29Dec1:56 pmEST

Someone is Lying and Needs to Be Interrogated

While crude oil and Russian stocks (gauging the RSX ETF) look to be staging clear breakdowns today, the energy stocks themselves in the XLE ETF (and the oil service stocks in the OIH ETF) are hanging in there.

The issue then becomes which one of these is "lying," in the sense that the energy stocks could be sporting a bullish divergence which quickly reverse Russia and crude higher, or instead that energy stocks are simply on borrowed time before they roll back over.

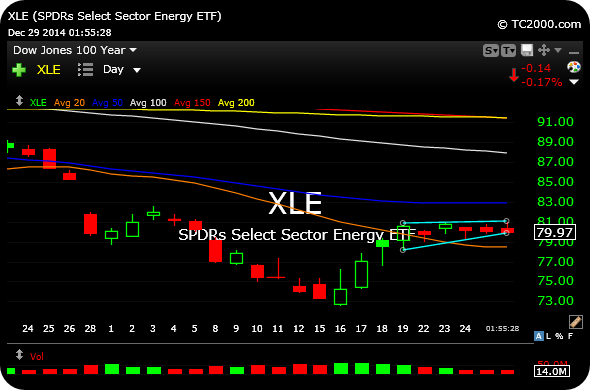

Observing the daily chart for the XLE, below, I am using a rough two-point bracket, in the $79-$81 range, to determining whether the real move is up or down for the correlated groups mentioned above.

While crude oil and Russian stocks (gauging the RSX ETF) look to be staging clear breakdowns today, the energy stocks themselves in the XLE ETF (and the oil service stocks in the OIH ETF) are hanging in there.

The issue then becomes which one of these is "lying," in the sense that the energy stocks could be sporting a bullish divergence which quickly reverse Russia and crude higher, or instead that energy stocks are simply on borrowed time before they roll back over.

Observing the daily chart for the XLE, below, I am using a rough two-point bracket, in the $79-$81 range, to determining whether the real move is up or down for the correlated groups mentioned above.

Dueling with a Familiar Foe;... Ebola Now Threatening Scotla...