27Feb10:58 amEST

No Longer Between the Hedges

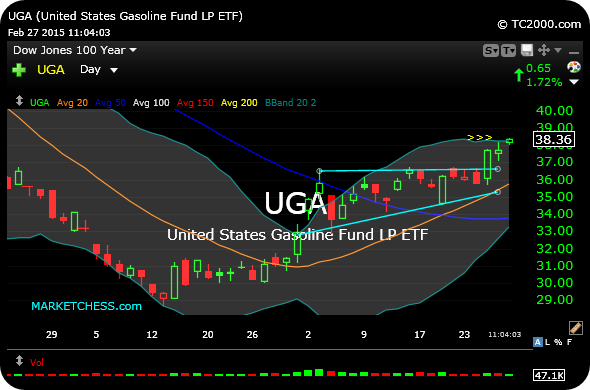

I am considering selling the final piece of my UGA ("University of Georgia") long, which is the ETF for gasoline.

As I noted when I initiated the position, my sizing was smaller than usual because the ETF trades thinly in terms of volumes. Nonetheless, a profit is a profit.

And at this point the ETF is no longer "between the hedges" as price hit its upper daily Bollinger Band, seen below. That was my first target for the trade, and as it comes to fruition I am considering a sale into the weekend. To be sure, some short-term rotation within commodities away from natural gas and oil and towards gasoline looks to have occurred this week.

Elsewhere, JCP is gapping down post-earnings. But that $8.30 level is key to watch, below.

And MBLY (as well as GPRO) is mired in a steep downtrend with many bottom-callers, but those recent-IPOs continue to underwhelm on the whole and are probably best avoided.

Stock Market Recap 06/27/16 ... A Gothic Take on the Euro's ...