04Mar12:13 pmEST

Waiting to See Their True Colors

Two trade setups I am watching can be found below.

I am also short CAT, seen on the first daily chart. But I am looking to add to my bet if the stock can now churn a bit at its lower Bollinger Band on the highlighted (in purple) triangle breakdown. If so, I am considering an add to the bearish bet to play for an eventual break of the key $80 level.

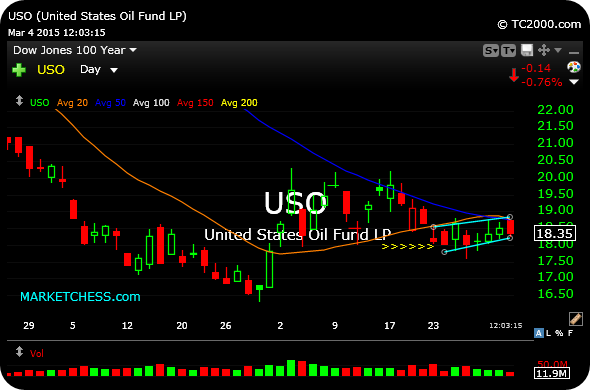

And crude oil, as mentioned earlier, is back on my short radar. If the USO ETF, second daily chart below, loses $18.20 and then $18, I have a long DWTI in mind to play the short side.

I still have a short REITs play on watch, via long SRS or DRV, if the IYR ETF weakens.

On the long side, the contrarian GPRO long is still tempting for a quick trade today.