29Dec12:29 pmEST

Dueling with a Familiar Foe; Chess Moves

I noted on Stocktwits and Twitter a few moments ago (@chessNwine) that I went long UGAZ at $4.96 with protective stop-loss below $4.70. The position represents roughly 4% of my trading portfolio capital. I plan on swinging the trade for a few days if it goes according to plan, which is a steady move higher.

UGAZ is the triple-long natural gas ETF, and a volatile one at that. Nonetheless, I have a solid history of playing this formidable foe, with some sizable gains while minimizing losses.

Currently, natural gas is trying to move up from a mini-crash in December. That weakness could have been due to the warm weather. But the temperatures are expected to drop into 2015.

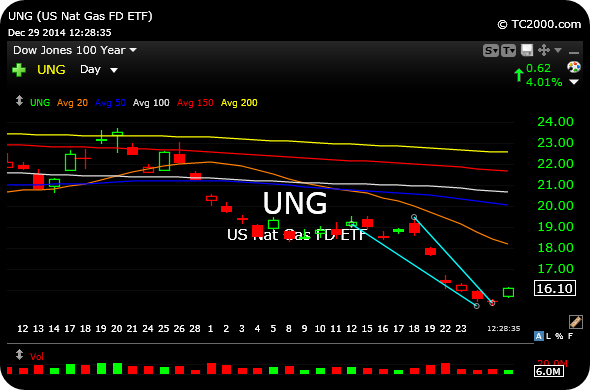

Either way, the trade is a technical one as natty has stomped out many bottom-fishers in recent weeks. Now, however, it is breaking up and out from the falling wedge seen below on the daily chart for the UNG ETF (the straight-up, non-levered natty ETF).

I noted on Stocktwits and Twitter a few moments ago (@chessNwine) that I went long UGAZ at $4.96 with protective stop-loss below $4.70. The position represents roughly 4% of my trading portfolio capital. I plan on swinging the trade for a few days if it goes according to plan, which is a steady move higher.

UGAZ is the triple-long natural gas ETF, and a volatile one at that. Nonetheless, I have a solid history of playing this formidable foe, with some sizable gains while minimizing losses.

Currently, natural gas is trying to move up from a mini-crash in December. That weakness could have been due to the warm weather. But the temperatures are expected to drop into 2015.

Either way, the trade is a technical one as natty has stomped out many bottom-fishers in recent weeks. Now, however, it is breaking up and out from the falling wedge seen below on the daily chart for the UNG ETF (the straight-up, non-levered natty ETF).

A Nice Reflection on These T... Someone is Lying and Needs t...