19Feb12:54 pmEST

Dow Credit Card Drama

Despite still being in the Dow Jones Industrial Average, American Express has almost half the market cap as non-Dow component Mastercard, obviously another credit card play. Visa, of course, is bigger than both AXP and MA and is also in the Dow.

Although we do not analyze the Dow as frequently as we do the other indices due to its narrow (only thirty holdings) and stodgy (they tend to be bulkier names whose fastest growth is behind them) nature, Pam Bondi has launched a renaissance of sorts for the Dow, boasting earlier this month about the index hitting the big, round 50,000 number.

While it seems childish to harp on big, round, numbers, the reality is that markets often do respond to them for extended periods of time. Case in point: The Dow found resistance at 1,000, even, for much of the 1970s (take a moment and reflect at the Dow being a 50-bagger since the late-1970s). Thus, we may very well look back on the Bondi boasting and the 50,000 level as contrarian bearish signals in the years to come.

But sentiment signals aside, we have repeatedly, both here and with Members, harped on the weakness in both MA and V, as both remain firmly below their 200-day moving averages with bounces struggling.

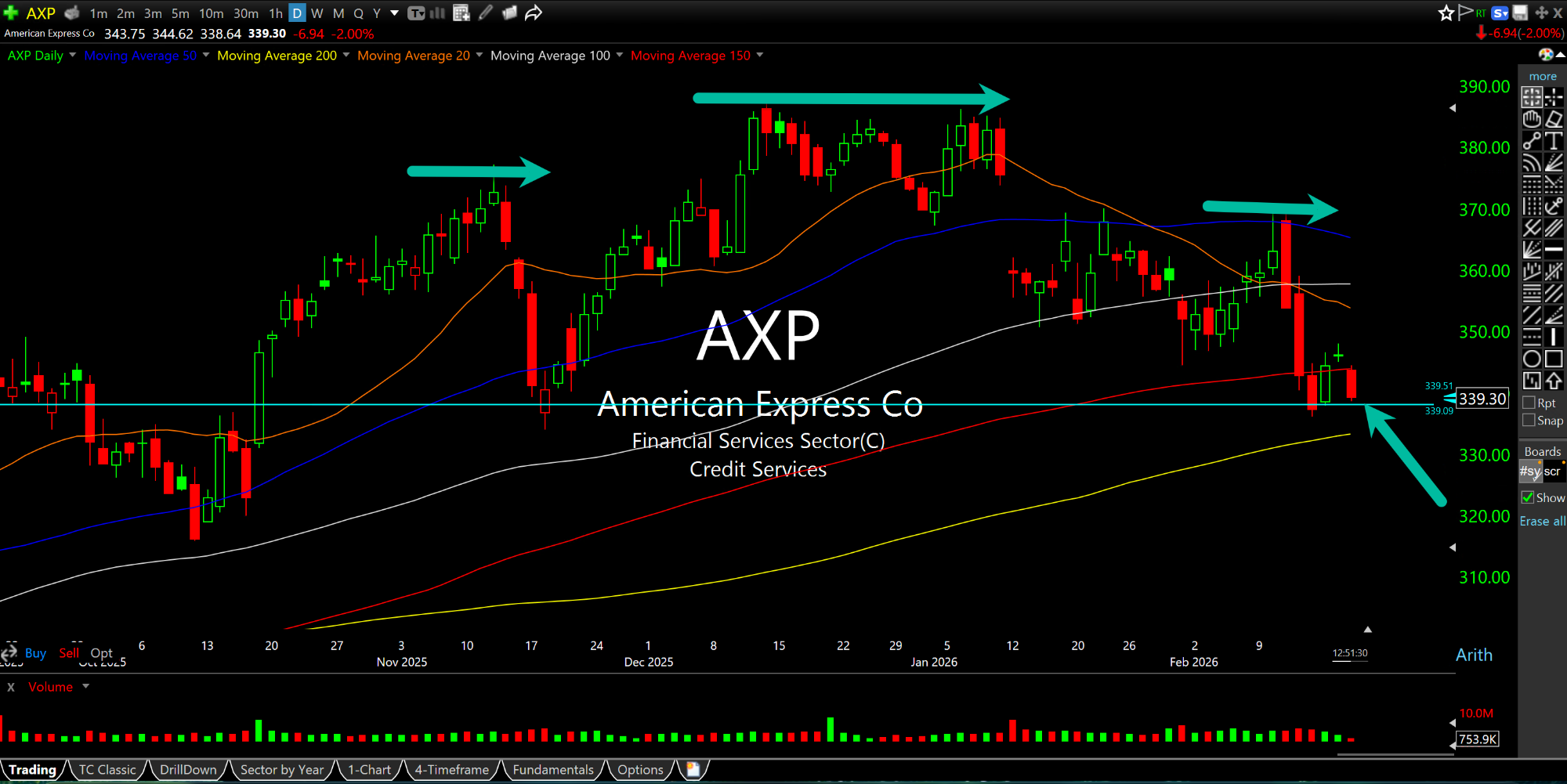

And that leaves us with AXP, below on its daily chart, still above its 200-day (yellow line) for the time being. However, you can see the major potential top I have highlighted and the stock's weakness today.

I expect AmEx to follow MA and V lower with a decisive breach of the 200-day in the coming weeks, confirming a major top and adding problems for the consumer as credit card companies flash trouble.