02Mar12:00 pmEST

Fishing in a Frozen Pond

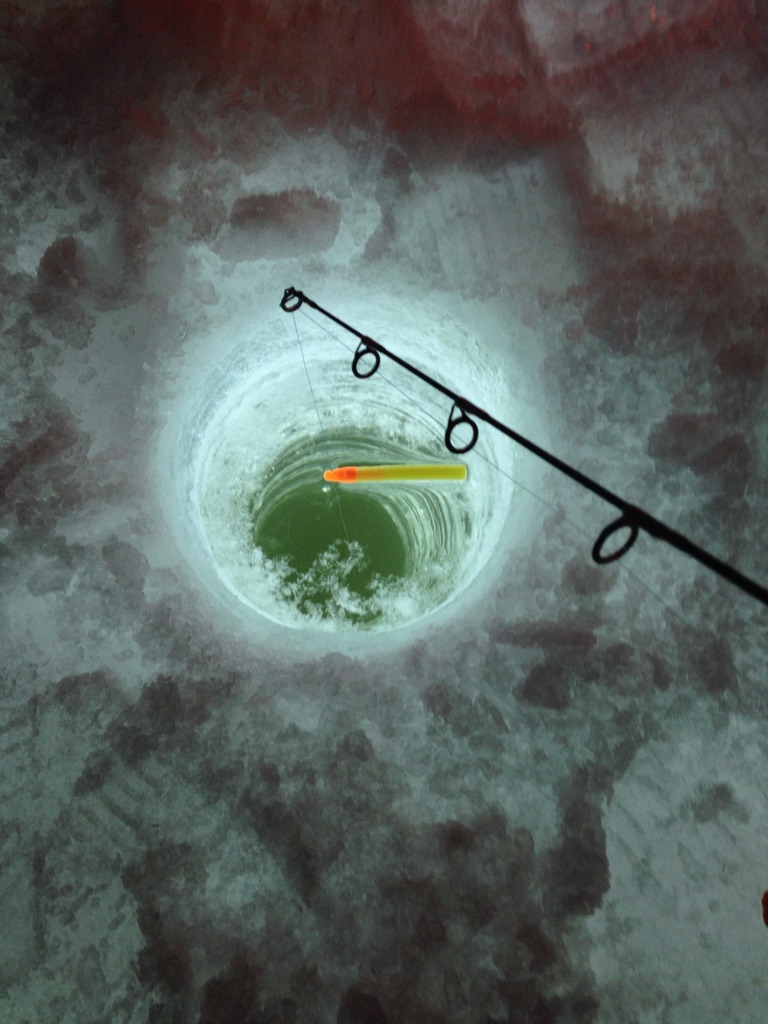

Playing bonds on the short side and looking to short the rate-sensitive sectors, such as REITs and utilities, feels a bit like the first time you try to fish in a frozen pond before you get the hang of "ice fishing."

Nonetheless, the bond short will necessarily have to stay on the radar for another entry as the rate-sensitive sectors continue to struggle.

First, utilities are the weakest link, now slicing down to their 200-day moving average, the yellow line on the first daily sector ETF chart, below. That bear flag (highlighted on chart) consolidation we observed last week indeed triggered quite sharply lower, cementing a notable change in character in the bonds and bond proxies.

And REITs, on the second daily sector ETF chart, below, are seeing some rejection off their 20 and 50-day moving average convergence. Further downside action from here would also add credence to the bond short thesis playing out for higher rates.

I know all eyes are on the Nasdaq today. But these opportunities, be it DRV SRS TMV, etc., have my interest.