23Feb2:13 pmEST

Inversion Issues for Tesla

Tesla Motors continues to operate at the cross-section of an important technical juncture.

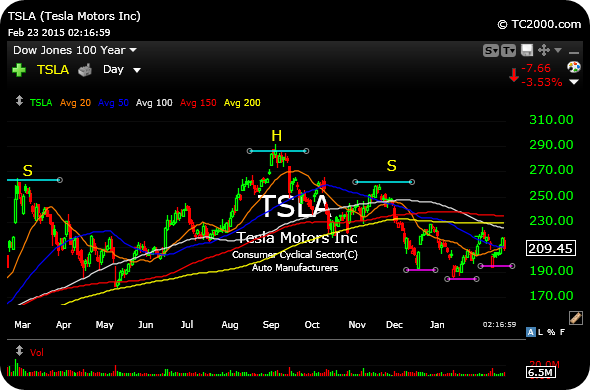

On the one hand, the case can be made for a broad, cockeyed topping pattern (light blue lines on daily chart, below). But on the other hand, Tesla is still a super-stock from 2013 with major disruptive abilities in the auto sector. Beyond that, the stock could still be a buyout target if AAPL finally puts its massive cash position to work, thus making the stock a difficult short for anything more than a quick scalp.

From a technical perspective, the purple lines indicate a potential inverse head and shoulders bottom. $230 is a now a widely-watched level on TSLA by many traders, and it could be a self-fuffiling prophecy if the stock squeezes above that level and leads to a breakout.

To my eye, TSLA could easily be keying off of oil's next directional move. I suspect if crude stays rangebound then TSLA could as well, with the risk being to the downside, especially below $192. But if crude stages a secondary rally off recent lows then I would expect the inverse head and shoulders bottom to be given a fair chance at proving true.

Two Early Afternoon Observat... Back in an Energy Short; Che...