22Dec2:49 pmEST

Hacking Into These Two Charts with Precision

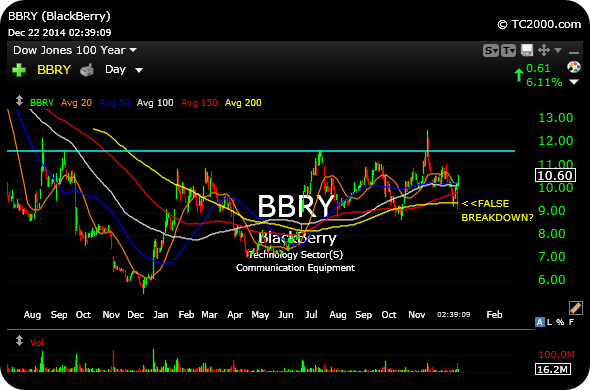

BlackBerry has been a popular ticker for short-term traders for a while now. And updating the daily chart, first below, we can see that Friday's weakness apparently was a failed move lower. We know that from failed moves in the market often come aggressive moves in the opposite direction. Thus far, we are seeing just that in BBRY, with today's large spike higher.

I still view BBRY as putting in a potential major bottom, with the stock needing to clear $11.65 (light blue line) to confirm the thesis.

In addition, also note the steels on the second daily chart. The sector ETF is breaking cleanly down from a bear flag. The lesson here is to use extreme care in bottom-fishing broken charts, despite how forgiving this bull market has been to dip-buyers. Names like X, down 8.5% today, should drive that lesson home--There is no substitute for discipline.

BlackBerry has been a popular ticker for short-term traders for a while now. And updating the daily chart, first below, we can see that Friday's weakness apparently was a failed move lower. We know that from failed moves in the market often come aggressive moves in the opposite direction. Thus far, we are seeing just that in BBRY, with today's large spike higher.

I still view BBRY as putting in a potential major bottom, with the stock needing to clear $11.65 (light blue line) to confirm the thesis.

In addition, also note the steels on the second daily chart. The sector ETF is breaking cleanly down from a bear flag. The lesson here is to use extreme care in bottom-fishing broken charts, despite how forgiving this bull market has been to dip-buyers. Names like X, down 8.5% today, should drive that lesson home--There is no substitute for discipline.