20Feb2:01 pmEST

Staying Opportunistic

After closing out my UGAZ long earlier today, I am debating a crude oil short trade over the weekend.

Whereas natural gas was ripe for a snapback rally over the last two weeks, crude oil already had its relief rally and may be close to rolling back over to continue its bear market.

DWTI would be my preferred trading vehicle, the triple-short crude oil ETF I have traded before.

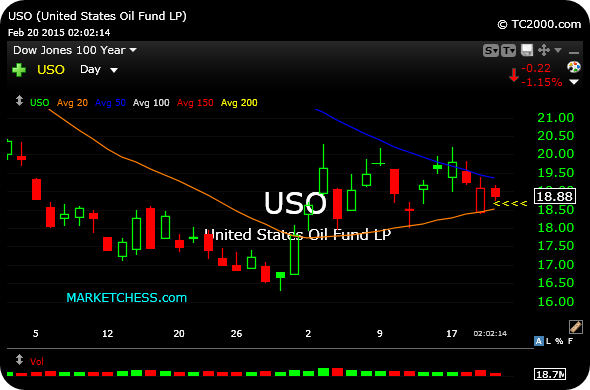

On the USO ETF, seen below on the daily timeframe, price is stuck in a moving average "sandwich" between the 20-day moving average (orange line) and the 50-day (dark blue line). Because crude is still in a steep downtrend, the presumption is that rallies are to be sold until we have more actual evidence of a bottom unfolding.

Longs can still make money, but typically they are doing so by quickly selling into pops, as has been the case in the vast array of bear market rallies in the metals and miners in recent years.

If crude weakens this afternoon I have DWTI in mind. If not, it is certainly on the table for early next week.

Locking in Another Big Natty... Two More Actionable Ideas as...