17Feb1:37 pmEST

Ideas to Consider as the Gravy Train Chugs Along

With the S&P 500 Index hitting the big, round, psychological 2100 number this afternoon it is tough to step in front of the indices as they grind higher seemingly in perpetuity.

Under the surface, though, we still may have two way trading opportunities. As I noted earlier, small and mid-cap biotechnology issues along with internet security stocks remain in play (CYBR FEYE VDSI, etc.). In addition, some China names are garnering momentum, namely JRJC and VIPS. But those industries amount to a game of musical chairs at times, with sudden shakeouts punishing latecomers chasing the action.

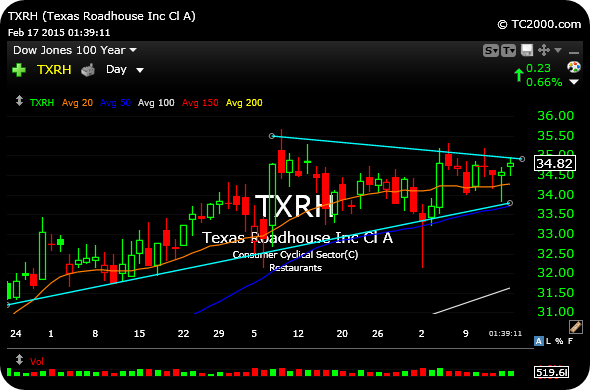

I have my eye on TXRH, seen on the first daily chart, below. Earnings are scheduled for February 23rd. But the basing consolidation within the context of an established uptrend is a quality setup to stalk for a quick long, especially if it clears $35.30 anytime soon.

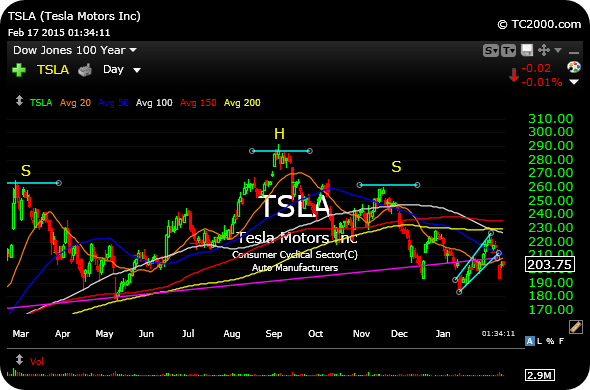

And it two-way trading is going to exist then TSLA is back on my radar as a short. Recall the successful TSLA short I had in January--The setup may still be there for more weakness. At a minimum, the relative weakness is glaring.