28Jan12:05 pmEST

Checks and Balances

If the Fed is going to remain dovish in terms of projected rate hikes, then to my eye the main entity which is capable of "checking" it would be the bond market. True, gold prices rising could add some pressure. But, for the most part, as long as rates stay historically low it is hard to see the Fed feeling inflationary pressures, with deflation being much more of a concern for them at the moment.

The old school types would be looking for the Fed to "lose the bond market" here, meaning the bond market stands up and shouts loud to the Fed, "Enough!" This would, effectively, seek to take away the printing press from the Fed.

However, all of that discussion is academic at this point, given how stubborn the bond market rally has been for decades on end, especially over the last year or so.

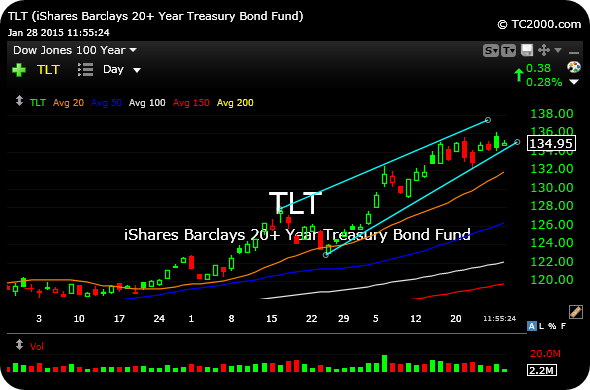

My attempts to short bonds have been, well, short-lived, with mixed results and small losses due to risk management discipline. Still, we are looking at a running rising wedge (light blue lines) on the TLT daily chart, below, for bond prices (inverse to bond yields, which are near historical lows).

Ultimately, even if you think the economic recovery in the U.S. is grounded in reality and here to stay, the reality is that interest rates at zero for this many years is categorically not normal and, in fact, unprecedented. You may very call this a true confidence game by global central bankers. Therefore, the idea is to look for the main check on the actors in the confidence game, meaning the bond market versus the central bankers.

Simply put, unless and until the bond market revolts against the Fed it is hard to see them truly feeling the heat within the U.S., even if other economies and central banks abroad are causing headlines.

If the Fed is going to remain dovish in terms of projected rate hikes, then to my eye the main entity which is capable of "checking" it would be the bond market. True, gold prices rising could add some pressure. But, for the most part, as long as rates stay historically low it is hard to see the Fed feeling inflationary pressures, with deflation being much more of a concern for them at the moment.

The old school types would be looking for the Fed to "lose the bond market" here, meaning the bond market stands up and shouts loud to the Fed, "Enough!" This would, effectively, seek to take away the printing press from the Fed.

However, all of that discussion is academic at this point, given how stubborn the bond market rally has been for decades on end, especially over the last year or so.

My attempts to short bonds have been, well, short-lived, with mixed results and small losses due to risk management discipline. Still, we are looking at a running rising wedge (light blue lines) on the TLT daily chart, below, for bond prices (inverse to bond yields, which are near historical lows).

Ultimately, even if you think the economic recovery in the U.S. is grounded in reality and here to stay, the reality is that interest rates at zero for this many years is categorically not normal and, in fact, unprecedented. You may very call this a true confidence game by global central bankers. Therefore, the idea is to look for the main check on the actors in the confidence game, meaning the bond market versus the central bankers.

Simply put, unless and until the bond market revolts against the Fed it is hard to see them truly feeling the heat within the U.S., even if other economies and central banks abroad are causing headlines.

Analysis Before the Big Game... Waiting for the FOMC Reactio...