again today that the Nasdaq has not actually made new highs since October 29th, 2025.

Beyond that, it is easy to forget that prior to the slide in software names the sector was actually a popular idea to benefit from rotation out of semis.

Recall that thesis for much of 2025, that semis could easily pause or dip but software would pick up the slack. As we noted with Members and here, that is the essence of a long-running bifurcated market. Everyone thinks the easy rotation will take place to keep the peace of the bull. But what usually happens in the "end" is that the weak software names get weaker while the strong semis eventually buckle.

Here, software names did indeed get weaker, and many of the longs in them from last year are likely still trapped in them. Semis, however, remain near recent highs with mixed internal action and no clear resolution yet. NVDA earnings are still about two weeks away, for example.

At issue now is whether the software group is truly at the end of a multi-year bull run.

On the IGV quarterly chart, below, you can see this January/early-February downdraft breached a steep rising channel since 2022. As expensive as many software names were (and still are) the case for buying value still seems like a reach. Thus, what bulls are truly betting on is simply a resumption of the status quo.

But with a Fed on hold and not likely to cut again without a major catastrophe, coupled with some clear evidence of slowing consumer spending, my view is that this multi-day bounce in IGV is a relief rally likely setting up another leg down to confirm a new regime lower.