06Feb11:28 amEST

Down to One

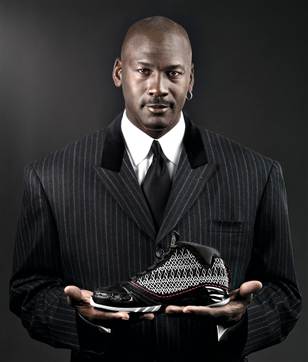

My only position at the moment is a NKE short, which I entered at $92.93 with a cover-stop over $97. I am barely down on it down, and am playing for the 100-day moving average (whitish line on daily chart, below) to break as support next week.

NKE is lagging the tape today, and has yet to put any real pressure on me this week, deposit the market rallying sharply. I view this as a factor in favor of my bear thesis, which is another reason I am still holding the short.

The next earnings are not scheduled until March.

As for the market at-large and fresh trades in the works, I will be back later with some ideas.

My only position at the moment is a NKE short, which I entered at $92.93 with a cover-stop over $97. I am barely down on it down, and am playing for the 100-day moving average (whitish line on daily chart, below) to break as support next week.

NKE is lagging the tape today, and has yet to put any real pressure on me this week, deposit the market rallying sharply. I view this as a factor in favor of my bear thesis, which is another reason I am still holding the short.

The next earnings are not scheduled until March.

As for the market at-large and fresh trades in the works, I will be back later with some ideas.